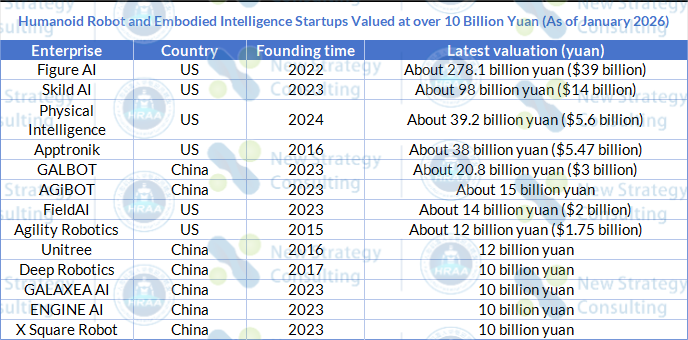

In the past two years, the embodied intelligence and humanoid robot sectors have experienced rapid growth, with the valuations of a number of startups soaring.

According to statistics from China Humanoid Robot Scene Application Alliance (HRAA), as of January 2026, there were over 30 unicorns (valued at over $1 billion and less than ten years old) in this field globally, with over 13 of them exceeding 10 billion yuan in valuation.

(Based on publicly available information on the Internet. If there are any incomplete parts, please make a correction.)

In terms of the number of companies, China and the US are roughly equal. However, US companies significantly lead in valuation: Figure AI, Skild AI, and Apptronik are all valued at over 30 billion yuan, with Figure reaching approximately 278 billion yuan, far exceeding the second tier.

In China, although there are more embodied intelligence startups and a higher development density, current valuations are mainly concentrated between 10 billion yuan and 20 billion yuan, with representative companies including GALBOT, AGiBOT, and Unitree.

This article focuses on the latest developments of the US humanoid robot unicorns valued at over $10 billion by 2025.

Figure AI

In 2025, Figure AI’s development revolved around a core goal: to advance the productization, manufacturing, and large-scale deployment of humanoid robots based on its self-developed end-to-end models.

At the beginning of the year, Figure announced the end of its collaboration with OpenAI, clearly shifting its focus to developing its own large-scale model system. The company publicly stated that it had achieved a phased breakthrough in end-to-end robot AI and hoped to fully integrate models, data, hardware, and deployment into its own closed loop.

In February, Figure released the Helix VLA model. Helix unifies visual perception, language understanding, and continuous motion control, with a single set of weights supporting multi-task learning and running on low-power GPUs.

Subsequently, the company first deployed Helix in logistics sorting scenarios, successively demonstrating its capabilities in tasks such as package flipping, alignment, and delivery. In the first half of the year, Helix’s performance in real logistics tasks continued to improve, with object types expanding to complex objects such as soft bags and envelopes, operation time shortening, and success rate and stability gradually improving.

Simultaneously advancing with the model was the construction of its manufacturing system. In March, Figure announced its BotQ manufacturing plant with a planned annual production capacity of approximately 12,000 units, along with its self-developed manufacturing software system. In July, the company disclosed the engineering solution for its F.03 battery system, covering capacity, range, fast charging, and safety certification standards, serving as a crucial component for subsequent mass production.

In the second half of the year, Figure expanded Helix’s capabilities from the factory to the home environment. In August, the company demonstrated a clothes-folding task; in September, it released a multi-step demonstration of loading a dishwasher, emphasizing the acquisition of new skills through data expansion without changing the model architecture.

September became the most busy month of the year. Figure announced a strategic partnership with Brookfield to leverage its global real estate assets for large-scale real-world deployment and data collection; subsequently, it launched Project Go-Big, proposing “Internet-scale” pre-training of humanoid robots, and completed its Series C funding round, raising over $1 billion, with post valuation at approximately $39 billion. The funds will be used for model training, data systems, manufacturing expansion, and increased deployment scale.

In October, Figure released its next-generation product, Figure 03, redesigned around safety, sensing systems, wireless charging, and manufacturability in home and public environments.

In November, the company disclosed data from 11 consecutive months of continuous deployment of Figure 02 at the BMW Spartanburg plant, including runtime, number of assembly tasks, and stability metrics, to guide engineering improvements for the next-generation product.

