According to China Low-Speed Automated Driving Industry Alliance (LSAD), CiDi is successfully listed on the main board of the Stock Exchange of Hong Kong (HKEX) today. China International Capital Corporation Limited (CICC), China Securities International, and Ping An Securities (Hong Kong) are the joint sponsors, making it the first company focusing on intelligent driving for commercial vehicles of HKEX. CiDi offers 5,407,980 shares globally at a price of HK$263 per share, raising a total of HK$1.422 billion, with a market capitalization of HK$11.517 billion.

The prospectus shows that CiDi is a supplier of intelligent driving products and solutions for commercial vehicles in China. The company focuses on the research and development of autonomous mining and logistics vehicles in closed environments, V2X technology, and intelligent perception solutions, and provides products and solutions based on proprietary technologies. During the track record period, it primarily focused on autonomous mining in closed environments.

In terms of market share, according to China Insights Consultancy, CiDi ranks sixth among all intelligent driving commercial vehicle companies in China, with a market share of approximately 5.2%. It is worth noting that in 2024, the company’s product sales revenue in the intelligent driving commercial vehicle market was approximately RMB 250 million, representing a market share of approximately 16.8% based on product sales.

Regarding product delivery, as of June 30, 2025, CiDi had delivered 304 autonomous driving mining trucks and 110 independent autonomous driving truck systems, and received indicative orders for 357 autonomous driving mining trucks and 290 independent autonomous driving truck systems. Among these, CiDi delivered 56 autonomous driving mining trucks to a mining area in China, which, along with approximately 500 manned trucks, formed the world’s largest mixed-operation mining fleet.

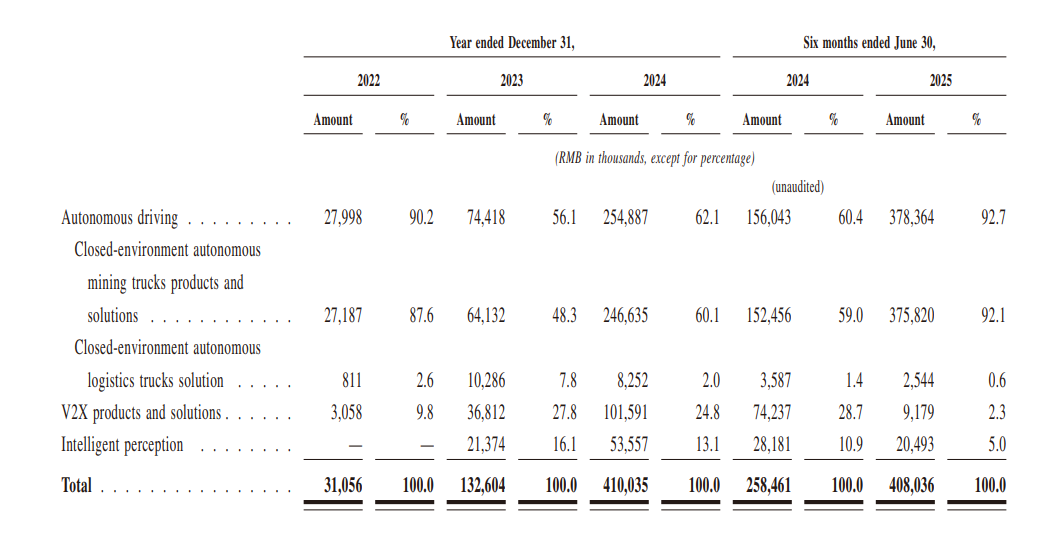

Financially, the revenues of CiDi for the fiscal years 2022, 2023, 2024, and the six months ended June 30, 2024 and 2025, was approximately RMB 31.056 million, RMB 133 million, RMB 410 million, RMB 258 million, and RMB 408 million, respectively.

In terms of financing, since 2018, CiDi has completed eight rounds of financing, receiving a total investment of nearly RMB 1.5 billion from institutions including Sequoia Capital, Xin Ding Capital, Legend Holdings, Everbright Limited, and Baidu Ventures. Its valuation in its last round of financing at the end of January 2024 was approximately RMB 9 billion.

Of the net proceeds from this IPO, approximately 55% will be used for its R&D over the next five years; approximately 15% will be used to improve its domestic and international commercialization capabilities and further strengthen its cooperation with domestic and global customers; approximately 20% will be used for potential investment and M&A opportunities aimed at further integrating upstream and downstream resources in the industry chain; and approximately 10% of the net proceeds will be used for working capital and general corporate purposes.

———————————————————————————————————————————————————————————————————————————

Today, China Low-Speed Automated Driving Industry Alliance (LSAD) and Wuhan Junshan New City Technology Investment Group Co., Ltd. jointly host the “5th Annual Conference on Low-Speed Automated Driving Industry” in the National Intelligent Connected Vehicle (Wuhan) Test Demonstration Zone. At the conference, the Annual Report and Forecast of Low-Speed Autonomous Driving Development for the Next Five Years will be released offline. Stay tuned!

探索者论坛-scaled.jpg)