This year, more than ten autonomous driving-related companies have initiated IPO processes.

In July, Chenqi Technology went public on the Hong Kong Stock Exchange (HKEX), becoming the “first autonomous driving operation technology stock.” On August 8, Black Sesame Technologies, an autonomous driving chip company, also listed on HKEX. In October, Horizon Robotics, a leading domestic autonomous driving chip company, and autonomous driving startup WeRide were listed on HKEX and Nasdaq. Horizon’s IPO became the largest tech IPO in Hong Kong this year. Pony.ai, another star company nearing IPO, has increased its fundraising target to as much as $452 million, reportedly due to high investor demand.

Other companies, including Momenta, ZongMu Tech, Mogo Auto and MINIEYE, are also preparing for IPOs. Westwell, a technology company specializing in vehicle-road collaboration, has announced its plans to list on the A-share market. Meanwhile, QCraft plans to push forward with its IPO in 2025 after completing its Series C+ funding.

The autonomous driving industry, often dubbed a “cash-burning machine,” faces long-term R&D expenses and challenges in short-term monetization. This wave of IPOs reflects not only the companies’ funding needs but also investor pressure for returns. Going public during an industry upswing provides crucial financial support for these companies to sustain their development.

Here is a look at the latest financial reports of key players entering or advancing in the “second half” of the autonomous driving industry:

Black Sesame Technologies

Black Sesame, which went public in August, reported revenue of ¥180 million for H1 2024, with an adjusted net loss of ¥600 million. Between 2021 and 2023, the company generated revenues of ¥60.5 million, ¥165 million, and ¥312 million, respectively, with cumulative net losses of approximately ¥9.96 billion during the same period.

CiDi

Recently filed for an HKEX IPO, CiDi has shown a more stable path to commercialization with relatively smaller losses. From 2021 to H1 2024, the company reported revenues of ¥77.4 million, ¥31 million, ¥133 million, and ¥259 million, respectively, with net losses of ¥180 million, ¥263 million, ¥255 million, and ¥123 million during the same periods.

RoboSense

RoboSense, listed in January, announced Q3 2024 sales figures, reporting 138,600 lidar units sold, a 134.9% year-over-year increase. Among these, vehicle-mounted lidar sales grew by 147% to 131,400 units.

