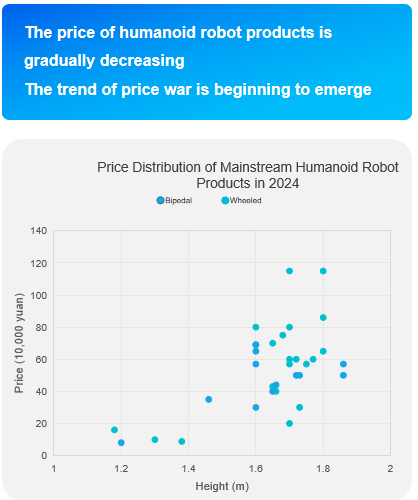

Before the technology is fully implemented, the “price war” has already begun.

Recently, the topic of humanoid robots has become extremely popular, and various new products have been launched frequently. But at a time when this track is still exploring basic capabilities and application scenarios are not yet clear, some players have already raised the price to an “unexpected” low level – more than 100,000 yuan, or even less than 100,000 yuan.

This is a price war that came too early.

At the node where humanoid robots have not yet been completely “implemented”, prices are gradually “lowered”. Is this “war” an inevitable result of technological progress, or an early release of market anxiety? Is it strategic pressure, or blindly following the trend?

As soon as an investment is made, the price is “lowered” first.

From 2024, the price of humanoid robots began to show a significant decline. Compared with the early prototype quotations of hundreds of thousands of yuan, some companies began to try the “cost-effective” approach to win attention and early orders in the market first.

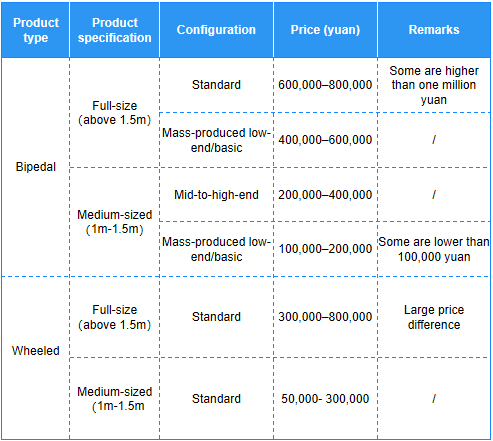

According to statistics from the New Strategy Humanoid Robot Industry Research Institute, in 2024, the price of a full-size bipedal humanoid robot will be between 600,000 and 800,000 yuan. Some companies have reduced the price to less than 500,000 yuan through mass production and cost reduction, thus small and medium-sized bipedal robots are mostly within 300,000 yuan.

At the same time, more and more companies are choosing to enter the market with “unexpected” pricing, starting an invisible but fierce price test.

At the same time, more and more companies are choosing to enter the market with “unexpected” pricing, starting an invisible but fierce price test.

For example, the G1 robot Unitree launched is priced at only 99,000 yuan, which has attracted great attention. ENGINEAI is not to be outdone, and the PM01 product is priced at 88,000 yuan. The newly released humanoid robot by Neotix even reported a “bottom price” of 39,900 yuan.

Although the above products are all small and medium-sized robots, there is still a gap with full-size robots in terms of size, degree of freedom and functional integrity, but as a carrier for early education and scientific research applications, its price advantage is very attractive.

Although the above products are all small and medium-sized robots, there is still a gap with full-size robots in terms of size, degree of freedom and functional integrity, but as a carrier for early education and scientific research applications, its price advantage is very attractive.

“Our strategic goal is to be quickly ‘attractive’.” Yao Qiyuan, the Co-founder and Marketing Director of ENGINEAI, once pointed out in an interview that although high pricing may bring higher profits, ENGINEAI currently puts the rapid expansion of the market first.

Yao Qiyuan said that ENGINEAI was able to keep the price so low due to the company’s comprehensive independent research and development capabilities. “From structural design, joint module design, to the mold opening of the whole machine, almost all key links are completed independently.”

Therefore, through independent research and development and lowering costs, although the price is low, they are still “profitable”, not a “losing business” as some people think.

