Within a single day, three autonomous driving industry chain companies received filing notices for overseas listings.

On October 14, China Securities Regulatory Commission simultaneously announced filing notices for overseas issuance and listings for WeRide, Pony.ai, and Seyond. The three companies launched IPO in Hong Kong, meaning that they had cleared key regulatory hurdles and would be poised to list on the HKEX.

WeRide and Pony.ai completed their respective IPOs in the US last year, and they promoted a secondary listing in HKEX this time. If successful, they could become the second autonomous driving companies, following Hesai Technology, to achieve dual listings on the US and Hong Kong stock markets.

The simultaneous approval of the three companies is a first in the history of the autonomous driving industry. It signals a shift in regulatory policy from encouraging innovation to supporting IPOs, and perhaps also reflects that China’s autonomous driving industry chain is entering a new capital-driven cycle.

Why now? Why them?

Over the past five years, China’s autonomous driving industry has evolved from a “policy pilot” to a “regulatory focus.” From 2021 to 2024, regulators will promote road testing of autonomous vehicles, the development of intelligent connected vehicle demonstration zones, and pilot programs for market access management. Since the end of 2024, policies have entered a new phase, a shift from “encouraging R&D” to “supporting compliant IPOs.”

Since the beginning of this year, China Securities Regulatory Commission has opened green channels for overseas issuance and filings for a number of smart manufacturing, high-end equipment, and next-generation information technology companies. This means that regulators no longer view autonomous driving as a “high-risk testing ground,” but instead incorporate it into the system of “strategic emerging industries”, leveraging the capital market to support the implementation of the technology.

The logic behind the capital market is also changing. The autonomous driving industry is characterized by high investment, long R&D cycles, and even longer payback periods. For WeRide and Pony.ai, the Robotaxi operating model requires the continuous expansion of their fleet and urban network. For Seyond, automotive-grade mass production, cost reduction, and process ramp-up are equally capital-intensive.

Against this backdrop, going public has become an inevitable path for sustained capital injections. As one industry investor put it, “From ‘financing-driven innovation’ to ‘IPO-driven implementation,’ the autonomous driving industry is completing its transformation from an entrepreneurial ecosystem to an industrial ecosystem.”

The three approved companies cover nearly all three core aspects of the autonomous driving industry: WeRide and Pony.ai represent the “technical” and “operational” sides of autonomous mobility/logistics, while Seyond represents the “technical foundation” of perception-based hard technology. A common characteristic of all three companies is that they have reached a critical inflection point in achieving scale:

WeRide

Founded in 2017, it pioneered the commercialization of Robotaxi. In the second quarter of 2025, the company’s revenue reached 127 million yuan, a year-on-year increase of 60.8%, in which robotaxi revenue increased by 836.7% year-on-year, accounting for 36.1% of total revenue, and its gross profit margin increased by 40.6% year-on-year.

Currently, WeRide’s business has expanded to 11 countries and over 30 cities, and it has obtained autonomous driving licenses in seven countries. From Shanghai and Guangzhou to Singapore, Belgium, and the UAE, WeRide is building a global autonomous driving travel network.

Pony.ai

Its pace is almost synchronized. In the second quarter of 2025, its total revenue reached 154 million yuan, a year-on-year increase of 75.9%. The total number of Robotaxi exceeded 500 and is expected to exceed 1,000 by the end of the year. The company has fully entered the paid operation phase in Beijing, Shanghai, Guangzhou, and Shenzhen, covering an area of over 2,000 square kilometers.

Financial reports show that its passenger fare revenue increased by over 300% year-on-year, approaching its operational break-even point.

Pony.ai Robotaxi in Qatar

Pony.ai is also actively expanding overseas market, having obtained autonomous driving road test licenses in Qatar, Singapore, Dubai, and other places, embarking on a global expansion.

Seyond

Located upstream in the industry chain, it is a leading Chinese company in automotive-grade LiDAR. It delivered approximately 230,000 LiDAR units in 2024, ranking second globally. According to the prospectus, its revenue was projected to grow from $66.3 million to $160 million between 2022 and 2024, with gross profit margin expected to turn positive at 12.6% in the first quarter of 2025, marking the transition from cash-burning expansion to profitability.

STARS’s IGV is equipped with the Robin W wide-angle lidar

Leveraging its dual technology strategy (1,550nm Falcon series and 905nm Lingque series), Seyond covers diverse scenarios, including passenger cars, commercial vehicles, and robotics, and has established stable partnerships with leading companies such as NIO, Shaanxi Heavy Truck, and ZELOS.

It’s no coincidence that the three companies received approval for overseas listings on the same day. They represent the most commercially viable forces in the autonomous driving market: WeRide and Pony.ai represent proven application success, while Seyond represents core components crossing the profitability threshold.

Why has Hong Kong become a preferred destination?

