At the military parade on September 3 of this year, quadruped robots dubbed “Robot wolves” made their debut. This demonstration not only showcased their excellent maneuverability and stability, but also signaled that China’s independently developed quadruped robots are gradually moving toward practical and systematic application.

China has become one of the most active countries in the global quadruped robot industry, leading the world in both market shipments and industry scale. From specialized companies with years of experience in the field to players transitioning to humanoid robots, and then to cross-industry entrants from listed companies and internet giants, China’s quadruped robot sector is presenting a landscape of fierce competition.

Figure: Selected Chinese Quadruped Robot Companies (Compiled from public information. If there are any omissions, please make a correction!).

From a corporate structure perspective, the quadruped robot sector is developing a clear “camp-based” competitive landscape, which can be preliminarily summarized as “two leading companies + multiple breakthroughs + cross-industry players entering the market + potential for catching up.”

The First Camp: Unitree VS Robotics: A Two-Power Landscape Established

The most striking example is the “two-power” structure represented by Unitree and Deep Robotics. These two companies are not only the earliest pioneers in China in venturing into the uncharted territory of quadruped robotics technology, but are also the most representative companies currently achieving industrialization. Furthermore, both companies have gradually entered the field of humanoid robots in recent years, becoming leading forces in China’s embodied intelligence industry.

- Unitree

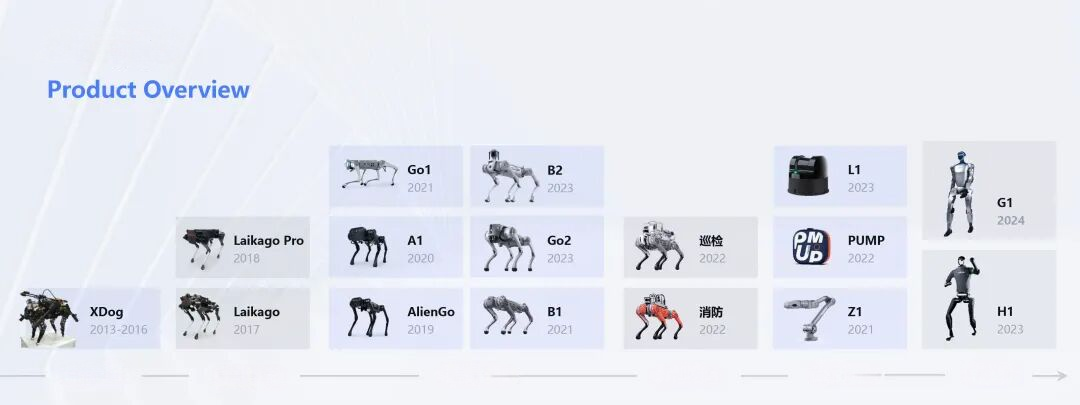

Founded in 2016, Unitree is a quintessential technology-driven company. Since its inception, it has adhered to a full-stack independent R&D approach, developing everything from motors, electronic controls, reducers, and complete motion control algorithms in-house. This technological mastery of underlying hardware and control systems has enabled Unitree to pioneer the balance between cost and performance in the quadruped robotics field and establish mass production capabilities.

From the early Laikago, to the widely popular AlienGo, to the globally popular Go series and industrial-grade B2 series, Unitree has been a key player in bringing quadruped robots to the public eye. In recent years, Unitree has gradually developed a “quadruped + humanoid dual-role, platform-based product matrix” development strategy. Its products have been exported to numerous countries worldwide, with industry-leading shipments.

- Deep Robotics

Founded in 2017, Deep Robotics is one of the first companies in China to use quadruped robots in real-world industrial scenarios. It focuses on high-value scenarios such as power inspection, energy operations and maintenance, complex terrain surveys, and emergency rescue. Its products are renowned for their long-term, stable operation in harsh environments.

From X20 to current X30, and then to the lightweight development version Lite3, Deep Robotics has built a product ecosystem spanning R&D testing to engineering deployment. It has established partnerships with energy system organizations such as State Grid and China Southern Power Grid, making it a truly leading company in promoting quadruped robots to the forefront of the industry.

In the field of humanoid robots, on October 9, Deep Robotics released the DR02, the world’s first industrial-grade, all-weather humanoid robot. The robot meets IP66 water and dust resistance standards, can operate in temperatures ranging from -20°C to 55°C, and can withstand outdoor rain, humidity, and dust.

The Second Camp: Differentiated Breakthroughs Are Forming “Multi-Point Breakthroughs”

Companies in the second camp demonstrate a more distinct competitive path. Rather than competing head-on with the “two giants,” these latecomers seek breakthroughs through demand-side approaches, technological innovation, and user segmentation, gradually forming several distinct forces.

