According to public information, according to the incomplete statistics of new strategic mobile robot media, in 2024, a total of more than 500 bidding announcements were released in China, disclosing a total amount of more than 2.67 billion yuan.

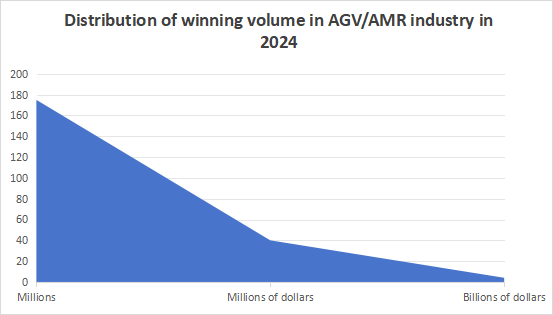

In terms of project volume, there are 4 projects at the level of 100 million yuan, with a total amount of more than 700 million yuan; 40 projects at the level of 10 million yuan, with a total amount of more than 1.13 billion yuan; and 175 projects at the level of 1 million yuan, with a total amount of more than 540 million yuan. The project amount is concentrated at the level of 1 million yuan.

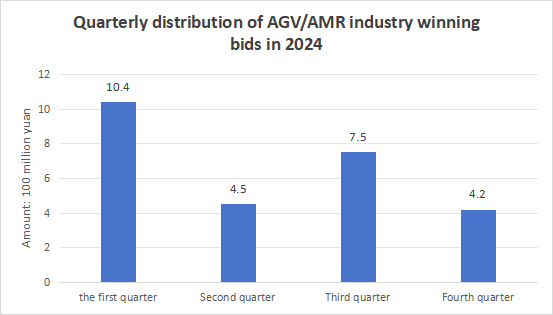

From the distribution of winning bid projects, over 50 announcements were released in the first quarter, with a total winning bid amount exceeding 1.04 billion yuan; in the second quarter, 157 announcements were made, and the disclosed total winning bid amount exceeded 450 million yuan; in the third quarter, 158 announcements were issued, with a winning bid amount surpassing 750 million yuan; in the fourth quarter, 169 projects were announced, with a winning bid amount exceeding 420 million yuan. It is evident that large orders are concentrated in the first quarter, while bidding activities are more active in the fourth quarter.

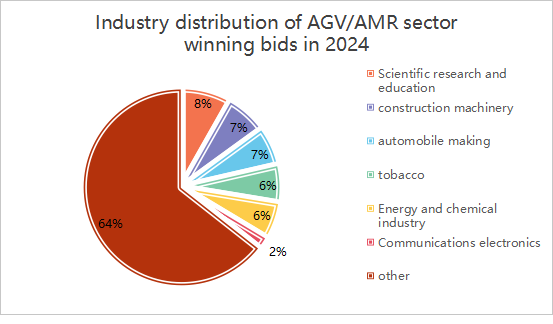

From the perspective of the target service industry, the winning projects are mainly concentrated in education and scientific research, construction machinery, automobile manufacturing, tobacco and other industries; in addition, warehousing and logistics, pharmaceutical circulation, energy and chemical industry, food and other industries also release some AGV/AMR bidding demand.

From the content of the standard, AGV carts and latent lifting AGV/AMR have a large demand, followed by unmanned forklifts, composite robots, heavy-duty AGV/AMR and three-dimensional warehouse construction. The overall project demand is concentrated on intelligent material handling, and the demand for robots applied to production lines is also expanding.

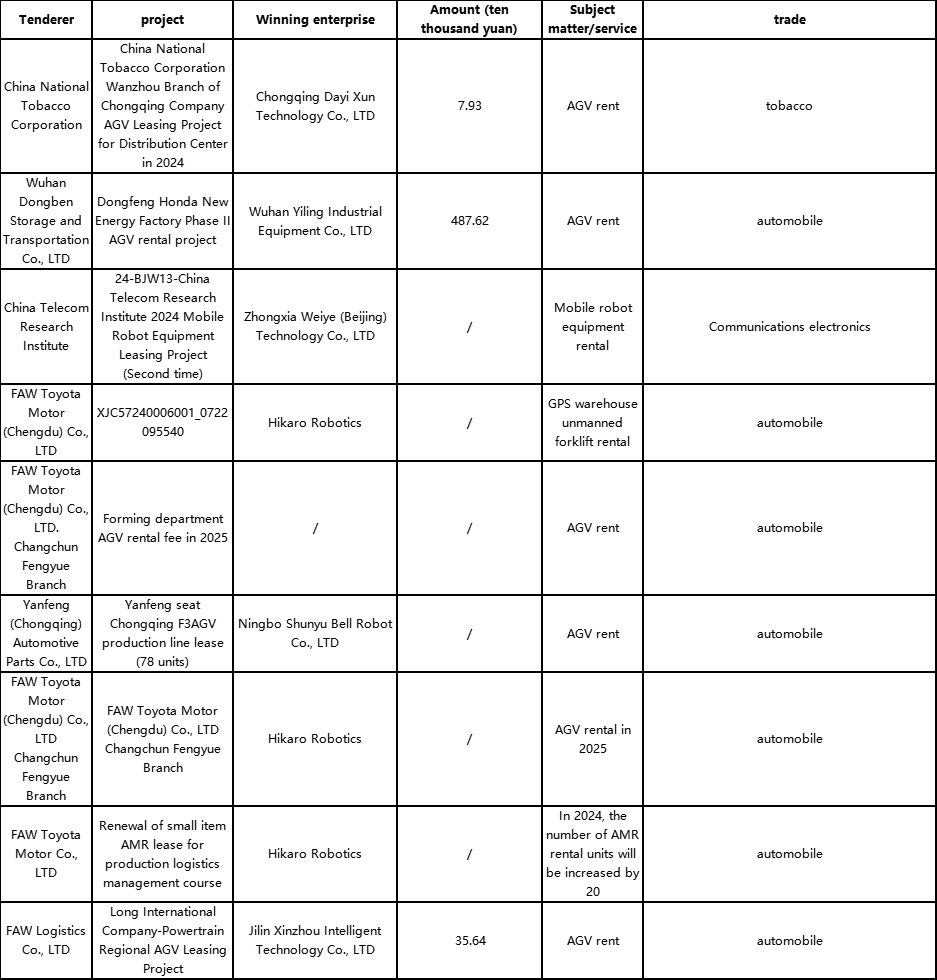

It is worth noting that this year has seen multiple successful bids for AGV leasing projects, with disclosed winning amounts exceeding 5 million yuan, all concentrated in the automotive manufacturing industry. For example, FAW Toyota Motor Corporation added 20 AMR leases for its 2024 project, and Dongfeng Hondas Phase II New Energy Plant also adopted an AGV leasing model for bidding. The use of AGV leasing in the automotive industry helps with cost control and avoids high initial investments. Additionally, for companies engaged in seasonal production or temporary capacity expansion, the leasing model offers greater flexibility, allowing them to adjust the number and duration of leases according to actual production needs, thereby reducing equipment idling rates and capital occupation costs. As mobile robot technology continues to advance, this leasing model is expected to be applied in more areas.

Overall, the demand for automated and intelligent logistics and warehousing solutions across various industries continues to exist. As downstream terminal demands steadily shift towards multifunctionality and intelligence, higher standards are being set for the operational stability and flexibility of mobile robots. The diverse needs of different industries test the project delivery and post-delivery support capabilities of mobile robot companies, driving them to accelerate technological and product innovation while also focusing on project delivery to provide more comprehensive products and services to various sectors.

探索者论坛-scaled.jpg)