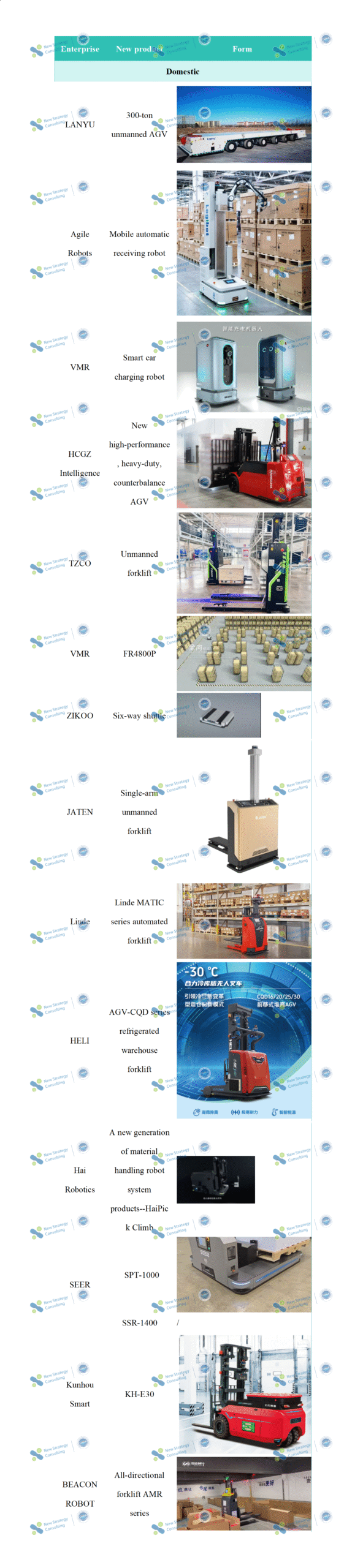

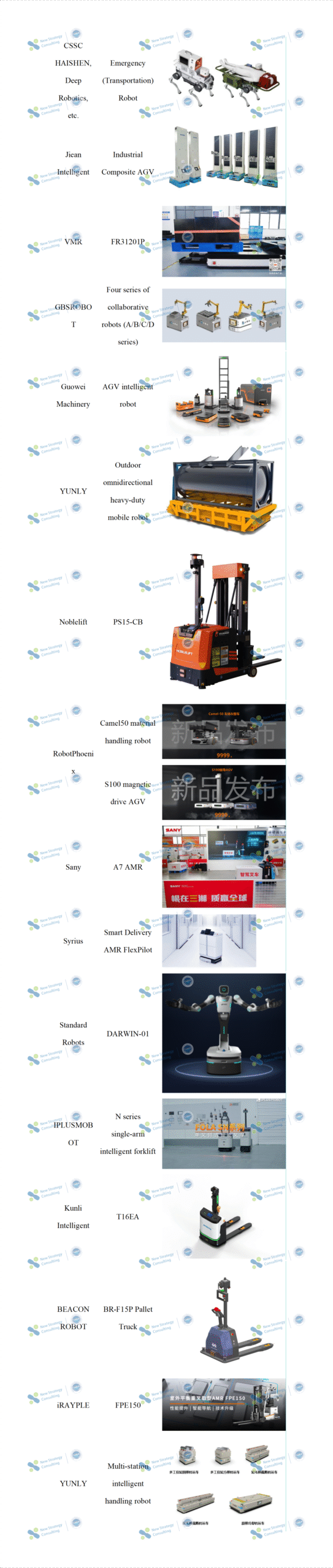

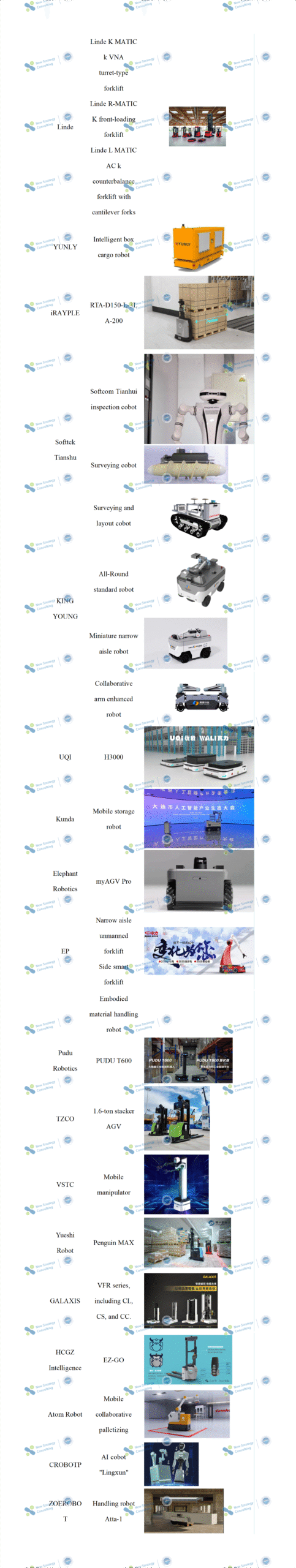

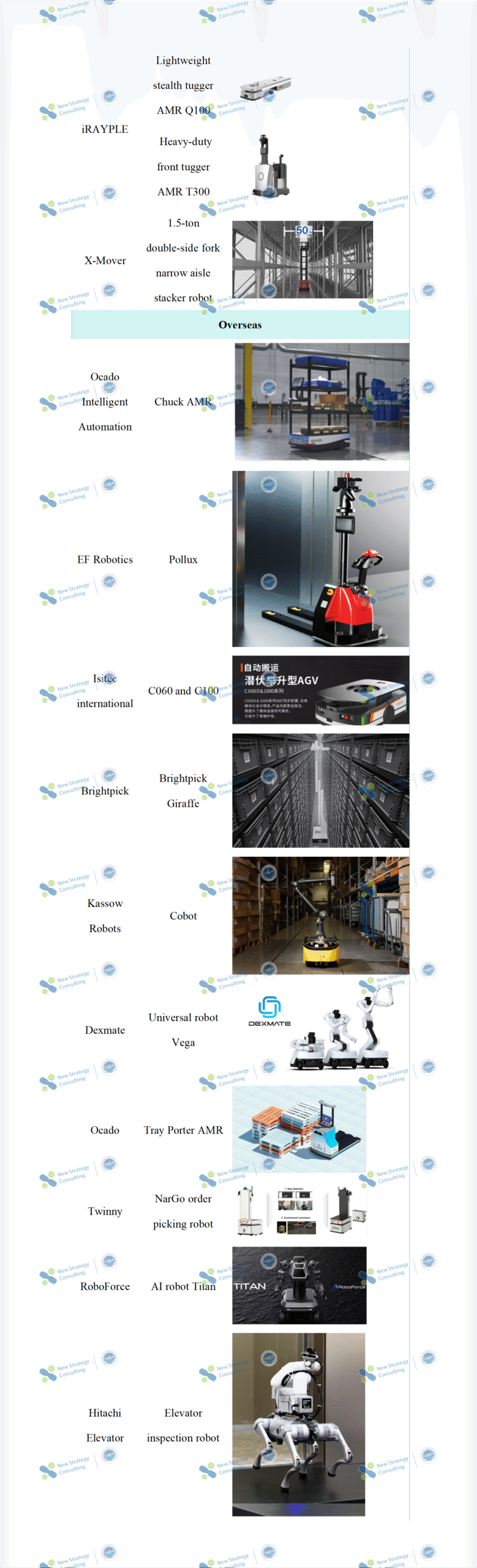

According to data of CMRA and incomplete statistics from New Strategy Mobile Robot Industry Research Institute, 82 new mobile robots were launched globally in the first three quarters of 2025, with 61 models released in the domestic market and 21 in foreign markets. Overall, domestic products accounted for approximately 74% of new releases, while foreign markets contributed only 26%, highlighting China’s significant advantage in the number of new product launches.

Chart: New Products of Domestic andOverseas AGV/AMR Companies in the First Three Quarters of 2025

(Compiled from public information. If there are any omissions, please make a correction!)