By the end of 2025, Figure AI has completed a full cycle of technology and engineering, from establishing its self-developed model, validating logistics scenarios, building its manufacturing system, to expanding into home tasks, securing funding, and launching new products, forming a development structure centered on Helix, based on BotQ, and driven by real-world data.

Skild AI

By 2025, Skild AI has transformed from a technology-driven startup into one of the highest-valued foundational model companies in the global embodied intelligence field.

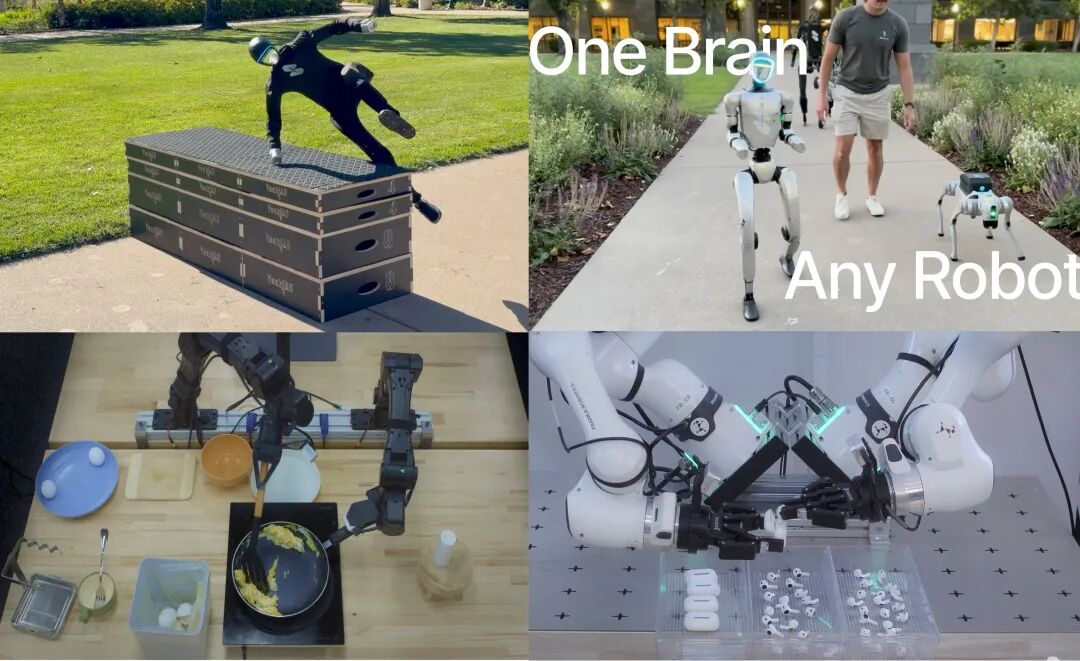

At the beginning of the year, Skild AI maintained a relatively low profile, with publicly disclosed information primarily focusing on its “general-purpose robot foundational model” roadmap. The company continued to advance the training and system architecture development of Skild Brain, aiming to enable the same model to operate across different robot forms, including quadruped robots, humanoid robots, robotic arms, and mobile manipulation platforms, covering multiple tasks and hardware with a unified model.

Entering the first half of the year, Skild accelerated its deployment in real-world scenarios. The company deployed Skild Brain in multiple application environments, including warehousing, manufacturing, security inspection, data centers, and building scenarios, for performing tasks such as handling, inspection, manipulation, and navigation. The focus at this stage was not on a single product release, but on accumulating real-world data through multi-scenario deployment to expand the training scale of the base model.

On the commercial front, Skild first disclosed entering a revenue growth phase in 2025. Public information shows that the company achieved revenue of tens of millions dollars from zero within a few months, mainly from licensing and system integration projects of its base model on different robot platforms.

In the second half of the year, Skild initiated a new round of large-scale financing negotiations, attracting participation from several large institutions and industrial capital, including SoftBank, NVIDIA, Lightspeed, Coatue, Sequoia, and Bezos Expeditions.

