Capital often moves faster than industry consensus.

As 2025 draws to a close, looking back on the year, the collective actions of mobile robot-related companies in the capital market are forming a clear and concentrated trajectory, that is, IPOs in Hong Kong, which has become a common choice for robot companies.

The Stock Exchange of Hong Kong (HKEX) has become one of the most important capital outlets for robot companies at this stage. This phenomenon has already exceeded the strategic choices of individual companies; it is more like a collective action at the industry level. It reflects not only a shift in companies’ preferences for listing locations, but also multiple changes in industrial structure, financing environment, and capital standards.

Surge in HKEX: Who is Listed? Who is Waiting?

Towards the end of the year, the mobile robot sector has seen a rather concentrated wave of activity in the capital market. Multiple robot companies have successively disclosed their plans for listing in HKEX or the latest progress, making this previously relatively dispersed capitalization process begin to show a clear outline.

According to data from China Mobile Robot Industry Alliance (CMRA) and New Strategy Mobile Robot Industry Research Institute (NSRI), as of December 18, a total of 24 mobile robot-related companies have attempted to list on the HKEX. Among them, four companies, including Geek+, have completed their IPOs and are successfully listed, while another 20 companies are still in the filing, feedback, or confidential submission stages.

See the Latest IPO Progress of Robot Companies in 2025. (As of December 18, 2025)

In this concentrated rush to the capital market, we can’t help but wonder, what kind of companies are these companies going public?

Chart: Distribution of Robot Enterprises Going Public in HKEX by Type

From the perspective of their main business structure, the companies rushing to list on the HKEX in this round can be roughly divided into the following categories: Industrial-grade mobile robot manufacturers whose core products include AGVs, AMRs, and composite robots, with typical examples including SEER, Geek+, and GALAXIS. Those focus on intelligent logistics systems, such as logistics integrators like LEAD and ZENDING, where mobile robots serve as a crucial component of the system solution. Those concentrate on cobots. Additionally, there are service robot companies applied in commercial services, such as Yunji and LDROBOT, as well as general mobile robot companies covering application scenarios like special-purpose robots and charging robots.

Despite their diverse business models, these companies converged on the same capital channel at the same time.

The concentration of listings in HKEX is particularly pronounced. Whether measured by the number of public filings or the disclosed filing and review information, HKEX has become the primary listing destination for robot companies.

Chart: Listing Channel Choices of Robot Companies

In contrast to the concentrated filings in HKEX, the A-share market exhibited a relatively cautious pace during the same period. On the one hand, the A-share market has seen increasingly stringent regulations on newly submitted IPO projects and spin-off listings such as “A-share to A-share” splits, causing some companies to experience slow progress or even temporary halts in the IPO queue. For example, Hikvision previously planned to spin off its subsidiary, Hikrobot, for a listing on the ChiNext via an “A-share to A-share” split, but according to information disclosed by the Shenzhen Stock Exchange on September 30, the project is currently suspended. Similarly, the A-share IPO process of another company, JAKA, on the Shanghai Stock Exchange was also disclosed to be suspended on September 30.

Against this backdrop, the advantages of HKEX in terms of institutional flexibility and pace of progress are gradually becoming apparent. For robotics companies still in the investment phase and not yet fully realizing their profitability, HKEX offers more feasible options in practice. Public information shows that Dahua Technology has chosen to spin off its subsidiary, iRAYPLE , for a listing on the HKEX via an “A-share to H-share” split.

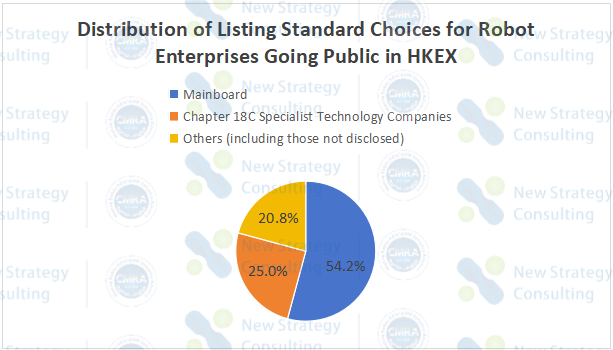

This choice is not accidental and is closely related to the institutional adjustments made by the HKEX in recent years. In August 2024, HKEX updated its Chapter 18C of Listing Rules, allowing smaller, unprofitable specialized technology companies to list in Hong Kong. This rule opened a crucial pathway for robotics companies with technological potential but not yet profitable. Consequently, several companies, including SEER, Standard Robots, RobotPhoenix, and YOUIBOT, chose to pursue a listing on HKEX through Chapter 18C.

Chart: Distribution of Listing Standard Choices for Robot Enterprises Going Public in HKEX

The divergence in listing locations and standards essentially reflects the objective differences in institutional design and risk tolerance among different capital markets. It is precisely under these differences that HKEX has become a realistic choice for more mobile robot companies at the current stage.

