In recent years, as autonomous driving technology has matured, real-world applications have started to accelerate. The industry is undergoing rounds of large-scale shakeouts, and the remaining autonomous driving companies are trying to diversify their strategies. These companies are either switching sectors, updating their product lines, or altering their business models in search of greater revenue growth and more practical applications.

Expanding Scenarios: Seeking More Applications

Nuro

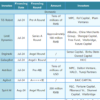

On September 11, U.S.-based autonomous driving technology developer Nuro announced an expansion of its business model, including licensing its autonomous driving platform, Nuro Driver, to automotive OEMs and mobility service providers.

As a unicorn in the autonomous delivery field, Nuro was the first U.S. autonomous vehicle developer to receive an exemption from the National Highway Traffic Safety Administration (NHTSA) and the first company in California to charge for unmanned delivery services.

With this strategic shift, Nuro will adopt two parallel market strategies:

- Providing a full suite of L4-level autonomous driving systems for unmanned delivery and passenger transport services, including both software and hardware. The key difference is that the company will no longer manufacture unmanned delivery vehicles.

- Collaborating with automakers, component suppliers, and service providers to develop autonomous driving products for consumer vehicles, covering systems from L2 to L4 levels.

Nuro will shift from focusing solely on developing autonomous delivery robots to becoming a broad supplier of autonomous driving technology, spanning multiple fields from ADAS systems for passenger vehicles, to Robotaxi ride-hailing services, and autonomous delivery robots.

Westwell Technology

On July 7, at the 2024 WAIC, Westwellglobally launched its intelligent handling and loading robot, Well-Bot. Well-Bot is a robot based on Westwell’s autonomous driving technology, focusing on high-efficiency sorting, precise handling, and intelligent warehouse management.

Well-Bot, independently developed by Westwell, is an intelligent logistics robot for freight scenarios such as warehouse logistics centers and factories. It can autonomously perform complex path planning and safely and steadily handle the loading and unloading of goods within containers, achieving millimeter-level target positioning accuracy.

It is reported that the launch of Well-Bot aims to solve the “last meter” of on-site logistics. Previously, Westwell’s autonomous driving trucks were primarily used in large logistics fields, such as sea, land, and air ports; rail hubs; and factories, handling logistics transportation between sites.

Well-Bot can seamlessly integrate with logistics companies’ Warehouse Control Systems (WCS) and Warehouse Management Systems (WMS). Through data analysis and algorithm optimization, flexible on-site coordination is achieved. When paired with Westwell’s autonomous truck, Q-Truck, Well-Bot can execute a fully automated “truck-dock-warehouse” factory logistics process. This not only automates the “last meter” of on-site logistics but also significantly enhances overall operational efficiency.

The launch of Well-Bot demonstrates Westwell’s continuous upgrade of its technological and product capabilities, extending its technical expertise to the last mile and upgrading its business model into a service-oriented enterprise.

TuSimple

Compared to the companies seeking breakthroughs or enhancing their business within the autonomous driving sector, TuSimple seems to have taken a significant business turn.

On August 15, 2023, TuSimple announced a collaboration with Shanghai Three-Body Animation Co., Ltd. to jointly develop an animated feature film and video game based on the internationally renowned sci-fi novel series The Three-Body Problem by Liu Cixin. TuSimple stated that this project marks the official establishment of its new “Generative AI” business unit, which has already received unanimous approval from the company’s board of directors.

This move is TuSimple’s first major business announcement since its delisting in January this year. According to the company, since early 2022, TuSimple has been conducting research and practical applications of large-model technology and generative AI in the autonomous driving field. Additionally, the company has independently developed infrastructure for large-scale data management, providing a foundation for applying its generative AI technology in new areas.

Entering New Fields: Service Robots Expand into the Industrial Sector

Another robot company is now “working in the factory”!

On September 27, the intelligent service robot company OrionStar announced the birth of its 70,000th robot, which is also the latest mass-produced factory delivery robot—AI Picker “CarryBot” Earlier, on September 17, OrionStar officially announced its entry into the factory domain and launched its first factory robot, the “CarryBot”

Founded in 2016, OrionStar has previously focused on the development and application of service robots in commercial settings. The company has introduced a series of service robots to cater to various industries including dining, business, government, hospitality, and healthcare.

“Crossing Boundaries” into the Industrial Sector: OrionStar is neither the first nor the last company to do so.

In May of this year, Pudu Robotics launched its first robot designed for industrial delivery, the PUDU T300. This robot is specifically built for material transfer in industrial settings and heavy-load delivery in commercial environments, aiming to enhance logistics efficiency in discrete manufacturing. This launch marks Pudu Robotics’ official leap from commercial service into industrial service. In September, Pudu Robotics further introduced a new cleaning robot for large industrial environments—the PUDU MT1. By deeply integrating both delivery and cleaning functions, PUDU offers an innovative, all-in-one “delivery + cleaning” intelligent solution for industrial settings.

Additionally, sources suggest that Keenon Robotics has already applied some of its technologies in the industrial sector and is currently in the exploration phase.

Looking at these companies that have “crossed over” into the industrial sector, their motivations generally stem from several key factors:

- Seeking new growth points: After achieving some success in commercial applications, service robot companies are looking for new avenues of growth. The vast industrial market, with its high demand for intelligent solutions, serves as a major driver for this transition.

- Shared underlying technology: Service robots and industrial robots share certain core technologies, such as autonomous navigation and sensor applications. This commonality provides a technical foundation for service robot companies to enter the industrial sector. Through technology transfer and optimization, these companies can develop products that cater to the complexity of industrial scenarios.

- Opportunities in industrial automation and intelligent transformation: The ongoing push for automation and intelligence in the industrial sector presents significant market opportunities for service robot companies. As smart manufacturing continues to evolve, the demand for intelligent devices in the industrial field is increasing, offering service robot companies a chance to find new growth points.

Expanding business scope not only enhances a company’s market competitiveness but also allows it to achieve sustainable development through multi-scenario, multi-domain solutions. By meeting the diverse needs of the market, these companies can continue to grow.

Whether in autonomous delivery or autonomous cleaning, the demands of the industrial sector push companies to continuously innovate and come closer to large-scale deployment opportunities. This year, autonomous driving technology is on the cusp of large-scale application in various scenarios, and not only is the exploration of new fields accelerating, but new business models are also beginning to emerge.

探索者论坛-scaled.jpg)