During the end of 2025 and the beginning of 2026, Skild officially completed its Series C financing round, raising approximately $1.4 billion, with a post valuation exceeding $14 billion, making it one of the highest-valued robotics foundational software companies at the time. Following this financing, the company’s total funding approached $2 billion, which will be primarily used to expand model training scale, build a larger-scale data acquisition system, and promote compatibility with more hardware platforms.

In terms of technology roadmap selection, Skild has consistently adhered to a “foundational model first” approach, without launching its own robot body. Instead, it continues to strengthen Skild Brain’s positioning as a “cross-hardware universal brain,” providing a unified intelligent layer for humanoid robots, quadruped robots, and industrial platforms.

Physical Intelligence

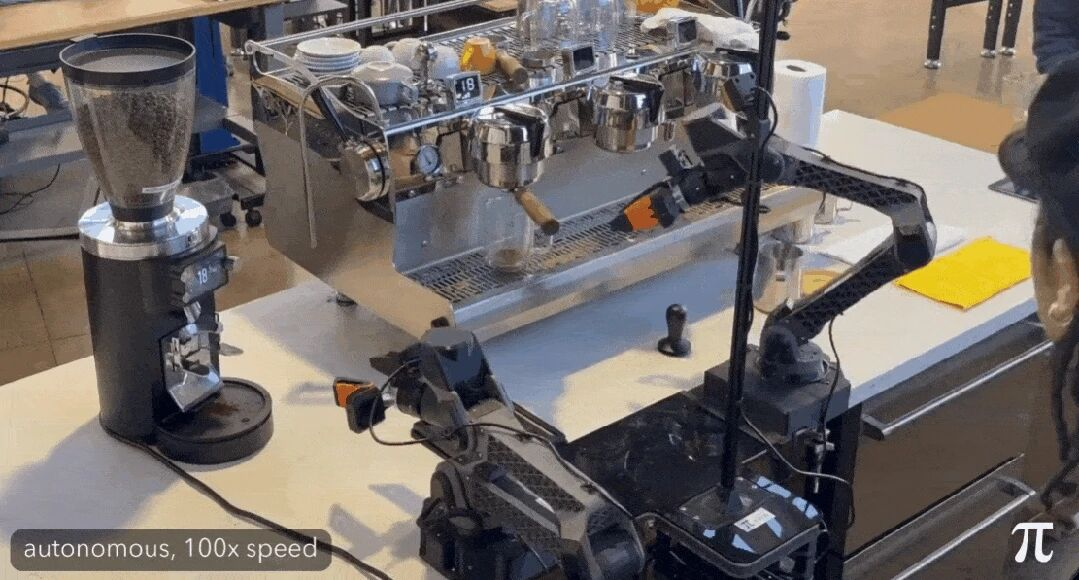

For Physical Intelligence (PI), 2025 will be a crucial year, marking the transition of its foundational model roadmap from technological research and development to practical verification and ecosystem building. Throughout the year, the company released multiple iterations of its models. The core goal of this model series is to enable robots to perform tasks in completely unfamiliar environments, improving their adaptability under zero-shot and few-shot conditions.

In February, Physical Intelligence released π0 and its open-source version. The company made π0’s weights and code publicly available, allowing researchers and developers to fine-tune and experiment on their own robot platforms. This move signifies the company’s shift from primarily internal R&D to a more open “open-source collaboration” model, building a broader developer ecosystem for its foundational models.

In April, Physical Intelligence released π0.5, an open-world, generalized vision-language-action model. Public information shows that π0.5 can complete multi-step operation tasks in unseen scenarios, demonstrating a significant improvement in its “cross-environment transfer capability.”

Regarding scenario validation, these foundational models began to be tested on various robot platforms and tasks. Internal demonstrations and experiments show that the model can control robots to complete multi-step and more precise operations, such as cleaning a kitchen, performing continuous manipulation tasks, or completing long-range operations in “open-world” environments. Some academic findings also indicate that the VLA system based on π0.5 can simultaneously process visual input, verbal commands, and low-level action sequences, enabling it to handle long-duration tasks in dynamic environments.

In the second half of the year, capital investment became another important factor. In November, Physical Intelligence completed a funding round of approximately $600 million, raising its valuation to approximately $5.6 billion (approximately 39.2 billion yuan). This round of funding will primarily be used to expand the scale of basic model training, expand the engineering and simulation team, and strengthen data acquisition and cross-platform testing capabilities.