- Application-Side Differentiation

Some companies are taking an application-side differentiation approach. For example, some companies, such as WEILAN and MagicLab, are focusing on “emotional companionship,” transforming quadruped robots from industrial tools into family companions, emphasizing pet-like interactive experiences. Other companies, such as AGiBOT and LimX Dynamics, focus on “research and developer ecosystems,” providing lightweight, programmable robot platforms that have become important vehicles for universities and AI development teams to train embodied intelligence.

- Industry Experience Extension

Another group leverages their existing technological expertise to enter the market. Sevnce Robotics, a typical example of specialized robotics, is a prime example. Drawing on its years of engineering experience in security and bomb disposal and hazardous operations, Sevnce Robotics has launched an explosion-proof quadruped robot, directly targeting high-risk industrial environments like the oil and gas chemical industry and hazardous power plant areas, creating a differentiated competitive advantage by addressing critical market needs.

- Morphological and Structural Innovation

Some companies are choosing to innovate within the morphological and structural aspects themselves. For example, Dobot, instead of following the market trend with a quadruped robot, launched a hexapod robot dog. This design offers advantages in gait redundancy, stability, and obstacle-crossing safety, providing a new option for robots in complex tasks or load-carrying scenarios, and pioneering a technological path distinct from traditional biomimetic approaches.

As can be seen, the common denominator of the second camp lies not in speed but in direction. Their differentiated approaches have transformed the quadruped robot market from a single path to a multi-pronged one, thereby creating a more multifaceted and multi-layered competitive landscape.

The Third Camp: Cross-industry players enter the market, accelerating the expansion of the industry landscape.

Companies in the third camp often originate from other industries, bringing with them capital, engineering expertise, or brand momentum to enter the quadruped robot market, driving further industrialization and scale within the industry. This camp is primarily represented by three types of companies:

- Traditional industrial manufacturing and special equipment companies

These companies already have access to industrial customer base and engineering delivery capabilities, so when entering the quadruped robotics market, they often focus directly on engineering scenarios. Companies like CITIC Heavy Industries and Boomy Intelligent, for example, are characterized by a strong project-based approach, rapidly implementing their products through existing channels and industry resources.

- Large technology companies and internet technology companies

The core strength of these companies lies not in hardware manufacturing but in AI algorithm capabilities and the ability to build a software ecosystem. For example, the quadruped platform launched by Tencent Robotics X emphasizes dynamic control capabilities and humanoid motion intelligence, serving as a model platform for multimodal perception and embodied intelligence experiments.

- Automobile, new energy, and robotics ecosystem companies

These companies prioritize control over the future era of embodied intelligence rather than immediate sales. For example, Pengxing Intelligent, originating from the new energy vehicle company XPENG, launched the rideable quadruped robot “Xiaobailong,” exploring the integration of “robotics + mobility.”

What these cross-industry companies have in common is that they entered the quadruped robotics industry not to develop a single product, but to secure a position in the future robotics industry chain. These changes have brought about changes in capital, channels, mass production systems, and even ecosystem standards, ushering this previously technology-driven sector into a new phase of competition for resources and systems.

The Fourth Camp: Potential Chasers Emerge, and the Sector Continues to Expand Rapidly

In addition to leading and cross-industry players, a group of new players are also rapidly entering the quadruped robot market, forming a “potential chaser” camp. Most of these companies are relatively new, but they share characteristics such as rapid product iteration, flexible market strategies, and clear goals.

Some, like ENGINE AI, focus on entry-level quadruped products to encourage user experience. Others, such as Vbot, are attempting to expand into the consumer market, hoping to bring quadruped robots to home use. Still others, such as GLRoad and EIR Technology, view quadrupeds as part of their future multi-modal robotics strategy, representing a “preemptive” entry.

Conclusion:

Overall, China’s quadruped robot market has formed a clear, multi-layered competitive landscape: two leading players, differentiated players breaking through, cross-industry players joining the fray, and a continuous influx of new players. This is no longer a technology testing track, but a track that has truly entered the stage of commercial competition and industrial expansion.

——————————————————————————————————————————————————————————————————————————————

The 3rd Ecological Conference for Embodied Intelligence Humanoid Robot Scenario Application 2025 will be held at Hefei Platinum Hanjue Hotel on December 5, 2025. At the same time, Quadruped Robot Scenario Application Development Blue Book 2025 will be released.

Anyone who would like to attend the conference or get the blue book, please feel free to contact us via info@cnmra.com.

探索者论坛-scaled.jpg)