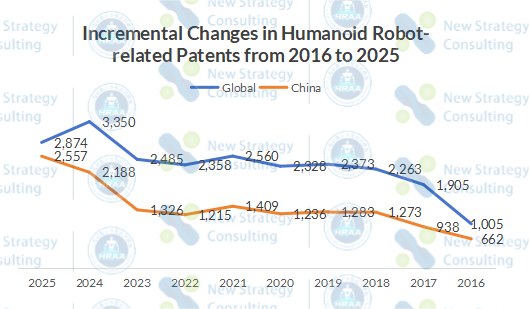

According to incomplete statistics from Humanoid Robot Scene Application Alliance (HRAA), combined with data from Google Patents and the China National Intellectual Property Administration (CNIPA), as of January 2026, the number of publicly disclosed patents for humanoid robots worldwide has exceeded 31,800, in which China has over 15,400 patents, maintaining its position as the world’s leading technology producer.

In 2025, the number of newly published patents across the world exceeded 2,820, with China adding over 2,557, setting a record high, indicating that technological investment and industrial layout are entering an accelerated phase.

Note: Due to systematic differences in the public disclosure, homologous deduplication, and indexing processes between Google Patents and CNIPA across countries, this article adopts a hybrid approach using China as the benchmark for CNIPA and Google for overseas data, which may result in omissions or deviations. A detailed analysis of the disclosed humanoid robot patents in 2025 is below, which is primarily based on China data:

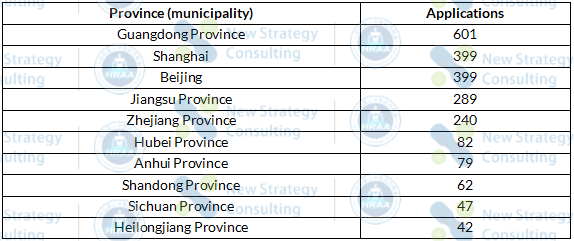

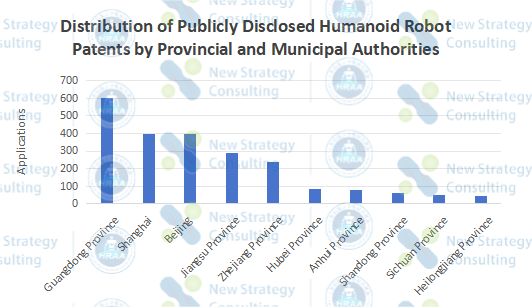

Regional distribution: The Yangtze River Delta and the Pearl River Delta form a dual-core structure

Regarding patent application numbers in China’s provinces and municipalities in 2025, the regional agglomeration effect is particularly prominent. Among the top ten provinces and municipalities, Guangdong Province leads with 601 applications, accounting for approximately 26% of the total in the top ten provinces and municipalities, significantly higher than other regions; Shanghai and Beijing share the second place with 399 applications each, followed closely by Jiangsu Province and Zhejiang Province with 289 and 240 applications respectively.

The top ten provinces and municipalities in terms of publicly disclosed humanoid robot patents in 2025 (Compiled based on publicly available online information; please make a correction if there is any omission)

The top five provinces and municipalities collectively contributed over 80% of the patent applications, with the Pearl River Delta, Yangtze River Delta, and Beijing-Tianjin-Hebei urban agglomerations forming the core regions of China’s humanoid robot technology innovation. In contrast, provinces such as Hubei, Anhui, Shandong, Sichuan, and Heilongjiang have fewer than 100 applications, indicating that this field has not yet formed a nationwide diffusion but rather a highly concentrated innovation industry.

(Compiled based on publicly available online information; please make a correction if there is any omission)

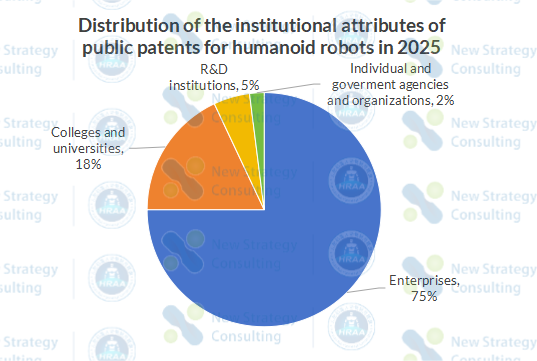

Institutional attributes: Enterprise-led with active participation from research institutions

From an institutional perspective, enterprises have become the dominant force. In the statistical sample, enterprises applied for 2,124 patents, accounting for approximately 75% of total applications; colleges and universities applied for 496 patents, representing about 18%; R&D institutions applied for 136 patents, making up roughly 5%; individuals and government agencies and organizations combined accounted for less than 2%.

