The year of 2025 remained a challenging one for the autonomous driving industry. Capital withdrawal, commercialization setbacks, and fierce internal competition led many once-prosperous companies into difficulties.

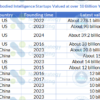

According to incomplete statistics from China Low-Speed Automated Driving Industry Alliance (LSAD), in 2025, more than 10 companies in the autonomous driving industry were involved in layoffs, bankruptcies, or delistings, further intensifying industry consolidation.

Canoo: Entered bankruptcy review proceedings in January 2025

Founded in 2017 by a team of former executives from BMW and Faraday Future, Canoo’s core highlight is its innovative skateboard chassis technology. This chassis integrates key components such as batteries and motors onto a flat platform, allowing for flexible adaptation to various vehicle models.

Furthermore, the company had planned to achieve L2 or L2.5 assisted driving capabilities in its vehicles, gradually improving autonomous driving functions through software upgrades. It claimed that its platform design supported future upgrades to higher levels of autonomous driving and facilitated the integration of third-party autonomous driving solutions or hardware upgrades through reserved interfaces and modular design.

However, due to its failure to generate revenue and profit, coupled with chaotic internal management and unfulfilled huge orders, it finally filed for Chapter 7 bankruptcy in the United States in January 2025 and immediately entered liquidation proceedings. Its business ceased, and its assets were handled by a bankruptcy trustee.

Zongmu Tech: Entered bankruptcy review proceedings in April 2025

Zongmu Tech focuses on ADAS solutions such as automatic parking, and has accumulated investments of over 2.2 billion yuan from giants such as Xiaomi and Lenovo, with a valuation once reaching 90 billion yuan. However, due to continuous losses, three failed IPO attempts, over-reliance on a few major clients leading to order losses, and failed technological challenges, its cash flow eventually dried up. Since the end of 2024, the company has experienced issues such as unpaid wages, interrupted social security payments, and executive departures. Finally, in April 2025, the court formally accepted its bankruptcy review, and it entered judicial reorganization proceedings.

ALLRIDE.AI: Declared bankrupt and liquidated in August 202

ALLRIDE.AI was founded in 2018 by Wang Jing, former senior vice president of Baidu and hailed as “China’s first person in autonomous driving.” It focused on L4 autonomous driving based on “Vehicle-Infrastructure Cooperative Systems (VICS)” technology, but its technology relied on large-scale roadside infrastructure construction, resulting in high costs and slow commercialization. The company failed to secure new financing after March 2023 and became an enforcement target multiple times from October 2024, with a total amount exceeding 47 million yuan. In 2025, due to its inability to pay a 15,000 yuan labor arbitration fee, and after a court investigation found that ALLRIDE.AI had multiple unenforceable cases involving huge sums of money, was insolvent, and was not operating in its registered location with an unknown business address, making it impossible to contact. The company was declared bankrupt and liquidated by the court.

Tsingtech: Declared bankrupt and liquidated in May 2025

Tsingtech was once a highly regarded autonomous driving technology company, relying on the background of Suzhou Automotive Research Institute, Tsinghua University, focusing on the research and development of automotive active safety technologies such as binocular stereo vision sensors. The company was once awarded the title of “Suzhou Unicorn Cultivation Enterprise” and completed multiple rounds of financing between 2019 and 2020, raising hundreds of millions of yuan in total. Its valuation once reached 9 billion yuan. In early 2024, it even planned to invest 150 million yuan in Wuhu, Anhui, to build a sensor project with an annual production capacity of 30,000 units.

However, due to slow commercialization of its technology, high costs, and intensified industry competition, the company’s cash flow eventually dried up. On May 30, 2025, the Wujiang District Court of Suzhou City accepted its bankruptcy liquidation application. At the time of bankruptcy liquidation, the company had only 903,800 yuan in bank deposits and three cars, while the total amount of claims exceeded 138 million yuan, including claims from banks, suppliers, investors, and other parties, creating a huge contrast between assets and liabilities.

ZDRIVE.AI: Deeply Restructured in May 2025

ZDRIVE.AI was established on February 1, 2023, jointly held by Chery Automobile Co., Ltd. and others. Its initial positioning was as a key vehicle for Chery Group to achieve “full-stack self-developed” intelligent driving capabilities. The company was led by Dr. Gu Junli, a former member of Tesla’s Autopilot team and a key figure in XPeng Motors’ autonomous driving division. However, due to slower-than-expected commercialization progress, coupled with strategic positioning and the need for overall group synergy, in May 2025, Chery Group announced the integration of ZDRIVE.AI with Lion Tech and related businesses of its R&D institute to establish a new “Chery Intelligent Center.” ZDRIVE.AI ceased operations as an independent company, and its business and team were incorporated into the new Intelligent Center system.

