On July 22, UBTECH announced an equity financing, intending to issue approximately 30,155,450 new H shares at a price of HK$ 82.00 per share, raising approximately HK$ 2.473 billion. After deducting related fees and expenses, the net amount of funds raised was approximately HK$ 2.410 billion. Guotai Junan International, CITIC Securities, and TradeGo Markets are its placing agents.

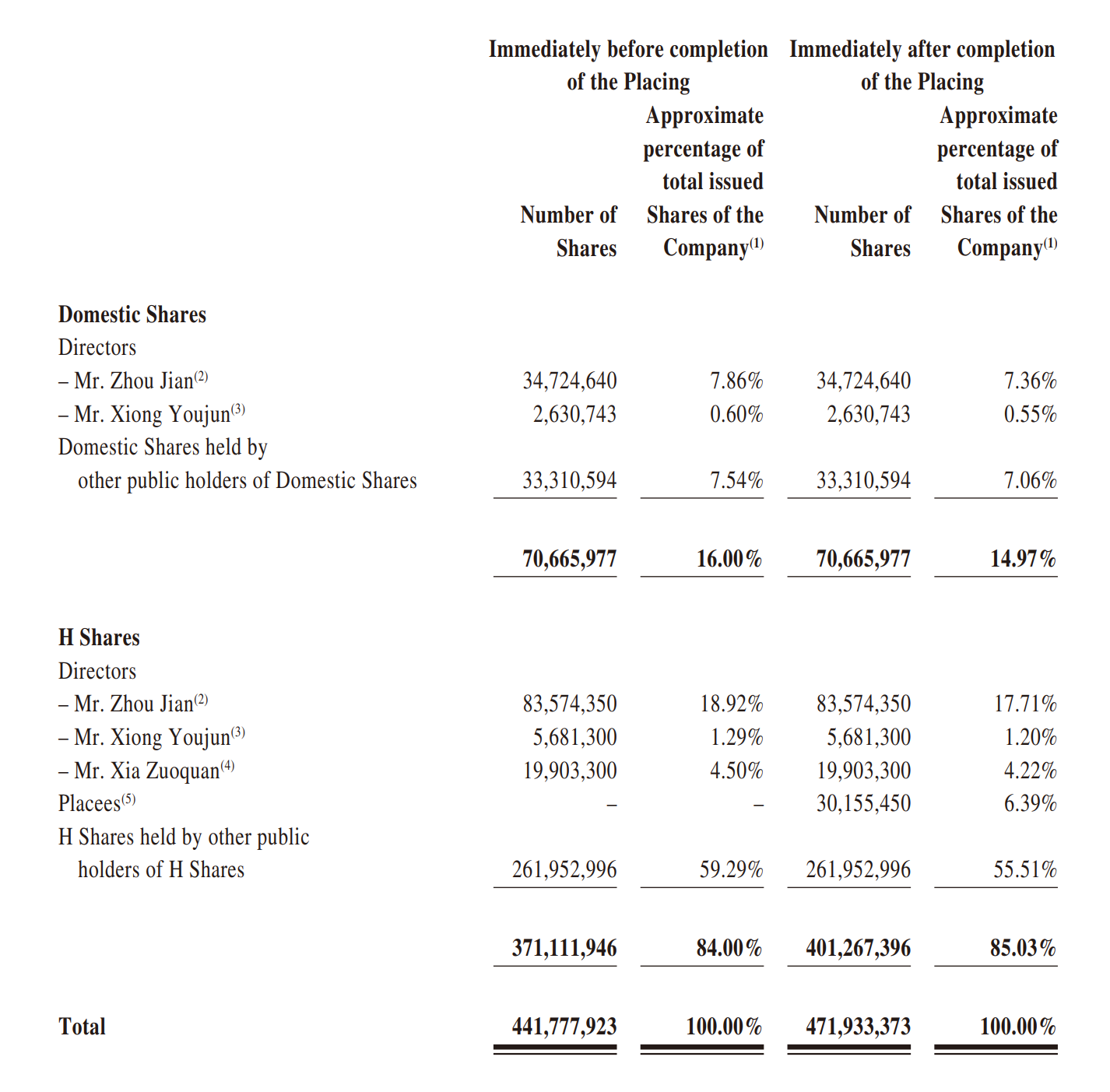

The placing price is 9.14% lower than the closing price of the previous trading day and the placing shares are equivalent to approximately 6.39% of the enlarged number of issued shares.

UBTECH stated that the proceeds from the placing will be used for its business operations and development, including working capital, general corporate purposes, domestic and overseas investments, project construction and decoration, and repayment of amounts due under the credit business of relevant financial institutions.

According to statistics, this is the fifth time that UBTECH has conducted an equity financing since its listing on the HKEX. In terms of IPO financing, UBTECH has raised a total of HK$ 5.582 billion, with a total of approximately 13.85% of the shares issued (accounting for the total shares after the completion of this placing).

Note:

Logistics Automation Development Strategy & the 7th International Mobile Robot Integration Application Conference Southeast Asia will be held in Concorde Hotel Kuala Lumpur, Malaysia on 21st August 2025. At the same time, the2025 Global MobileRobot Industry Development Report will be released. Welcome to join us.

For agenda, please click https://cnmra.com/logistics-automation-development-strategy-the-7th-international-mobile-robot-integration-application-conference-southeast-asia-21st-august-2025-concorde-hotel-kuala-lumpur-malaysia/

For registration, please click https://docs.google.com/forms/d/e/1FAIpQLSdGHjpHRU0mR0_2ZlqtJpUV25s3XlIIHtkkUUfxz0W6vpBqiA/viewform?usp=header

探索者论坛-scaled.jpg)