This structure of humanoid robot patent distribution demonstrates that the industry has clearly entered a stage centered on enterprise engineering capabilities. However, colleges and universities and R&D institutions continue to play crucial roles in fundamental research and key technological breakthroughs, collectively forming an innovation pattern characterized by “enterprise leadership with academic support”.

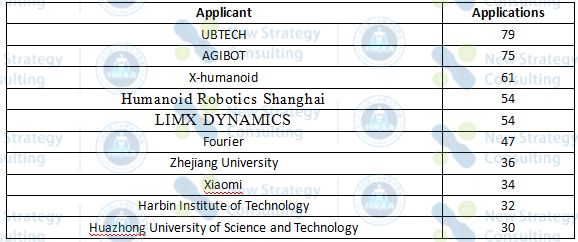

Leading applicants: Rapid rise of startups and new platform-type institutions

In respect of leading applicants, patent activity in 2025 has shown a clear concentration trend. UBTECH ranked first with 79 patents, followed by AGIBOT with 75, X-humanoid with 61, Humanoid Robotics Shanghai and LIMX DYNAMICS both with 54.

The top ten applicants for humanoid robot patents in 2025 (Compiled based on publicly available online information; please make a correction if there is any omission)

In addition, Fourier and Xiaomi have significant application volumes. Meanwhile, Zhejiang University, Harbin Institute of Technology, and Huazhong University of Science and Technology ranked in the top ten with 36, 32, and 30 patents respectively, demonstrating that leading universities maintain strong presence in key technological fields. Overall, the industry is transitioning from a “multi-entity parallel exploration” model to a “leading enterprise-dominated” competitive structure.

Inventors: Team-based and institutionalized characteristics are prominent

At the inventor level, the trend toward institutionalization and team-based collaboration is particularly pronounced. In 2025, excluding cases of ‘anonymous requests,’ the top-ranked named inventor was Jiang Lei, with 50 publicly filed applications. Liu Yufei and Zhao Guozeng followed with 41 and 34 applications, respectively.

Top 10 inventors of humanoid robot patents published in 2025 (Compiled based on publicly available online information; please make a correction if there is any omission)

Compared to previous years, the number of individual inventor applications has decreased, indicating that humanoid robotics technology is increasingly dependent on team collaboration and organized R&D, with diminishing room for individual breakthroughs. This trend directly correlates with the rapidly increasing technical complexity in the field: from structural design and drive systems to perception systems, control mechanisms, and algorithms, humanoid robots have evolved into highly systematic engineering challenges. Individual inventions are being replaced by multidisciplinary team-based collaborative research and development.

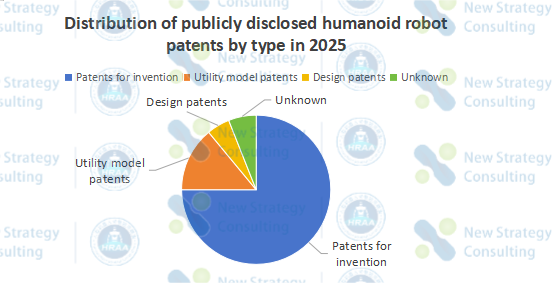

Patent Type: Invention patents dominate, with technology still in the core R&D phase

In terms of patent type, the patent structure reveals a clear dominance of invention patents. In the sample, there are 2,122 patents for invention, accounting for nearly 75%, while there are 397 utility model patents, making up 14%, and only 118 design patents (less than 5%). This pattern indicates that humanoid robots are still in a phase focused on core technological breakthroughs, with competition concentrated on fundamental capabilities like motion control, drive systems, perception, and system architecture, rather than superficial improvements in appearance or structure.

(Compiled based on publicly available online information; please make a correction if there is any omission)

Conclusion

Overall, the regional clustering, enterprise dominance, and concentration trends in patent data indicate that China’s humanoid robotics industry is transitioning from early exploration to a phase of systematic competition, with its technological capabilities still in the core development stage. However, it is important to note that patents themselves are merely an important reference for observing innovation activities, and it cannot be simply inferred that “more patents mean stronger technology.” In the actual industry, there are significant differences in patent strategies among enterprises: some tend to apply frequently and cover a wide range, while others adopt more conservative application strategies in core technologies, even deliberately reducing disclosures to gain a longer technical window. Therefore, the number of patents is more suitable for judging industry stages and structural evolution rather than simply measuring corporate strength. What truly determines the future landscape will still be system integration capabilities, engineering efficiency, and scenario implementation capabilities.

探索者论坛-scaled.jpg)