Starting in the second half of 2025, China’s humanoid robot sector is seeing a flurry of highly “capitalized” signals.

On December 25, multiple media outlets reported that Deep Robotics, one of the “Six Little Dragons of Hangzhou,” recently completed a pre-IPO round of financing worth hundreds of millions of yuan. This round was led by the National Artificial Intelligence Industry Investment Fund, and followed by JD.com.

Just two days earlier, on December 23, Deep Robotics disclosed in the regulatory system that it had officially started IPO tutoring, becoming the second humanoid robot startup this year, after Unitree, to attempt an A-share listing. This also makes it the third of the “Six Little Dragons of Hangzhou” to initiate the IPO process, following MANYCORE and Unitree.

According to public information, the sponsor institution of Deep Robotics is China Securities, and the tutoring period is expected to end in June 2026. After the tutoring is completed, the company will submit its initial public offering (IPO) application to the SSE STAR MARKET.

In a time when “embodied intelligence” and “humanoid robots” are still considered cutting-edge sectors, this series of actions is not common. This is more like a signal: some leading companies have begun to restructure their operations according to the logic of “listed companies,” rather than focusing solely on technological iteration or product demonstrations as their core narrative.

Deep Robotics is not an isolated case. Its emergence coincides with a larger-scale capital operation cycle for humanoid robot companies.

At least 6 companies have completed shareholding reforms, and 3 companies are clearly aiming for IPOs.

If we extend the timeline to the past year, we find that Deep Robotics is not an isolated case.

In China’s humanoid robot sector, at least 6 leading companies have completed shareholding reforms and have publicly or semi-publicly signaled their intention to go public to varying degrees.

Among them, Unitree is progressing the fastest. Public information shows that Unitree completed its shareholding reform and started its IPO tutoring in mid-2025, and subsequently passed the tutoring acceptance within 2025, becoming one of the most advanced humanoid robot companies. This company, which started with quadruped robots, has been continuously expanding into general-purpose humanoid robots in recent years. Its product roadmap is characterized by high mobility and engineering maturity, covering both scientific research and industry, and achieving shipment scale in both consumer and industrial markets.

Following closely behind is Leju Robot. On October 30, 2025, Leju Intelligent (Shenzhen) Co., Ltd. completed its IPO filing with the Shenzhen Securities Regulatory Bureau, with Orient Securities as its sponsoring broker. Leju announced the completion of a pre-IPO financing round of nearly 1.5 billion yuan. On the business side, Leju is one of the earliest companies in China to develop humanoid robot bodies, pursuing a path that combines engineering and industrialization. Its capital operations emphasize preparing for production lines, R&D, and delivery capabilities.

Deep Robotics completed its pre-IPO financing and initiated IPO tutoring at the end of 2025. Its shareholder structure includes both national-level industrial funds and industrial capital. Similar to Unitree, Deep Robotics also started with quadruped robots, but its products emphasize adaptability to complex environments and engineering reliability, and on this basis, it is advancing its embodied intelligent humanoid robot development.

Compared to the above three companies, AGiBOT, Fourier, and GALBOT are currently still in the earlier preparation stages.

