Robotphoenix Intelligent Technology Co., Ltd. (hereinafter referred to as “Robot Phoenix”) officially submitted a prospectus to the HKSE on June 30, 2025, and plans to be listed on the main board of the HKSE through Chapter 18C. ABC International served as the exclusive sponsor.

Founded in 2012, Robot Phoenix is a comprehensive industrial robot company that focuses on the design, research and development, manufacturing and commercialization of industrial robots, and provides comprehensive robot solutions, deeply cultivating the light industry.

Up to now, the industrial robot product portfolio launched by Robot Phoenix covers parallel robots (Bat series), AGV/AMR (Camel series), SCARA robots (Python series), wafer handling robots (Lobster series) and six-axis industrial robots (Mantis series), and has independently developed core technologies-control and vision systems (Gorilla and Kingkong series). Based on the robot product portfolio, Robot Phoenix also provides comprehensive robot solutions based on intelligent automation systems to cope with specific application scenarios in intelligent manufacturing, including but not limited to loading and unloading, sorting, picking and placing, packaging, visual inspection, assembly and gluing systems.

As of June 21, 2025, Robot Phoenix’s orders on hand are worth more than 400 million yuan.

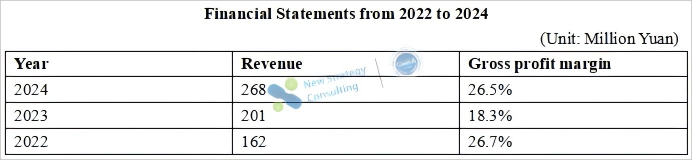

In terms of financial data, from 2022 to 2024, Robot Phoenix’s revenues were 162 million yuan, 201 million yuan and 268 million yuan, respectively, with a compound annual growth rate of 28.5%; during the same period, Robot Phoenix’s gross profit margins were 26.7%, 18.3% and 26.5%, respectively.

Under the Chapter 18C, the leading senior independent investors of Robot Phoenix are CBC and THG VENTURES; senior independent investors are Ivy Capital, Primavera Capital, Guoke Yingfeng, JASIC, SW Fund and Frees Fund; in addition, Robot Phoenix’s investors also include YHGT, Junyuan Capital, Flyfot Ventures, China Equity Group, Chuxin Capital, Wutong Investment, Coco Capital Corporation, Ferry Venture Capital, TusStar and other institutions.

After completing the last round of financing before the IPO, Robot Phoenix’s valuation was 3.604 billion yuan.

Robot Phoenix stated in its prospectus that the net proceeds from the IPO would be mainly used for robotics technology development, production line development and capacity construction, development of overseas business networks, investment in upstream and downstream of the supply chain and supplement in working capital.

Note:

Logistics Automation Development Strategy & the 7th International Mobile Robot Integration Application Conference Southeast Asia will be held in Concorde Hotel Kuala Lumpur, Malaysia on 21st August 2025. Welcome to join us.

For agenda, please click https://cnmra.com/logistics-automation-development-strategy-the-7th-international-mobile-robot-integration-application-conference-southeast-asia-21st-august-2025-concorde-hotel-kuala-lumpur-malaysia/

For registration, please click https://docs.google.com/forms/d/e/1FAIpQLSdGHjpHRU0mR0_2ZlqtJpUV25s3XlIIHtkkUUfxz0W6vpBqiA/viewform?usp=header

探索者论坛-scaled.jpg)