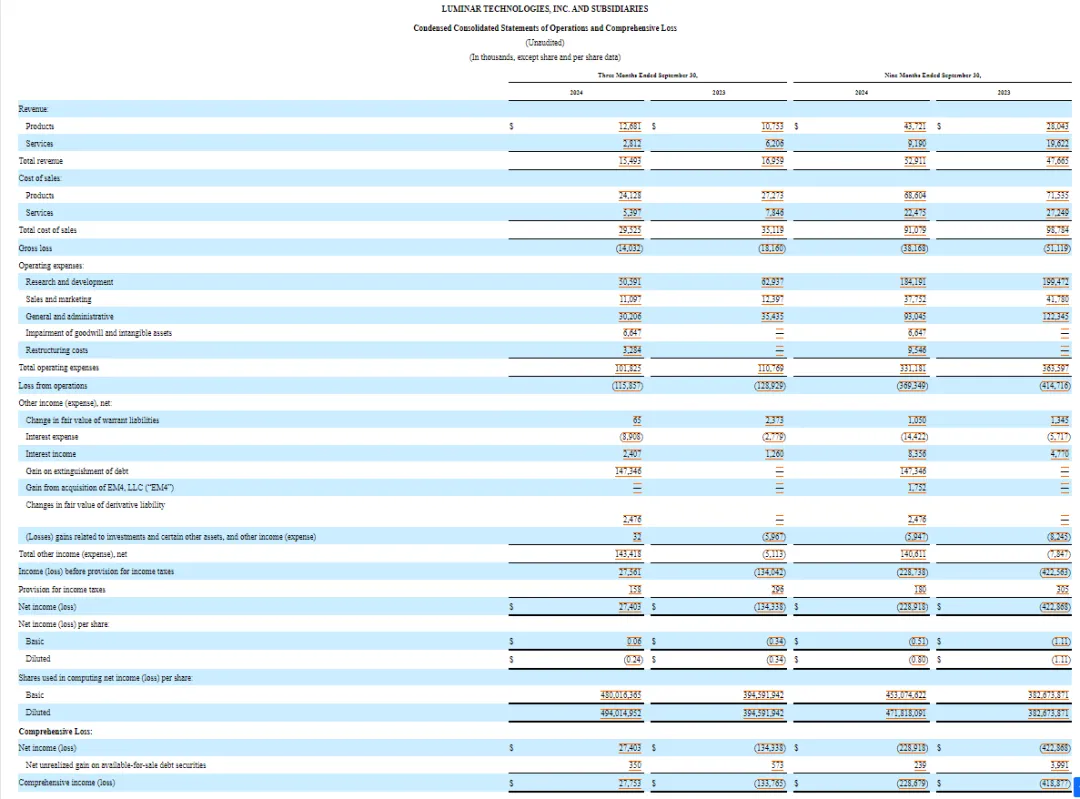

Luminar

On November 11, Luminar Technologies reported Q3 2024 revenue of $15.5 million, falling short of market expectations of $17.7 million and declining from $16.5 million in Q2. The company’s gross margin for the quarter was -$14 million, slightly down from Q2. Luminar highlighted new contracts with Volvo and Nissan.

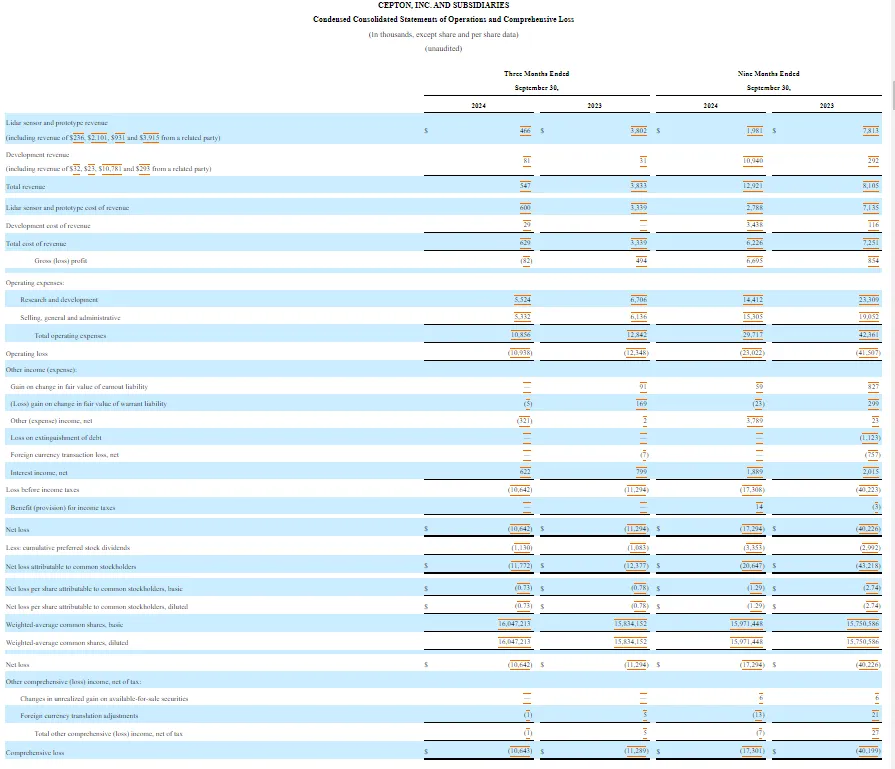

Cepton

Cepton reported Q3 2024 revenue of $547,000, including $466,000 from lidar sensors. Year-to-date revenue totaled $12.92 million, a 59.42% year-over-year increase, while net losses narrowed by 57.01% to $17.29 million.