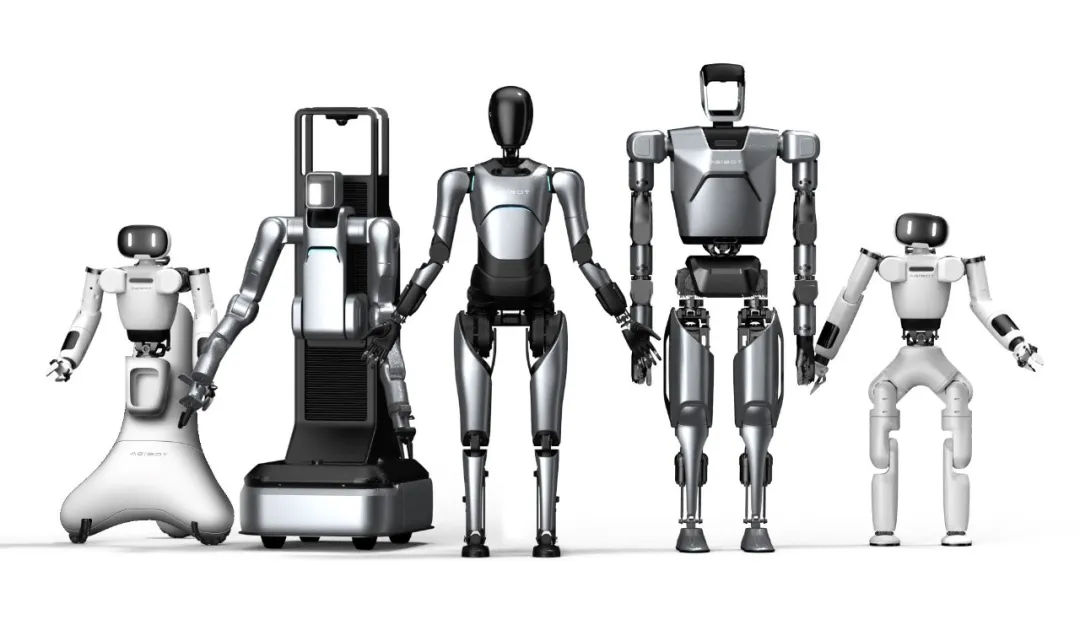

AGiBOT has completed its shareholding reform and attracted market attention in 2025 through a series of capital operations, including the acquisition of a controlling stake in SW Ancor listed on SSE STAR MARKET (it explicitly stated that it would not pursue a backdoor listing within three years). Its technological approach does not focus on a single robot form, but emphasizes “embodied intelligent brain” and general robot platform capabilities, attempting to establish long-term barriers at the system level, thus making its capital path more diversified.

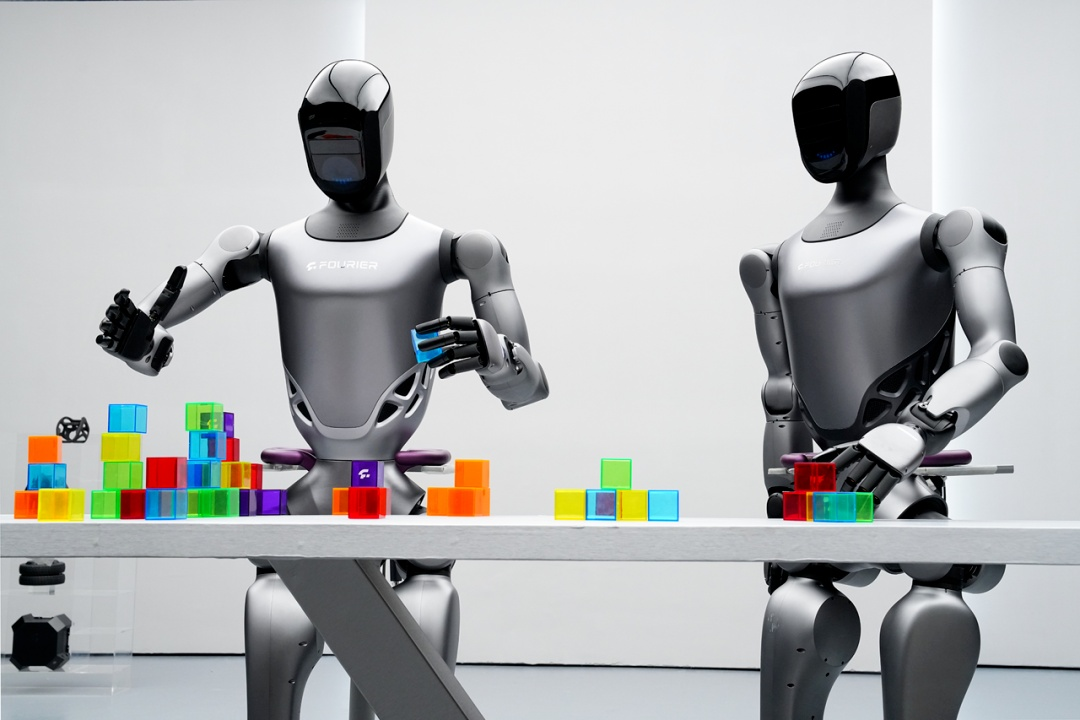

Fourier‘s background is more unique. Compared to most companies that start with general robots, Fourier has long been deeply involved in the field of medical rehabilitation robots, possessing more mature experience in commercialization and delivery. After completing its shareholding reform, Fourier began to simultaneously promote the technological integration of humanoid robots and rehabilitation scenarios, and media reports indicate that it is preparing for an A-share listing.