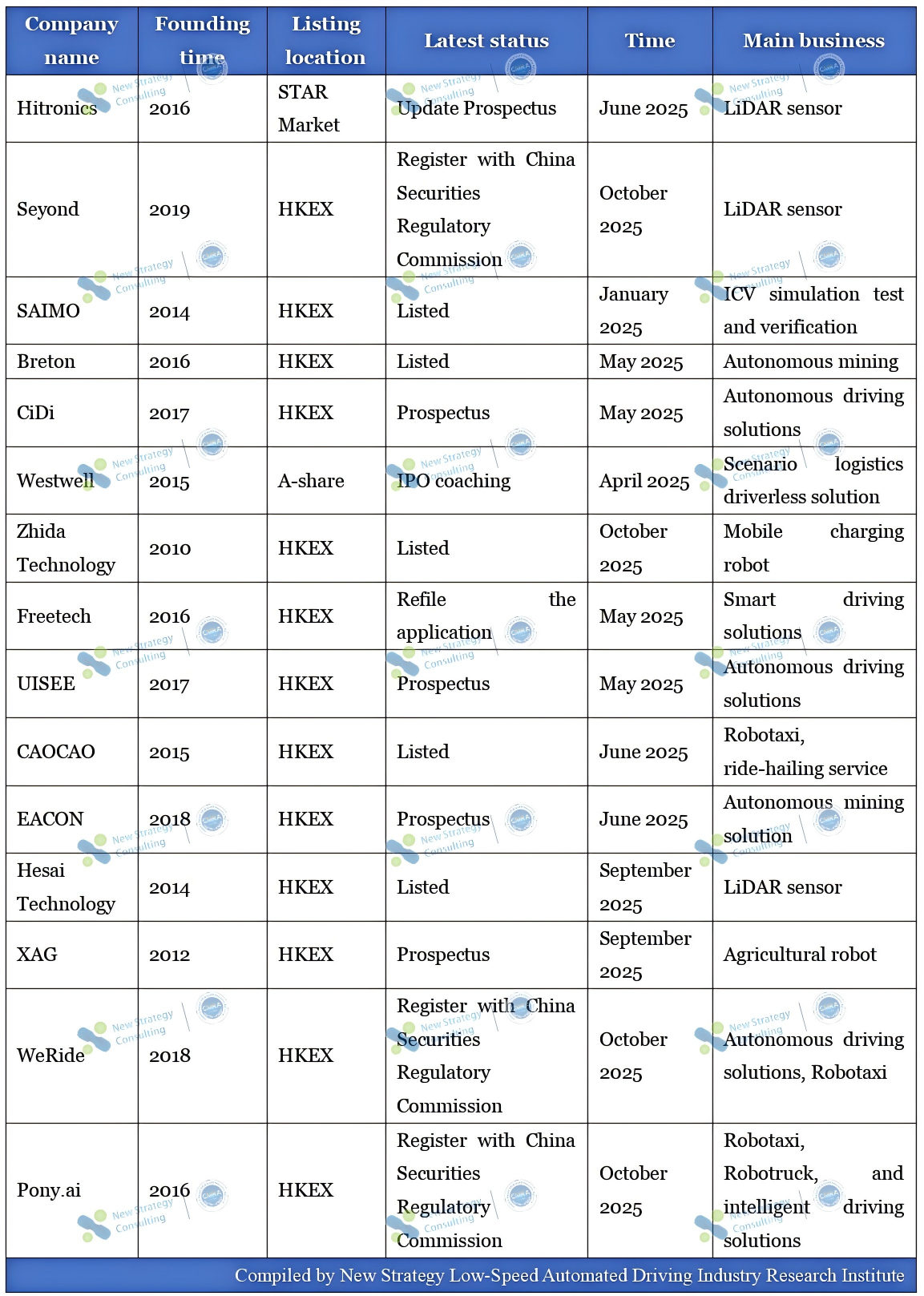

According to statistics from the New Strategy Low-Speed Automated Driving Industry Research Institute, since 2025, over 15 domestic autonomous driving companies have updated their listing status (including successful IPOs, filing applications, and CSRC registrations). Thirteen of these companies, representing over 86%, have listed on HKEX.

In addition to the aforementioned companies, Momenta is said to consider changing its IPO location from New York to Hong Kong. In June 2024, Momenta received a filing notice from the China Securities Regulatory Commission for a US listing, which expired on June 17 of this year.

The list of autonomous driving companies that have successfully listed on HKEX includes iMotion, RoboSense, ON TIME, Black Sesame Technologies, Horizon Robotics, and MINIEYE. Clearly, HKEX has become the preferred destination for autonomous driving companies to go public.

As the most international financial center in Asia, Hong Kong boasts multiple advantages, including geographical location and international perspective.

In terms of its regulatory framework, HKEX is both aligned with international standards and backed by national institutional backing, making it an ideal choice for balancing policy security and global capital. Secondly, HKEX allows dual primary listings, attracting both international institutional investors and southbound capital from mainland China, providing companies with diversified financing channels. For WeRide and Pony.ai, Hong Kong is not only a “capital replenishment center” but also a “springboard to the global market”, particularly in terms of global expansion, where they can access stronger financing and brand support through the Hong Kong stock market platform.

Most importantly, HKEX has a deeper understanding of domestic technology companies, prioritizing long-term technological barriers and scale of operations over profit figures. Hong Kong’s capital ecosystem is strongly coupled with the mainland’s industrial ecosystem, fostering a closed loop of “capital-scenarios-innovation.”

From Horizon Robotics, Black Sesame Technologies, Hesai Technology and Seyond, to EACON and CiDI, and from supply chain companies to complete vehicle/autonomous driving solution providers, a clustering effect is emerging in the HKEX‘s autonomous driving sector. This sectoralization trend will attract more global capital to China’s autonomous driving sector and may also drive other related companies to accelerate their capitalization efforts.

Increased capital market attention will further restructure the valuation system of the entire industry.

Conclusion

From the policy approval process, to the global expansion of businesses, and to the structural repatriation of capital, the approval of three companies on the same day symbolizes the entry of China’s autonomous driving industry into a “maturity cycle.” The three driving forces of China’s autonomous driving industry, namely, applications, technology, and capital, have officially converged.

——————————————————————————————————————————————————————————————————————————————

2025 Shenzhen International Artificial Intelligence Sanitation Robot Competition-cum-Application Innovation Competition will be held at Shenzhen University of Information Technology from November 26 to 29, 2025.

For details, please click https://cnmra.com/shenzhen-international-artificial-intelligence-sanitation-robot-competition-2025-will-be-held-in-shenzhen-from-november-26-to-29-2025/.

探索者论坛-scaled.jpg)