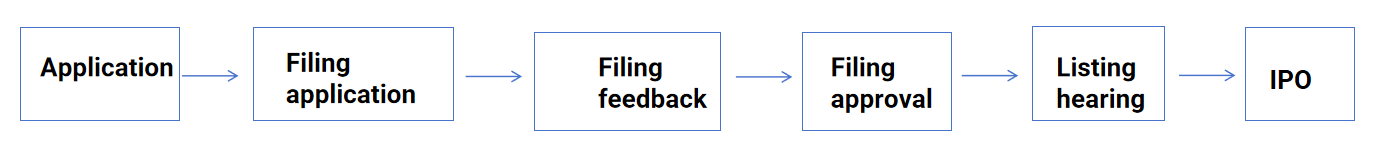

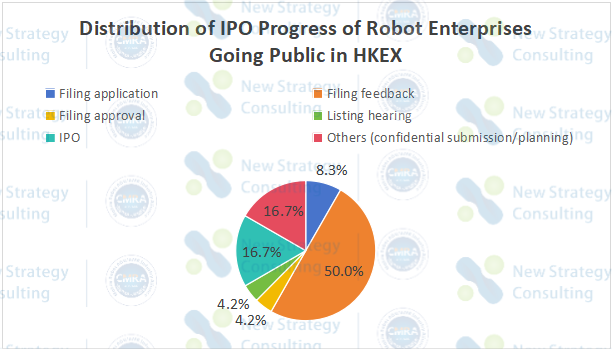

From the IPO progress perspective, as of December 18, 14 companies were in the filing application and feedback stage, accounting for approximately 58.3%; only 1 company had completed filing approval; 1 company had entered the hearing stage; and only 4 companies had actually completed IPO and successfully listed. In addition, some companies are still in the confidential submission or planning stage and have not yet entered the public disclosure sequence.

Chart: IPO Process of HKEX

Chart: Distribution of IPO Progress of Robot Enterprises Going Public in HKEX

(As of December 18, 2025)

From an overall structural perspective, most companies are still concentrated in the application, filing, and review stages, with only a small number actually completing listing or Pre-IPO. This means that the current stage is more like a “concentrated entry into the channel” process rather than a completed wave of listings.

This process distribution is more common among companies with strong technology attributes. TheHKEX’s review process for such companies is characterized by a relatively long cycle and strict information disclosure requirements. Therefore, a company entering the review process is already a significant milestone, but from the start of the process to the final listing ceremony, there are still many uncertainties.

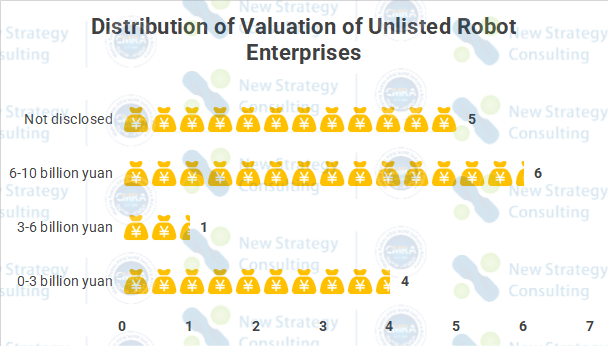

Looking at the market valuation of these companies rushing to list in HKEX: Among the unlisted companies, 5 companies have valuations concentrated in the 0-3 billion yuan range, 6 companies have valuations in the 3-6 billion yuan range, and 1 company has a valuation in the 6-10 billion yuan range.

Chart: Distribution of Valuation of Unlisted Robot Enterprises

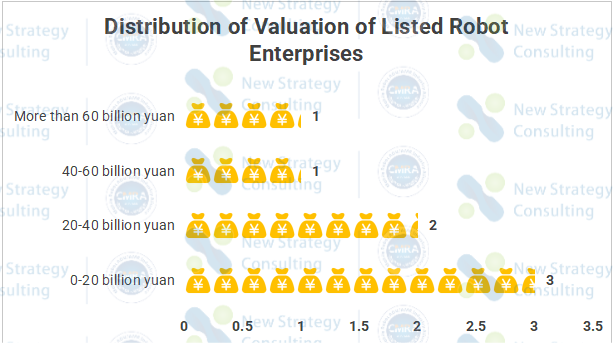

Among successfully listed companies, Estun and Zhida have market valuation exceeding 10 billion yuan, Geek+ and Fibocom have exceeded 20 billion yuan, and Lead’s market valuation has reached 74.2 billion yuan. It’s important to emphasize that public market pricing is constantly adjusting dynamically, and its core remains the rise and fall of a company’s business.

Chart: Distribution of Valuation of Listed Robot Enterprises

Going public brings far more than just a round of financing. It means that companies have opened up a continuous channel for obtaining funds, and can flexibly use equity, debt, and other tools to support R&D, expansion, and market competition at a lower cost and over a longer period. More importantly, going public greatly improves equity liquidity, allowing shares to be freely traded on the public market. This not only provides shareholders with an exit strategy but also attracts broader investor attention, thereby increasing valuations and expanding cooperation opportunities.