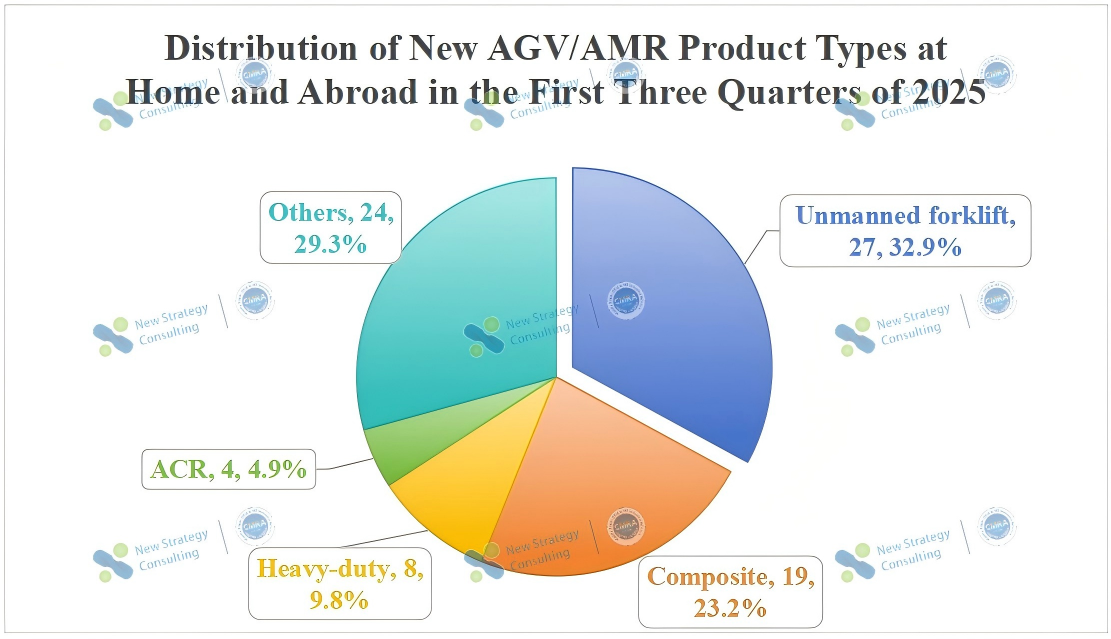

Analyzing product patterns from the first three quarters of 2025, supported by data from CMRA and the New Strategy Mobile Robot Industry Research Institute, the current market landscape reveals distinct trends. Unmanned forklifts maintain their dominance with 32.9% of new product volume, closely followed by composite products at 23.2%. Heavy-duty and containerized warehousing solutions show steady performance in specific niche markets, accounting for 9.8% and 4.9% respectively.

Among various product categories, unmanned forklifts are demonstrating a clear trend toward specialized segmentation. Manufacturers are moving beyond generic designs to address specific scenarios like narrow aisle operations, cold storage environments, and small-tonnage handling. Through precise adjustments to product configurations and optimized control strategies, they are accurately targeting more specialized warehousing needs. This trend not only enhances deployment density and spatial utilization efficiency but also further solidifies the dominant position of unmanned forklifts in the market.

Meanwhile, composite products accounting for 23.2% of the market are entering practical applications. These systems are increasingly serving as complementary solutions in industrial processes, successfully integrating “mobile + manipulative” capabilities to meet demands in scenarios requiring higher flexibility and precision, such as inspection, material handling, and assembly. Some manufacturers have further enhanced these robots by incorporating AI scheduling and visual navigation technologies, significantly improving their task planning and information flow management capabilities.

In contrast, although the heavy-duty and container warehousing products do not show the rapid innovation and extension as mentioned above, they continue to provide reliable support in the corresponding industrial links by virtue of their good adaptability to specific scenarios, and become an indispensable and stable force in the overall pattern.