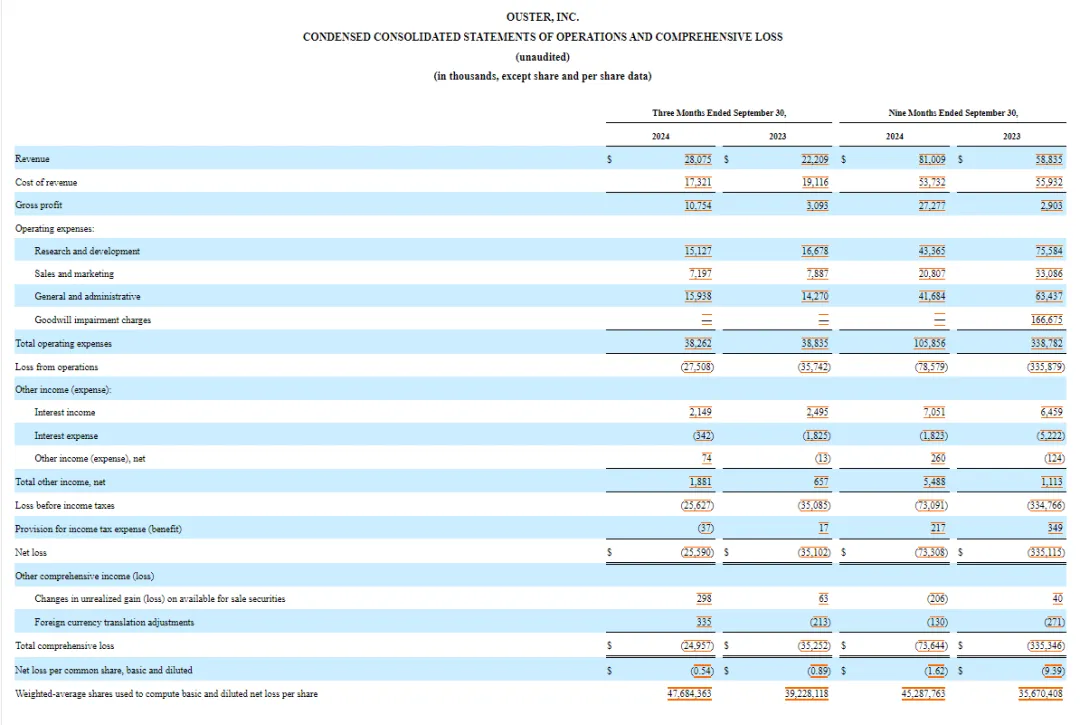

Ouster

Ouster reported Q3 2024 revenue of $28.08 million, a 26.41% year-over-year increase. Year-to-date revenue rose to $81 million, up 37.69%, while net losses for the same period narrowed by 78.12% to $73.31 million.

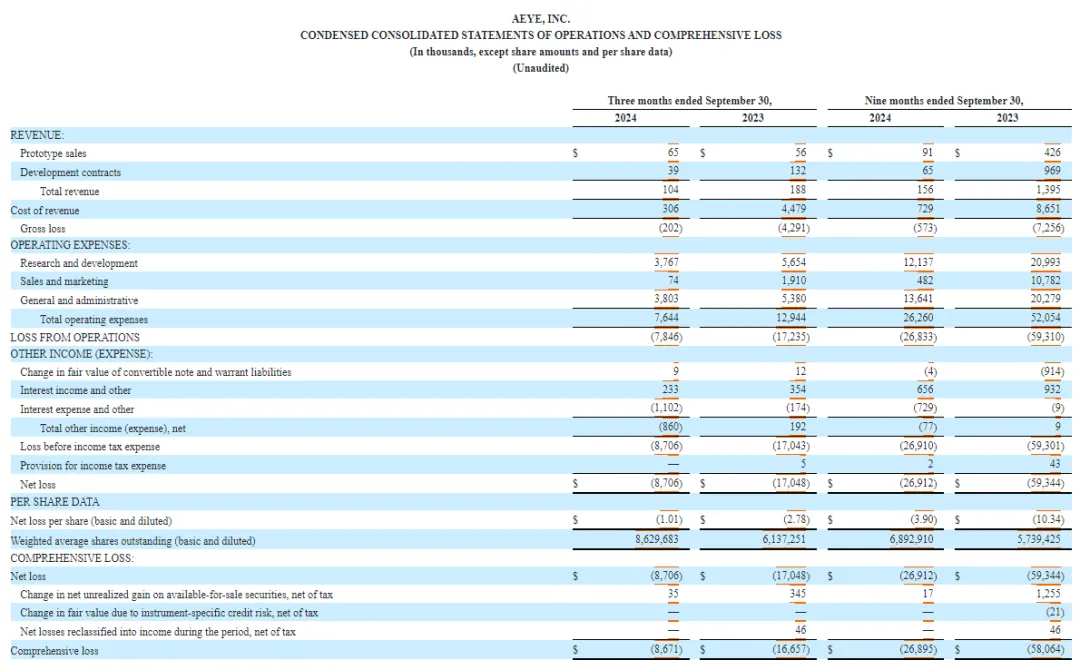

AEye

AEye reported Q3 2024 revenue of $10,400, with product sales revenue of $6,500, representing a 45% decline year-over-year. Total expenses for the quarter were $7.64 million, a 41% reduction compared to Q3 2023. Year-to-date revenue dropped by 88.8% to $156,000, while net losses narrowed by 54.65% to $26.91 million.

