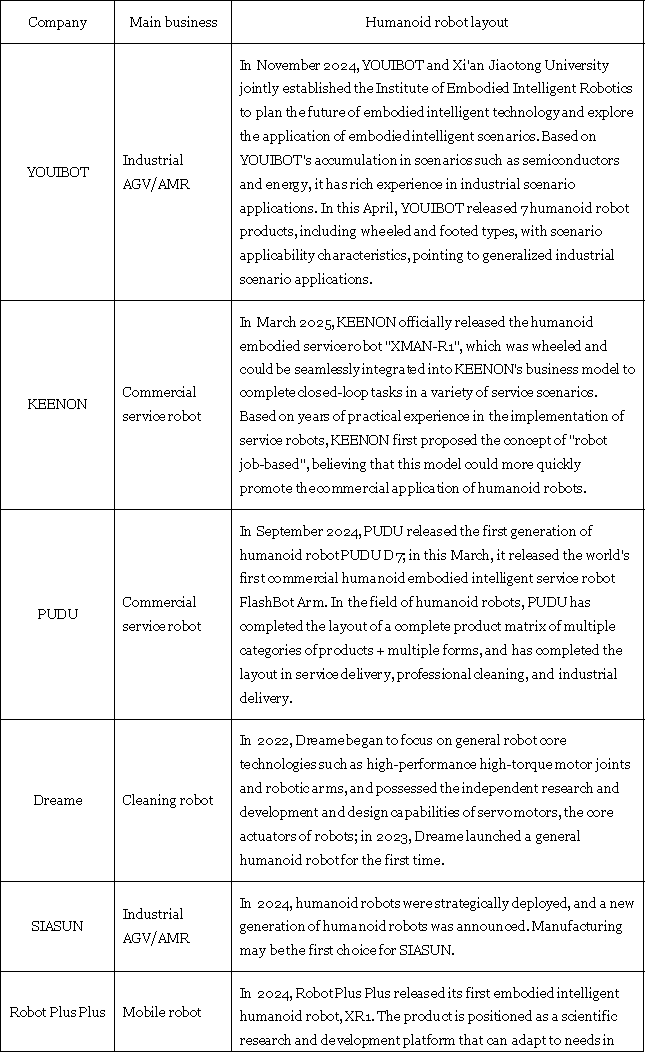

According to incomplete statistics from the New Strategy Mobile Robot Industry Research Institute, more than 10 mobile robot companies have begun to develop humanoid robot businesses as of now. Some companies have already given up related products, while some companies are in the early stages of research and development.

Fig.: Layout of humanoid robots by some mobile robot companies

On the one hand, for mobile robot companies, actively embracing the wave of embodied intelligence is not only to expand the product matrix, but also a forward-looking layout for future trends, and a strategic choice to compete for the entrance of embodied intelligence. On the other hand, mobile robot companies have a certain technical foundation and rich experience in scene applications, which undoubtedly supports their entry into the field of humanoid robots. In addition, the layout of mobile robots in the field of humanoid robots is conducive to obtaining more financing opportunities, and can use financing to accelerate technological breakthroughs, thereby improving the company’s own valuation.

Cross-border entry, how can mobile robots seize the industry’s first opportunity?

From the perspective of enterprise type, entrants are roughly divided into two categories: one is mobile robot companies that originally focused on industrial scenarios, such as YOUIBOT, SIASUN, SEER, VMR, FAIRYLAND, etc., relying on the deep accumulation in the manufacturing and warehousing and logistics fields, and transferring industrial-grade technical advantages to humanoid robot development; the other is mobile robot companies that are mainly oriented to the commercial field, such as KEENON, PUDU, and Dreame, which focus on service scenarios such as catering, hotels, and families.

From the perspective of product paths, most companies choose to start with wheeled humanoid robots. On the one hand, this is because the wheeled structure technology is mature and the control difficulty is relatively low. Enterprises can directly reuse existing mobile robot technology, which is conducive to shortening the R&D cycle, making the product quickly iterated and put into practical application; on the other hand, it is also convenient to integrate with the company’s existing robot product line. In addition, the standardization degree of wheeled parts is high, which can significantly reduce the cost of mass production and accelerate commercialization.

From the perspective of product paths, most companies choose to start with wheeled humanoid robots. On the one hand, this is because the wheeled structure technology is mature and the control difficulty is relatively low. Enterprises can directly reuse existing mobile robot technology, which is conducive to shortening the R&D cycle, making the product quickly iterated and put into practical application; on the other hand, it is also convenient to integrate with the company’s existing robot product line. In addition, the standardization degree of wheeled parts is high, which can significantly reduce the cost of mass production and accelerate commercialization.

It is worth noting that some companies have also launched footed humanoid robots, trying to make breakthroughs at the technical level. “LI-GONG D1”, the first full-size humanoid robot in China with a double-arm load of 40 kg, successfully developed and launched by LI-GONG, adopts advanced bionic design concepts, simulates the flexibility and coordination of human movement, and emphasizes its ability to adapt to unstructured environments; YOUIBOT, Dreame, etc. have also launched footed humanoid robot products. Although footed humanoid robots still face problems such as high cost and difficulty in landing, their structural characteristics that are closer to human movement ability still have a large market.

Overall, mobile robot companies have entered the field of humanoid robots, reflecting the development path of “starting from familiar scenes and gradually improving anthropomorphic capabilities.” The wheeled structure is the main choice for commercialization at this stage, while the footed structure carries the potential for technological leadership and brand value.

Mobile robot companies have their own strategic considerations for the layout of humanoid robot business, and they also have certain inherent advantages, but it should be noted that “cross-border entry” is not that simple.

- Technical complexity and R&D investment pressure. Humanoid robots need to break through core technologies such as bipedal balance, dexterous operation, and multimodal interaction, which are significantly different from the wheeled movement of AGV. For example, key technologies such as dynamic balance algorithms and force control sensors still need to rely on external cooperation or high R&D investment.

- Fragmentation of application scenarios and uncertainty of demand. Mobile robot companies often focus on the application of a certain scenario, while humanoid robots need to cover diversified scenarios such as home services and medical care, and companies need to reconstruct their product definition capabilities. At the same time, the current humanoid robots are expensive and have limited market acceptance, and companies need to balance the scale of mass production and the investment return cycle.

- Market competition and ecological construction difficulties. International giants such as Tesla and Nvidia are accelerating their layout, and domestic companies such as Unitree and UBTECH have seized the opportunity. Mobile robot companies are facing differentiated competition pressure. The humanoid robot ecosystem needs to integrate multiple resources such as AI algorithms, hardware manufacturing, and scene services. Mobile robot companies may have shortcomings in cross-domain collaboration capabilities.

The essence of mobile robot companies’ layout of humanoid robots is a triple leap in technical logic, scene logic, and ecological logic. This leap not only requires breaking through technical bottlenecks such as motion control, interactive capabilities, and energy management, but also requires reconstructing market cognition, supply chain ecology, and capital operation models. The humanoid robot industry is in its early stages. For all industry participants, how to find their own position in this technological and market transformation will be the key to determining future development.