Chart: Distribution of New AGV/AMR Product Types in China and Overseas during the First Nine Months of 2025

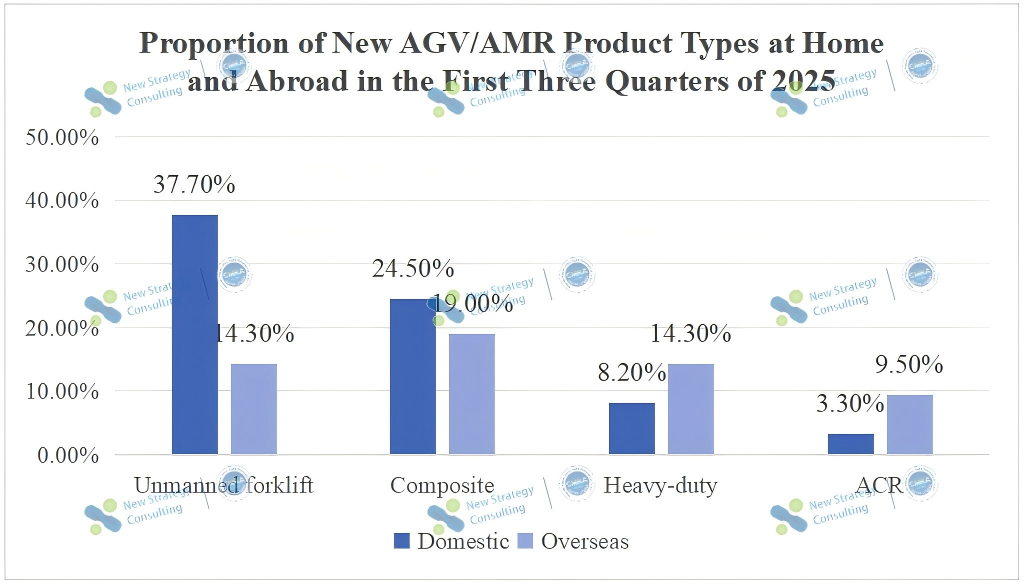

From a regional perspective, the new product launches in the first three quarters of 2025 reveal distinct regional variations. The domestic market is characterized by high volume, rapid pace, and broad scenario coverage. Companies generally focus on “cost-effectiveness + adaptability,” persistently cultivating automation demands in traditional sectors like warehousing, logistics, and manufacturing – aligning with domestic priorities for extensive application scenarios and cost control. In contrast, foreign markets exhibit a “less but better” trend, emphasizing deep optimization of products for specific high-end applications that meet their stringent requirements for precision and stability.

These regional disparities are also evident in the product category distribution. Domestic manufacturers have achieved higher market shares for unmanned forklifts and hybrid products compared to international counterparts, reflecting the domestic market’s demand for large-scale adoption of core products and the need to expand application scenarios for hybrid solutions. In contrast, foreign markets maintain stronger presence in heavy-duty and containerized warehousing equipment, which aligns with their stringent requirements for handling stability, precision management, and their “less is more” strategic approach.

Chart: Distribution of New AGV/AMR Product Types at Home and Abroad in the First Three Quarters of 2025

Conclusion

The data in the first three quarters of 2025 clearly shows the mobile robotics industry is expanding its applications and scale. The core shift here is from quantity-driven competition to value-driven competition. Companies are moving beyond rapid product launches to validate commercial viability and adapt to real-world scenarios through a few high-maturity products.

The future competition will be based on the closed loop of “product-scenario-value”. Whoever completes the closed loop construction first will have the first opportunity in the wave of industrial implementation.

———————————————————————————————————————————————————————————————————————————

The 2024-2025 Global Mobile Robot Industry Development Report, compiled by China Mobile Robot (AGV/AMR) Industry Alliance (CMRA) and New Strategy Mobile Robot Industry Research Institute (NSRI), has been released, which covers sales amount and volume, popular application segments, popular product categories, analysis of each industry chain segment, representative global market players, and future development trends.

For details of the report, please click https://cnmra.com/release-of-the-2024-2025-global-mobile-robot-industry-development-report/.

Moreover, this report just costs $398. If you need it, please feel free to contact us via info@cnmra.com.

探索者论坛-scaled.jpg)