According to the Stock Exchange of Hong Kong (HKEX) on May 27, Shanghai Seer Intelligent Technology Co., Ltd. (hereinafter referred to as SEER) submitted an application for listing on the main board of the HKEX, and CICC is the exclusive sponsor.

SEER is the [9th] special technology company to publicly submit a listing application in accordance with the HKEX Chapter 18C* Equity Securities Specialist Technology Companies since it came into effect, and it is also the [1st] specialist technology company in Shanghai to publicly submit a listing application in accordance with this chapter.

*Chapter 18C refer to Chapter 18C of the Main Board Listing Rules of the HKEX, which officially came into effect on March 31, 2023, and aims to provide a tailored listing channel for specialist technology companies. This chapter focuses on cutting-edge fields such as artificial intelligence, cloud computing, advanced manufacturing, new energy, and quantum computing, allowing technology companies that do not meet traditional financial indicators to enter the Hong Kong stock market through core indicators such as R&D strength and commercialization prospects.

The champion team leads the way, with GLP and Ecovacs as shareholders

SEER was established in 2020. Zhao Yue, the founder of the company, was admitted to the mixed class of the Chu Kochen Honors College, Zhejiang University as an undergraduate and obtained a master’s degree in control science and engineering. During his time at school, he served as the captain of the small group robot football team of the Zhejiang University Robotics Laboratory, and led the team to win the RoboCup world championship twice in a row on behalf of Zhejiang University. Ye Yangsheng and Wang Qun, the co-founders, are both core members of the champion team.

Since the establishment, SEER has completed four rounds of financing, and its shareholders include GLP, China Growth Capital, Ecovacs, IDG, SAIF Partners, Broad Stream Cap, Prospect Bridge, Hongtai Aplus and many other well-known industry and financial investors.

The sales volume of robot controllers ranked first in the world for two consecutive years

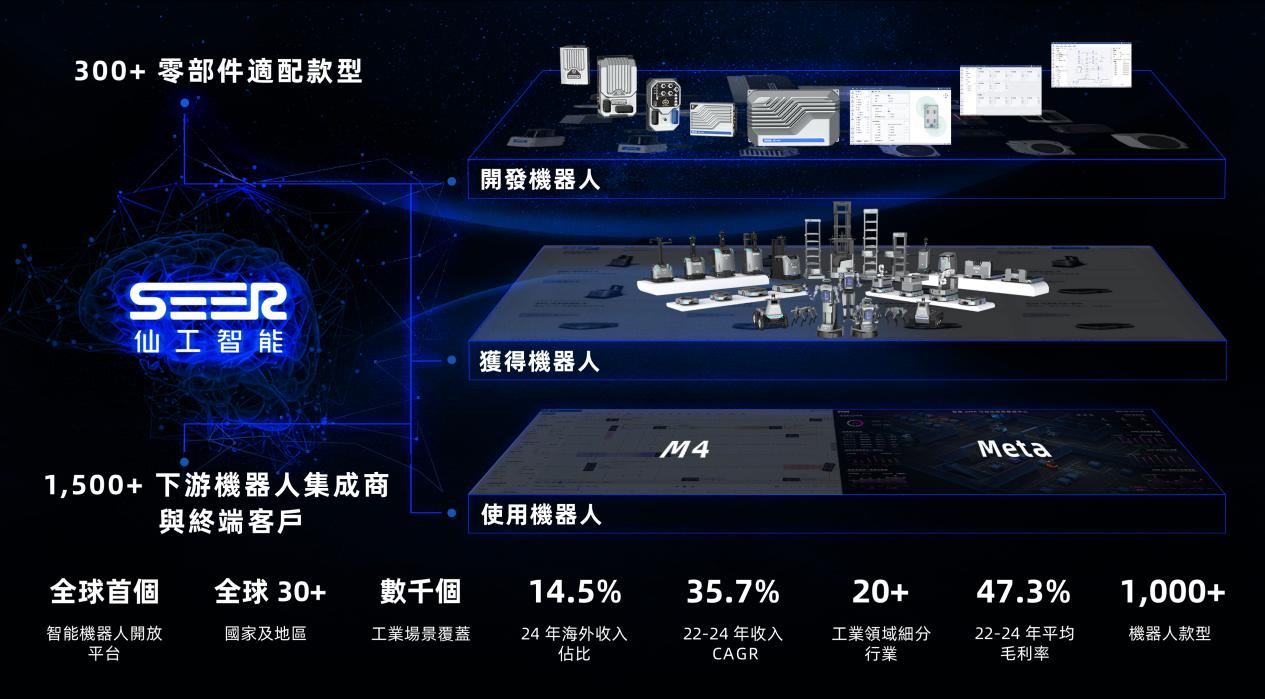

SEER is an intelligent robot company with control system as its core. Based on the technology and market position of the “robot brain” – control system, it integrates global supply chain resources to provide customers with one-stop solutions for robot development, acquisition and use.