On November 17, Physical Intelligence officially released its next-generation robot basic VLA model, π0.6. This model continues the hierarchical design architecture of π0.5. Its core logic is to decompose complex tasks into two hierarchical decision-making processes: high-level sub-task planning and low-level continuous action generation, achieving efficient collaboration between “perception-planning-execution.”

In terms of technology selection, Physical Intelligence has consistently adhered to a “model-first, cross-platform universality” R&D direction throughout the year, avoiding involvement in complete robot manufacturing and instead focusing on building a unified intelligent layer that can serve multiple types of robot hardware. The company systematically collects multimodal data during robot operation through its self-built experimental system, providing high-quality real-world training samples for its models, enabling continuous iteration over larger scales and longer time spans.

Apptronik

Apptronik, in 2025, gradually transitioned from a research-oriented company to a phase of simultaneous expansion in capital, production lines, and customers.

At the beginning of the year, Apptronik completed a large Series A funding round in February, raising approximately $350 million, led by B Capital and Capital Factory, with participation from Google. The company explicitly stated in its official disclosure that this funding will primarily be used for mass production preparations for the Apollo humanoid robot, supply chain construction, and early customer deployment.

In March, the company further strengthened its capital structure, completing an additional $53 million in financing with Mercedes-Benz, ARK Invest, and other institutions, bringing its total Series A funding to over $400 million. Mercedes-Benz not only participated as an investor during this phase but also announced a pilot program with Apptronik to utilize Apollo’s automated assisted operations within its factory system, supporting material handling and processing tasks in manufacturing.

Entering the second quarter, Apptronik shifted its focus from financing to building production lines and partnerships. The company established a partnership with electronics manufacturing services provider Jabil, which is responsible for building Apollo’s manufacturing, testing, and quality systems. Simultaneously, Apptronik began early pilot deployments of Apollo at multiple industrial customer sites, focusing on warehousing, manufacturing, and logistics support processes.

In June, Apptronik announced the establishment of a wholly-owned subsidiary, Elevate Robotics Inc., positioned as an independent business unit focusing on industrial and augmented robot technologies, to advance product line development for higher-load and more demanding applications. This organizational restructuring was designed to support the company’s medium- to long-term industrial robot strategy, excluding Apollo.

In the second half of the year, the company continued its expansion in terms of capital. Multiple media outlets reported that Apptronik completed a Series B funding round in the third quarter, raising approximately $560-660 million, bringing its post valuation to nearly $5.5 billion. This brings the company’s total funding within a year to over $1 billion, making it one of the largest companies in the humanoid robot sector in terms of funding in 2025.

In terms of products and technology, Apptronik did not release any new models in 2025. Instead, it focused on engineering and system-level improvements around Apollo, including modular joints, overall reliability, integration of perception and control systems, and interface adaptation with industrial systems.

Simultaneously, Apptronik continued to expand its cooperation within its ecosystem. In the field of AI, it maintained technical collaboration with Google DeepMind’s Gemini Robotics project to enhance the robot’s perception and movement capabilities in complex environments.

FieldAI

In 2025, FieldAI transitioned from its initial technological accumulation phase to a stage of simultaneous large-scale deployment and industry application.

At the beginning of the year, FieldAI continued to advance the development of its core technology architecture, Field Foundation Models (FFMs). These models are the first risk perception foundational models designed for embodied intelligence, enabling robots to autonomously navigate, make decisions, and execute tasks in highly dynamic, unknown, or unpredictable real-world environments.

Unlike some models that are adapted for robots using general-purpose language models, FFMs are built from the outset around the risks of the physical world, environmental uncertainties, and perceptual inputs (such as vision, LiDAR, and multimodal data), allowing robots to operate adaptively without GPS or pre-set maps.

In the first half of the year, FieldAI accumulated practical experience in real-world scenarios across multiple industrial sectors. The company stated that its models have been tested and deployed in complex environments such as construction, energy, manufacturing, urban delivery, and inspection, including actual work at customer sites in multiple countries, using the models to control robots to perform routine tasks such as inspection and autonomous navigation.

