According to incomplete statistics from China Mobile Robot Industry Alliance (CMRA) and Humanoid Robot Scene Application Alliance (HRAA), the number of new humanoid robot products launched globally in 2025 exceeded 166.

In comparison, the number of new humanoid robot products launched globally in 2024 was 106, an increase of approximately 56%.

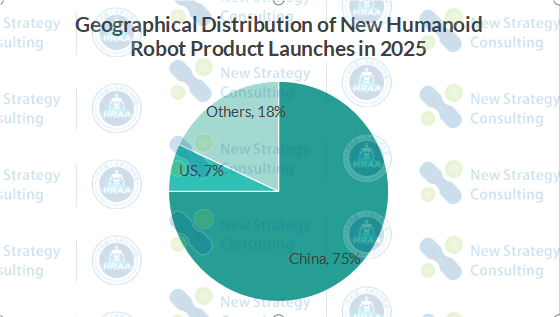

Geographical Distribution: China Contributes Over 70%, Establishing a Scale Advantage

In terms of geographical structure, among the new humanoid robots launched globally in 2025, Chinese manufacturers launched 127 products, accounting for approximately 75%; US manufacturers launched 12 products, accounting for approximately 7%; and other countries and regions combined launched 30 products, accounting for approximately 18%. Whether in absolute numbers or percentages, China has become the core region for new humanoid robot product launches globally.

This advantage stems from a combination of factors: a complete component supply chain, overall integration capabilities, dense application scenarios, and lower trial-and-error costs, enabling Chinese manufacturers to accelerate product launches at a faster pace. The high proportion of new products also means that many exploratory solutions first emerged and were validated in China.

In contrast, while overseas manufacturers release fewer new products, they tend to focus on high-end bipedal robots, cutting-edge control systems, or specific applications, emphasizing strategic direction rather than scale expansion. The humanoid robot industry in 2025 already exhibited a clear division of labor characterized by “high density of Chinese products and depth of overseas technology.”

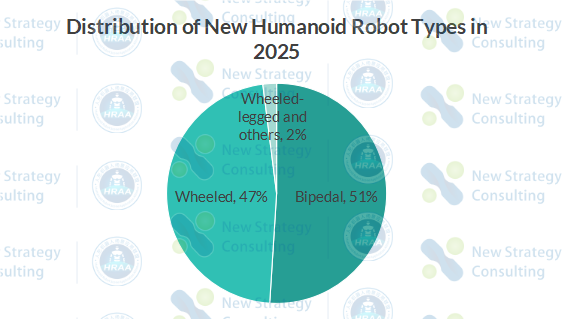

Product Forms: Wheeled and Bipedal Robots Compete for Supremacy, and Four Mainstream Routes Emerge

In terms of mobility, among the new humanoid robots globally in 2025, there were 84 bipedal products (approximately 49.7%), 78 wheeled products (approximately 46.2%), and 4 wheeled-legged and other forms (less than 2.5%). This indicates that the industry has entered a stage of multiple forms operating in parallel, and bipedalism is no longer the only solution.

Based on specific product structures, the industry has currently converged into four mainstream forms: full-size bipedal, small-to-medium-size bipedal, wheeled chassis with folding upper limbs, and wheeled chassis with lifting structures.

Among these, full-size bipedal robots primarily serve as technology demonstrations and explore general capabilities, while small-to-medium-size bipedal robots seek a balance between cost, stability, and control complexity.

The rapid growth of wheeled solutions reflects manufacturers’ proactive compromises regarding practical application—in most industrial and service scenarios, stability, battery life, and load capacity still take precedence over “fully humanoid” designs.

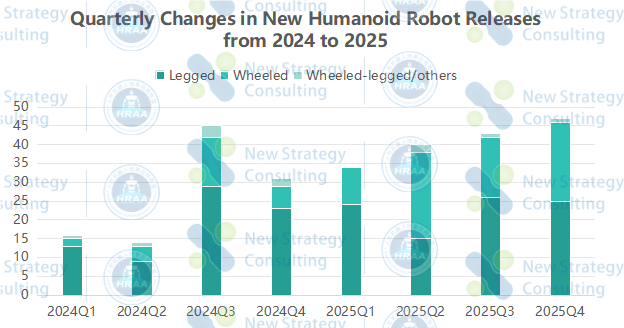

Timeline: A clear multi-peak pattern, with wheeled robots growing faster.

Looking at the quarterly distribution, the release of new humanoid robots in 2025 exhibits a clear multi-peak characteristic. Legged robots are concentrated in Q1 and Q3, while wheeled robots see a significant increase in Q2 and Q4, showing differentiated choices in release timing based on different technological approaches and product positioning.

Behind this change, on the one hand, the number of humanoid robot manufacturers is rapidly increasing, and releases are no longer highly concentrated among a few leading companies; on the other hand, exhibition dates, financing opportunities, and progress in scenario pilots are becoming important triggers for new product releases. Some companies have even developed a quasi-product rhythm of “iterating every six months” or “two appearances a year,” rather than a single concept release.

Overall, 2025 marks the beginning of a new phase for the humanoid robot industry characterized by high-frequency trial and error and rapid iteration. However, behind the frequent releases of new humanoid robots lies a hidden concern: homogenization.

Product Positioning Shift: Nearly Half of New Products Directly Target Real-World Applications

From a product positioning perspective, nearly half of the humanoid robots released in 2025 clearly defined their application direction or pilot scenarios at the launch stage, rather than merely showcasing mobility or technical specifications. Compared to earlier products centered on “motor capabilities,” more and more new products are being designed around specific tasks such as handling, inspection, reception, and auxiliary operation.

This shift directly impacts form factor selection. Wheeled and simplified structural designs account for nearly 50% of new products, not due to technological regression, but rather a proactive choice of commercialization path. Even bipedal products have shifted their design goals from extreme movements to stable walking, long-term operation, and maintainability.

Overall, the release of new humanoid robots in 2025 has shifted from “proving what can be done” to “validating what value can be brought.” This also signifies that the industry is moving from a technology competition phase to a product competition phase centered on application scenarios and efficiency.

Conclusion: From a Year of Quantity to a Year of Value

166 new products represent the humanoid robot industry’s report card for 2025. This year, we witnessed the diversification of forms, the normalization of pace, regional polarization, and a shift in product positioning from “automatic” to “usable.” The explosive growth in quantity stemmed from the combined forces of technological maturity, capital investment, and scenario-driven demand, signifying that the window of opportunity for industry growth has opened.

However, a review of the year’s new product releases reveals that products with true long-term viability are not necessarily the most human-like, but rather those closest to real-world needs. 2026 will no longer be about “who can build a humanoid robot,” but rather “who can make it work.” The focus is shifting from competing on parameters and form to competing on reliability and service loops; the industry’s center of gravity is moving towards more complex and pragmatic issues.

After mass production, value is king. The real watershed moment has only just begun.

探索者论坛-scaled.jpg)