By 2025, the “price war” has further spread to the field of full-size humanoid robots.

UBTECH launched the 1.7-meter-tall humanoid robot Tiangong Walker, priced at 299,000 yuan, breaking the previous market’s impression that “full-size humanoid robots must be expensive.” However, DOBOT went a step further and announced in March 2025 that its ATOM robot would start at 199,000 yuan, triggering widespread discussion in the industry.

A full-size humanoid robot priced at less than 200,000 yuan was almost unimaginable a year ago. But the reality is that more and more companies are entering the market at “exceeding expectation” prices. “The technology may not be fully in place, but the market window will not wait for anyone.”

A full-size humanoid robot priced at less than 200,000 yuan was almost unimaginable a year ago. But the reality is that more and more companies are entering the market at “exceeding expectation” prices. “The technology may not be fully in place, but the market window will not wait for anyone.”

What is more noteworthy is that some companies that have not yet disclosed their prices are also formulating a “low-price strategy”. Some companies frankly stated in the communication, “We will launch a full-size humanoid robot priced at less than 150,000 yuan before the end of this year. We will first grab some market share and then slowly improve the functions.”

The urging of capital has also promoted the early outbreak of the price war to a certain extent. An industrial investor said, “The humanoid robot track is too popular, and everyone wants to see results quickly. When the price is lowered, it is easier to implement and it is easier to have a ‘story’ to tell.”

Behind the “price war”: ambition, anxiety and temptation

In the process of price reduction, the strategies of enterprises are different. Some are to narrow the distance with users and speed up product iteration, some are to find “stories to tell” in the fierce financing environment, while other companies try to layout the B-end order market in advance through the model of small profits but quick turnover.

But it cannot be ignored that there is a more complex game hidden behind this “price war”.

On the one hand, it is the strategic ambitions of start-up companies that are driving this. For a group of new entrepreneurs, humanoid robots are no longer just a symbol of “key and core technology”, but a product that can be put into production, mass-produced, and shipped. Whoever can take the lead in bringing down the price and bringing it to the market will have the opportunity to establish the “first batch of user minds”.

On the other hand, the anxiety behind the “price war” is also obvious. In the past few years, the concept of humanoid robots has continued to be prevalent, but the progress of implementation has not met expectations. Capital is watching, and the market’s patience with companies is also decreasing.

“In the past, everyone looked at the ‘vision’ in the field of robots, but now they are more concerned about specific ‘scenarios’ and ‘sales’. After the price reduction, it is easier to get orders and generate substantial revenue. Even if the short-term profit is meager, it is better than no progress.” An industry insider admitted.

Therefore, the logic behind the “price war” has become the “anxiety release” driven by capital and the market – at a stage when the technology is not yet fully mature and the market prospects are unclear, a short-term market heat is quickly created with a low-price strategy.

So, how to strike a balance between short-term price temptation and long-term value adherence has become a difficult problem that the entire industry has to face.

Humanoid robots do not need “low prices” but “value”.

In the communication with many industry professionals, a consensus has become clearer, “Price is important, but value is the key.” In the long run, the core competitiveness of humanoid robots does not lie in simple price, but in technological innovation, application landing and user value. Although price cuts may quickly open up the market and win industry attention in the short term, to truly retain customers and form stable market demand, it still depends on the reliability and actual use experience of the product itself.

ENGINEAI said that although the low-price strategy helped the company accumulate users and voice in the early stages, this is not the company’s long-term direction in the future. In the future, the company will continue to improve its products, not only based on cost-effectiveness or price as a criterion, but from multiple dimensions to ensure that the product can meet market demand in all aspects.

Many companies also expressed the hope that the entire industry can pay more attention to technological innovation and application implementation, rather than blindly pursuing low prices. “The market ultimately pays for the services and experience provided by the product. In addition to price competition, companies should work harder on technology accumulation, product stability, and scene implementation capabilities.”

After all, the humanoid robot race is long, and what is tested is endurance, not sprint speed.