According to the data of China Insights Consultancy, SEER ranked first in the global robot controller sales volume for two consecutive years from 2023 to 2024, and based on this, it built the world’s first large-scale intelligent robot open platform.

As of December 31, 2024, SEER controller is compatible with more than 300 parts and supports more than 1,500 integrators and end customers. So far, there are more than 1,000 types of robots deployed based on the SEER platform, covering more than 20 sub-industries such as 3C, automobiles, automation equipment, new energy, semiconductors, engineering machinery, and biomedicine.

“Technology + platform” dual flywheel drive, enhancing commercial landing capabilities

SEER has created a robot control system that integrates excellent performance, ease of use and cross-industry adaptability, and has absolute technical advantages in terms of high reliability, high ease of use and high generalization. Its business model is “technology + platform” dual flywheel drive, which not only meets customer customization needs, but also realizes cross-industry scalable deployment. Based on this business model, SEER further strengthens its ability to commercialize robot solutions in a variety of industrial environments and operating environments.

SEER provides a one-stop solution of “controller + software + robot” to downstream integrators and end customers through the platform, and is committed to making the development, acquisition and use of intelligent robots without barriers.

The prospectus shows that SEER’s business covers more than 30 countries and regions around the world, covering thousands of industrial scenarios. In 2022, 2023 and 2024, it served 380, 587 and 832 customers respectively. Customers cover two major groups: integrators and end customers.

The annual revenue compound growth rate is 35.7%, and the gross profit margin is growing steadily.

The prospectus shows that SEER’s revenue structure mainly presents three core sectors: the sales of robots integrated with SRC series robot controllers are the core source of revenue. During the historical record period, its absolute amount and its proportion of total revenue continued to rise; the sales of robot controllers and accessories constitute another important revenue pillar; in addition, although the software sales revenue accounts for a small proportion, it is showing a steady growth trend. As a key product supporting controllers and robots, it plays a significant synergistic role in promoting the sales of other hardware products.

In addition, SEER also provides value-added services to customers through infrastructure and tool chains such as Nebula System, Roboshop and Robocare, further improving the smart manufacturing ecosystem.

Financial data shows that SEER’s operating incomes in 2022, 2023 and 2024 were 184 million yuan, 249 million yuan and 339 million yuan respectively, with a compound annual growth rate of 35.7% from 2022 to 2024. During the same period, the gross profit margins were 46.8%, 49.2% and 45.9% respectively. According to data from China Insights Consultancy, SEER’s comprehensive gross profit margin remained above 45% during the same period, which is at the leading level in the intelligent robot industry.

The adjusted net losses in 2022, 2023 and 2024 were 30.74 million yuan, 20.90 million yuan and 10.63 million yuan respectively. The losses narrowed year by year, showing a positive trend towards break-even.

SEER stated in its prospectus that the net proceeds from the IPO would be mainly used to promote the research and development of cutting-edge AGI and embodied intelligence technologies, build a multifunctional center integrating R&D, operation, assembly and testing functions, conduct investments and mergers and acquisitions in the upstream and downstream of the robot industry chain, and build a global sales system, and used for working capital and general corporate purposes.

Note:

Logistics Automation Development Strategy & the 7th International Mobile Robot Integration Application Conference Southeast Asia will be held in Concorde Hotel Kuala Lumpur, Malaysia on 21st August 2025. Welcome to join us.

For agenda, please click https://cnmra.com/logistics-automation-development-strategy-the-7th-international-mobile-robot-integration-application-conference-southeast-asia-21st-august-2025-concorde-hotel-kuala-lumpur-malaysia/

For registration, please click https://docs.google.com/forms/d/e/1FAIpQLSdGHjpHRU0mR0_2ZlqtJpUV25s3XlIIHtkkUUfxz0W6vpBqiA/viewform?usp=header

探索者论坛-scaled.jpg)