Cepton: Officially delisted in January 2025

Cepton, an American LiDAR company founded in 2016, had a core team primarily from Velodyne. Since its IPO in 2022, the company has consistently failed to achieve profitability, with revenue falling far short of expectations. As of the third quarter of 2024, the company’s accumulated net loss for the year was still as high as $17.294 million. Its stock price plummeted from a peak of over $80 to approximately $3, with its market capitalization evaporating by about 97%.

Meanwhile, the large-scale fixed-point order for LiDAR for GM’s Ultra Cruise platform, which brought Cepton its “rise to fame,” was canceled at the end of 2023. The loss of this core order completely shook the foundation of Cepton’s independent development as a publicly traded company. On January 7, 2025, Cepton announced the completion of its acquisition by Koito, a Tier 1 supplier of automotive lighting systems in Japan. This acquisition and merger took effect on January 7, 2025, and all issuances of Cepto securities ceased immediately. Cepton will then operate as a privately held subsidiary of Koito in the United States, continuing to operate its headquarters in San Jose, California.

Luminar: Entered Bankruptcy Reorganization in December 2025

As an American LiDAR technology company founded in 2012 by Austin Russell, Luminar focuses on autonomous driving sensing technology, providing LiDAR hardware and supporting software solutions for the automotive, defense, and other fields. It officially entered the autonomous vehicle field in 2017 and subsequently received cooperation intentions from several automakers. In 2020, Luminar went public on Nasdaq via a SPAC, with a pre-IPO valuation of $3.4 billion and a peak market capitalization of $5 billion, becoming the highest-valued LiDAR company on the US stock market.

However, factors such as slow commercialization of autonomous driving, difficulties in cost control, termination of cooperation by major customers (such as Volvo), and management turmoil led to a deterioration in the company’s financial situation and a tight cash flow. On December 15, 2025, the company officially filed for bankruptcy protection in the Southern District of Texas, with assets valued between $100 million and $500 million and total liabilities between $500 million and $1 billion. To alleviate financial pressure, as of January 2026, its core LiDAR business was planned to be sold to Quantum Computing Inc. for $22 million, but the transaction still required court approval. Luminar is currently in bankruptcy reorganization, and its future remains uncertain.

Cruise: Laid off approximately 50% of its employees

In early 2025, Cruise, the autonomous driving subsidiary of General Motors, announced the layoff of approximately 50% of its employees. In addition, General Motors announced that it has completed its full acquisition of Cruise, making Cruise a wholly owned subsidiary of GM, which will focus on personal autonomous vehicle technology. It is understood that the layoffs have expanded to the senior management team, with several executives, including the CEO, CHR officer, and CSA officer, leaving Cruise, affecting over 1,000 employees.

Mobileye: Laid off about 200 employees

Mobileye, an Israeli autonomous driving technology company, announced a new round of layoffs in December 2025, planning to cut approximately 200 employees, about 4% of its global workforce. The layoffs primarily affect its R&D team located in Israel (more than 3,000 of the company’s approximately 4,300 employees worldwide are in Israel). This layoff is one of a series of strategic contraction measures taken by Mobileye in the face of declining stock prices, intensified market competition, and financial pressure.

In 2024, the company had successively closed its LiDAR R&D department and lane departure warning system department, affecting approximately 190 employees. Meanwhile, its parent company, Intel, is also facing its own operational pressures and sold some of its Mobileye shares in July 2025.

Conclusion:

Looking back at the series of bankruptcies, layoffs, and restructurings in the autonomous driving industry in 2025, from Tsingtech. the once-glorious “Tsinghua-affiliated unicorn” to ALLRIDE founded by Wang Jing, “China’s first autonomous driving expert,” their abrupt endings reveal the harsh reality of the industry shifting from a technology-driven narrative to a business-driven one.

It is foreseeable that a structural shakeout, triggered by a return to rational capital, misjudged technology choices, and insufficient sustainability of business models, is currently unfolding in the autonomous driving industry.

So, what important lessons learned from these painful experiences have the survivors learned?

First, the industry still faces the ultimate test of its profit model. It must quickly establish a sustainable “self-sustaining” capability and abandon the model of simply relying on financing to “burn money.” Second, the choice of technology must be closely integrated with cost, mass production efficiency, and iteration speed. Stubbornly adhering to high-cost, high-complexity technology paths, or blindly betting on unattainable “future stories,” will lead to falling behind. Furthermore, in the trend of “the strong getting stronger,” integrating into the ecosystem is far more likely to weather the cycle than going it alone. Mid-to-lower tier companies need to rethink their positioning in the industry, find differentiated advantages in specific niche scenarios, and cultivate a deep ecosystem.

In short, the future of autonomous driving remains clear and promising, but only companies that can survive and thrive first will be qualified to participate in this ultimate contest of comprehensive strength.

探索者论坛-scaled.jpg)