Along with technological advancements, 2025 became the year with the most concentrated capital investment for FieldAI. On August 20, the company announced that it had raised approximately $405 million in two consecutive rounds of financing from investors including Bezos Expeditions, Temasek, Khosla Ventures, Intel Capital, Canaan Partners, Emerson Collective, and NVentures (NVIDIA’s venture capital arm), bringing the company’s valuation to approximately $2 billion (approximately 14 billion yuan).

By the end of 2025, FieldAI has essentially established its positioning as a “platform-based embodied intelligence solution provider,” not limited to any specific robot hardware form or single task scenario, but supporting the autonomous operation of multiple types of robots in real-world environments through a universal basic model.

Agility Robotics

Its development in 2025 revolved around “financing—production line ramp-up—warehousing and delivery,” gradually forming several reproducible real-world deployment cases.

At the beginning of the year, the company initiated preparations for a new round of financing. Multiple media outlets reported that it planned to raise approximately $400 million, with a pre-investment valuation of approximately $1.75 billion. The funds will be primarily intended to expand the RoboFab production line, increase the deployment and maintenance team, and prepare for the large-scale delivery of Digit. By mid-year, multiple data platforms indicated that the financing round was essentially complete.

Simultaneously with the financing progress, the RoboFab factory in Oregon entered a continuous ramp-up phase in 2025. Focusing on the single Digit model, the factory gradually solidified standardized assembly, calibration, and factory testing processes, prioritizing issues such as stable assembly cycle time, consistency of key components, and standardization of maintenance procedures. The manufacturing goal shifted from a “prototype pace” to a “mass delivery pace.”

At the product level, Agility did not launch any new models throughout the year, but instead continued engineering-level iterations of Digit, focusing on joint drive reliability, foot sensor stability, balance control, battery management, and remote diagnostic systems. The goal was to support continuous shift operation and reduce on-site downtime. These updates directly serve the long-term operational needs of warehousing scenarios.

In terms of commercial deployment, the focus in 2025 remained on the single track of warehousing and logistics, with quantifiable operational cases gradually emerging.

At GXO Logistics‘ warehouse, Digit entered a long-term commercial operation phase, used to unload cartons from AMRs or conveyor systems and move them to designated workstations. By the second half of 2025, publicly available data revealed that the site had completed over 100,000 pallet/carton handling tasks, becoming one of the earliest humanoid robot cases to achieve significant operational scale.

After mid-year, Agility and Mercado Libre launched a deployment project at their fulfillment center in San Antonio, Texas, for material handling and transfer processes in e-commerce fulfillment, serving as a starting point for future replication to multiple fulfillment centers.

At multiple customer sites, Digit began operating in parallel, collaborating with autonomous mobile robots (AMRs) and conveyor lines to handle high-frequency processes such as picking, transfer, recycling, and shelving. Deployment evaluation metrics focused on shift coverage, single-machine throughput, on-site downtime, and maintenance response time.

Regarding technology selection, Agility continued to maintain its hierarchical control and task planning architecture in 2025, refraining from introducing a large end-to-end model as the main control system. Instead, it emphasized predictability and safety redundancy to match the engineering requirements of structured warehousing environments.

Conclusion:

Looking back at the progress of these US billion-dollar unicorns in 2025, a common change is emerging: the focus of competition has shifted from “demonstrating capabilities” to “running a viable engineering system.”

Figure AI aims to be the first to establish a closed loop between models, complete machines, and manufacturing; Skild AI and Physical Intelligence are betting on general-purpose basic models; FieldAI is focusing on complex industrial scenarios; and Apptronik and Agility Robotics have entered the production line and delivery stages earlier. While their paths differ, the metrics are converging—whether the model forms a closed loop, whether the production line is operational, and whether deployment has entered continuous operation.

If US companies in 2025 represent a path “from model to engineering,” then on the other side, China’s billion-dollar unicorns is forging a different path under different industrial conditions. In the next article, we will turn our attention to Chinese companies, comparing and analyzing the progress of companies like GALBOT, AGiBOT, and Unitree in 2025 to observe the divergence in this track under the two systems.

探索者论坛-scaled.jpg)