According to public data, more than 56 notable investment and financing transactions were recorded domestically and internationally in the autonomous driving field during this quarter, with disclosed funds exceeding 13.2 billion RMB, including IPO fundraising.

The financing involved 45 domestic companies and 10 international ones. From a funding round perspective, most financed companies were in the early development stages, primarily securing Series A and B funding. Additionally, 12 companies in an accelerated development phase disclosed nearly 3.5 billion RMB in funding.

Looking at the funding amounts, confidence in the autonomous driving sector in Q3 was strong, with total disclosed financing exceeding 13.2 billion RMB. Among these, 16 financing events surpassed 100 million RMB (6 of which were over 1 billion RMB), accounting for 12.8 billion RMB or 97% of the total amount.

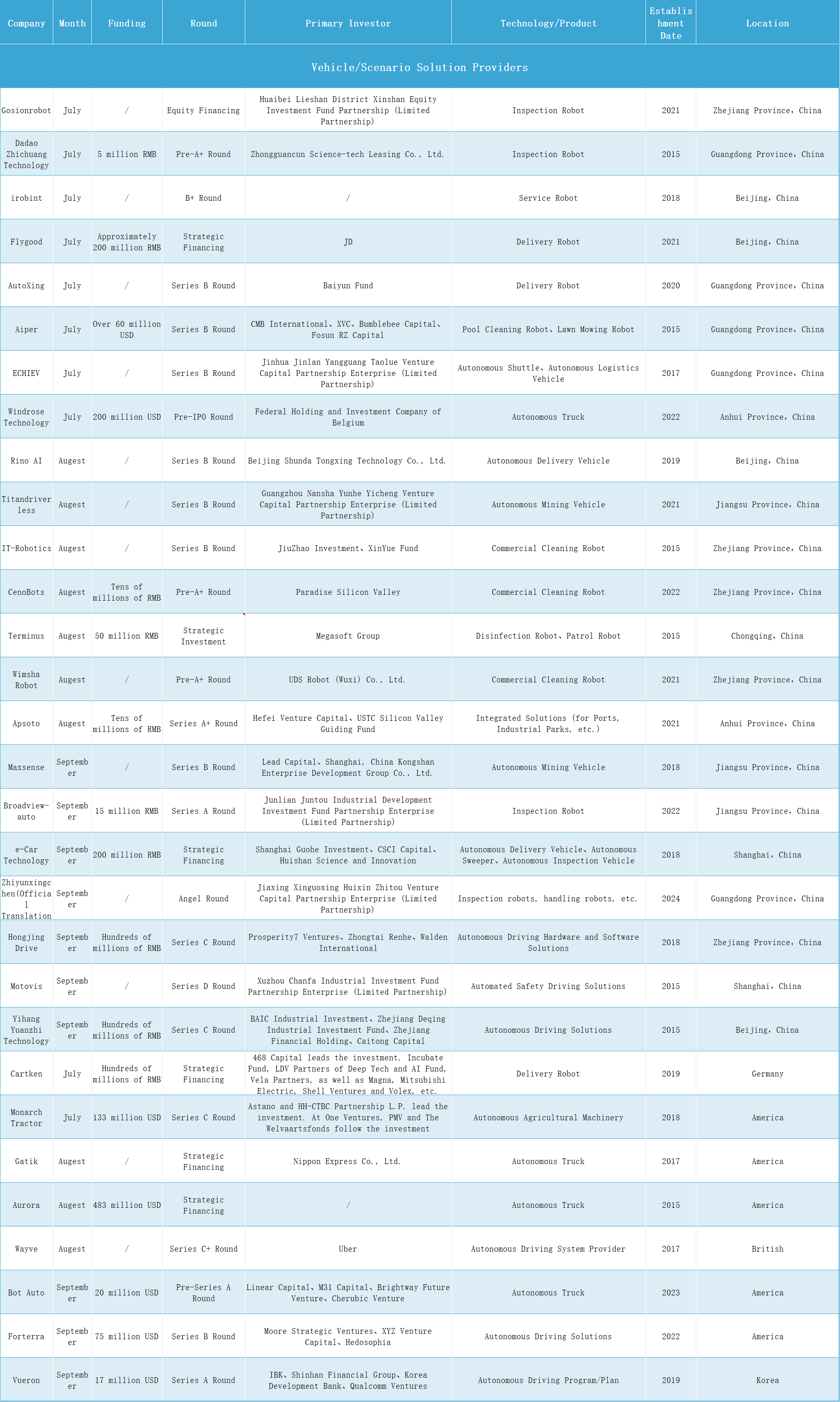

By financing domain, most investments were directed toward vehicle/scenario solution providers, with 30 companies reporting over 7.8 billion RMB. This suggests a focus on companies that have achieved early commercialization and profitability in specific application scenarios. In particular, autonomous delivery companies saw the most financing events, with six companies disclosing over 470 million RMB in total funding.

26 component and parts companies across both domestic and international markets secured funding, disclosing approximately 5.38 billion RMB, with high interest in lidar, millimeter-wave radar, and data services.

Overall, the financing landscape for Q3 2024 in this sector showed a significant upward trend in both event count and total funding compared to previous quarters. Additionally, the average financing size increased, with a higher concentration of large investments, indicating an increased market focus on leading players.

探索者论坛-scaled.jpg)