In other words, rushing for an IPO is a crucial leap for companies to enter the capital market pricing system. In this system, market valuation becomes the most direct growth metric, and competition in the mobile robot field has shifted partly from a contest of products and technology to a competition for capital recognition.

What sparked this fervor, and where will it lead?

The rush of companies going public is far from a mere bandwagon effect. For most robotics companies, going public has evolved from a strategic choice into a necessity for survival.

The mobile robot industry is at a delicate juncture. After experiencing explosive growth, the industry has rapidly entered a more complex phase, focusing on technological depth, application penetration, and operational efficiency.

Simultaneously, the capital landscape in the primary market has shifted significantly. Capital is now drawn to “humanoid robots” and “embodied intelligence.” Constrained by macroeconomic cycles, industry stage, and pressure for returns, the investment logic has shifted from the adventurous pursuit of high-growth narratives to a pragmatic consideration of ensuring project survival and capital exit.

Therefore, for the mobile robot sector, which has been developing for several years, fundraising is no longer as easy as it used to be, especially for large-scale financing, where the window for such funding is narrowing. With insufficient internal funding and dwindling external support, the public capital market has transformed from a icing on the cake into a lifeline for survival. Going public is a matter of survival.

It was at this juncture that the HKEX’s “Chapter 18C” came as a timely intervention. This policy window opened a brief but precious “time corridor,” allowing companies still in the “awkward period” of unprofitability to obtain public capital support and continue their development.

This also aligns with the practical demands of the underlying capital market. For investment institutions, pushing portfolio companies to list, even if the valuation doesn’t reach peak expectations, means transforming their “noncurrent assets” into “tradable securities,” providing a valuation benchmark and exit channel for the fund. Therefore, as long as the basic conditions are met, investors have a strong incentive to push companies onto the public market.

However, the path to the capital market is not smooth sailing; it is fraught with compliance reefs that require careful navigating.

Currently, the vast majority of companies are still in the “filing feedback” stage, which in itself highlights the regulatory scrutiny and oversight of companies listing overseas.

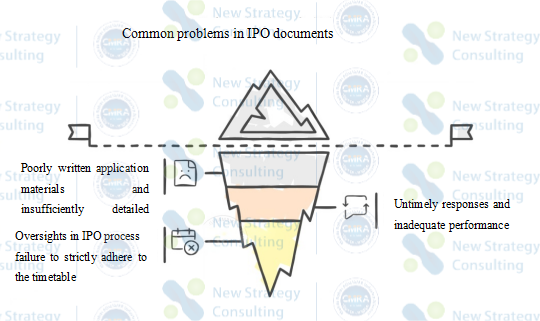

Recently, the Securities and Futures Commission of Hong Kong (SFC) and the HKEX jointly sent a letter to several sponsors, directly addressing concerns about the quality and compliance loopholes in IPO applications, and warning that if these issues are not addressed, they could affect the overall level and reputation of the Hong Kong capital market. The regulatory letter precisely points out three major problems commonly found in IPO documents this year: poorly written application materials and insufficiently detailed business models; untimely responses and inadequate performance of duties by issuers and sponsors to regulatory inquiries; and failure to strictly adhere to the timetable in the IPO process, resulting in oversights.

Chart: Common Problems in IPO Documents of HKEX

The regulator also warns that if the problems with the application documents are serious, the review process may be suspended until the relevant parties complete the supplementation and modification. Market observers point out that this is not only a signal to control the pace of IPOs and improve project quality, but also a potential constraint on the high valuations and high density of “A+H” listings. At a deeper level, regulators have begun to be wary of the potential for IPO overload to disrupt market order, and future “reasonable adjustments” to the pace and number of listings are not ruled out.

This is undoubtedly a clear “rational cooling down,” and a warning to the recent hot wave of corporate listings. The regulatory “warning” coincides with the rational retreat of market sentiment. The recent first-day price drops of some new stocks demonstrate that investors are shifting from early concept-driven chasing to a more rigorous assessment of company fundamentals, profitability, and valuation rationality.

Looking deeper, this IPO frenzy is accelerating industry reshuffling. Choosing to list on HKEX is itself a prelude to internationalization. From this moment on, companies must hold themselves to the standards of international capital markets; their financial reports, governance, and strategies will be under the scrutiny of global investors. This may force Chinese robotics companies to step out of their domestic comfort zones and re-anchor their position in the global industrial chain.

The tide will eventually recede. This concentrated IPO feast in 2025 is a collective coming-of-age ceremony for the mobile robotics industry, marking its transition from a period of unbridled growth to adolescence. It is filled with high-stakes gambles on the future, but also permeated with anxieties about the present.

As the noise of capital gradually settles, not everyone who tried to catch the waves will remain on the beach. Only those companies that truly create solid value and build a profitable cycle will be able to turn this listing into the true starting point of a great voyage.

探索者论坛-scaled.jpg)