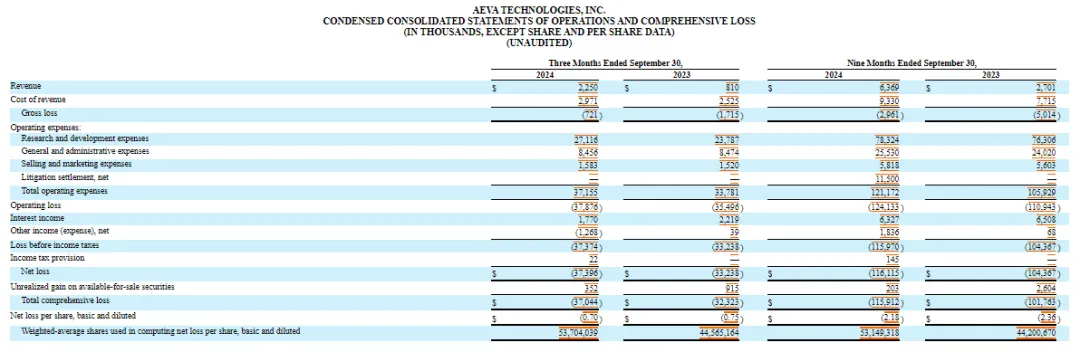

Aeva

Aeva reported Q3 2024 revenue of $2.25 million, a 177.78% year-over-year increase. However, the company posted a gross loss of $721,000. Year-to-date revenue grew by 135.8% to $6.37 million, while net losses widened by 11.26% to $116 million.

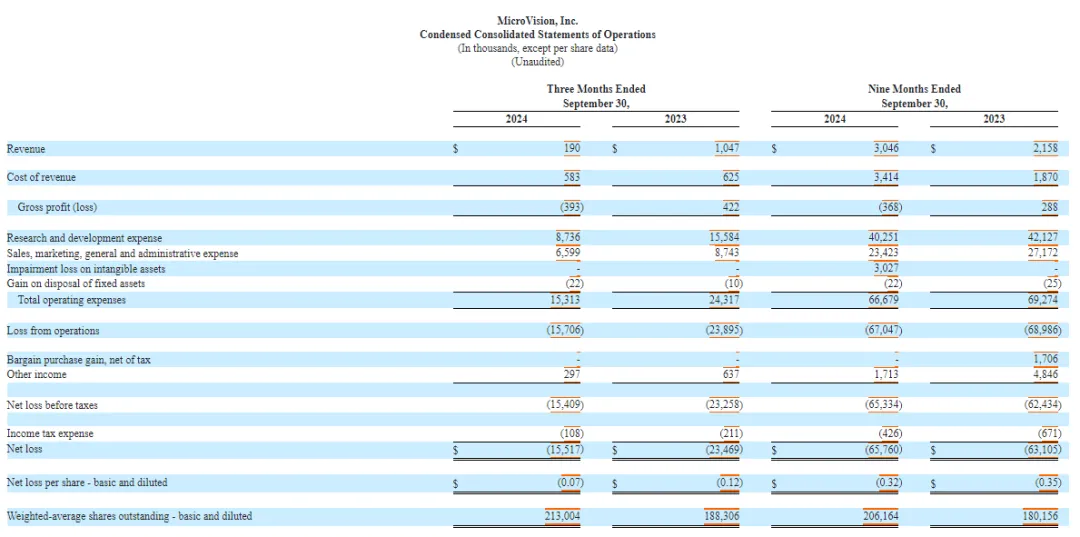

MicroVision

MicroVision, a leader in MEMS lidar and ADAS solutions, reported Q3 2024 revenue of $190,000, down from $1.05 million in Q3 2023. Year-to-date revenue increased by 41.14% to $3.05 million, while net losses expanded slightly to $65.76 million.

These financial results illustrate the intense competition and high R&D costs in the autonomous driving sector, where profitability remains a distant goal for many.

探索者论坛-scaled.jpg)