GALBOT has also completed its shareholding reform and completed multiple rounds of financing in a short period, with a cumulative financing scale exceeding 2.4 billion yuan. Its external narrative emphasizes the integration of large models and robot systems, positioning itself as a middleware provider of embodied intelligent capabilities. Compared to other companies, its listing schedule is not yet clear, but it is widely regarded by the market as a potential IPO candidate.

Overall, these six companies differ in product form, technological focus, and business path, but they are highly consistent at a crucial juncture: they all completed their shareholding reforms in 2025.

From the results, a relatively clear fact is emerging: the humanoid robot sector has entered a “preparation period for listing,” with only differences in the pace, path, and focus chosen by different companies.

2026 will be a busy year, but differentiation is underway.

With multiple humanoid robot companies completing shareholding reforms, initiating pre-IPO tutoring, or advancing pre-IPO financing around the same time, a clear consequence is that 2026 will be a year in which humanoid robot companies collectively face the capital market. Whether they ultimately choose the SSE STAR MARKET or the Stock Exchange of Hong Kong (HKEX), these companies will undergo multiple tests from regulators, investors, and the market at the same stage.

From a procedural perspective, this timing is not unexpected. IPO tutoring, acceptance, and application inherently have strong time constraints. Companies that completed shareholding reforms in 2024-2025 will objectively enter the application and review window around 2026.

From an industry rhythm perspective, humanoid robots are also entering a critical juncture. After years of technological accumulation, the industry is transitioning from “whether a prototype can be made” to “whether it can be delivered at scale.” This shift allows companies to offer more quantifiable metrics in their capital market narratives, moving beyond reliance solely on long-term projections.

However, as the IPO process progresses, the core issues the capital market focuses on are also changing.

In the early stages, the market focuses more on the forward-looking nature of the technological roadmap and the team’s background; but as they approach the public market, the evaluation criteria begin to shift towards more operational factors, including order structure, cost control capabilities, production ramp-up pace, and cash flow security. This means that going public does not automatically amplify a company’s value; rather, it may amplify differences.

Looking at the paths of several leading companies, this differentiation has already taken shape. Some companies excel in mature engineering capabilities and product delivery experience, some emphasize embodied intelligence systems or large-scale model capabilities, and others rely on relatively defined application scenarios such as healthcare and education. These differences can coexist in the primary market, but once in the public market, they are often compared using the same evaluation framework.

In terms of actual implementation, embodied intelligence has not yet entered the stage of large-scale general application. Currently, the clearer applications are mainly concentrated in three scenarios:

First, research, education, and the developer ecosystem, primarily featuring platform-based robots and experimental systems;

Second, specific structured or semi-structured environments, such as factories, industrial parks, and inspection sites, where the complexity of actions and safety requirements are relatively controllable;

Third, human-robot collaboration scenarios such as rehabilitation and caregiving, emphasizing stability and long-term use rather than generalization to complex tasks.

This means that although “general-purpose humanoid robots” are making continuous technological breakthroughs, in the real world, the vast majority of applications remain “weakly generalizable and strongly constrained.” Robots can complete specific tasks within limited environments, but there is still a considerable distance to go before true cross-scenario generalization. This reality also dictates that companies must carefully choose their entry point in the commercialization path.

Therefore, “who goes public first” is not the decisive issue. More importantly, after going public, companies can prove three things to the market in a short period: first, whether their technological capabilities can be translated into stable product delivery; second, whether there is room for continuous improvement in cost and efficiency; and third, whether business expansion is based on real demand, rather than single-point demonstrations.

From this perspective, the “excitement” of 2026 is more like a concentrated showcase of a phase. It’s both a result of increased industry maturity and a crucial starting point for industry stratification. For humanoid robot companies, the capital market provides new resources and a platform, and will also more quickly test the sustainability of their business and technological paths.

After successfully transitioning from the laboratory to the market, the real test may have just begun.

探索者论坛-scaled.jpg)