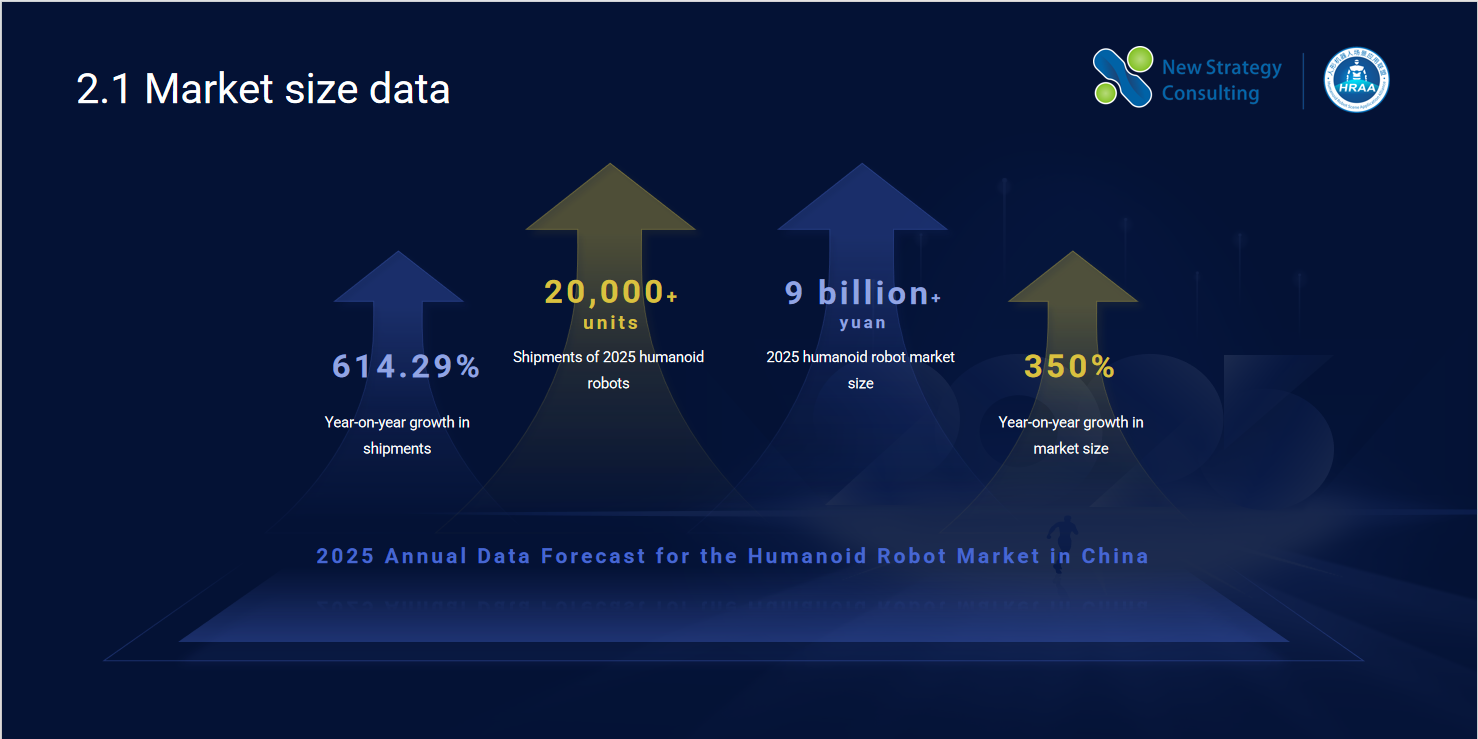

According to estimates by China Humanoid Robot Application Alliance (HRAA), China’s humanoid robot shipments are expected to reach 20,000 units in 2025, representing a year-on-year increase of over 614%; the market size will exceed 9 billion yuan, a year-on-year increase of 350%.

What’s driving this rapid growth?

China’s advantages behind three “growth engines”

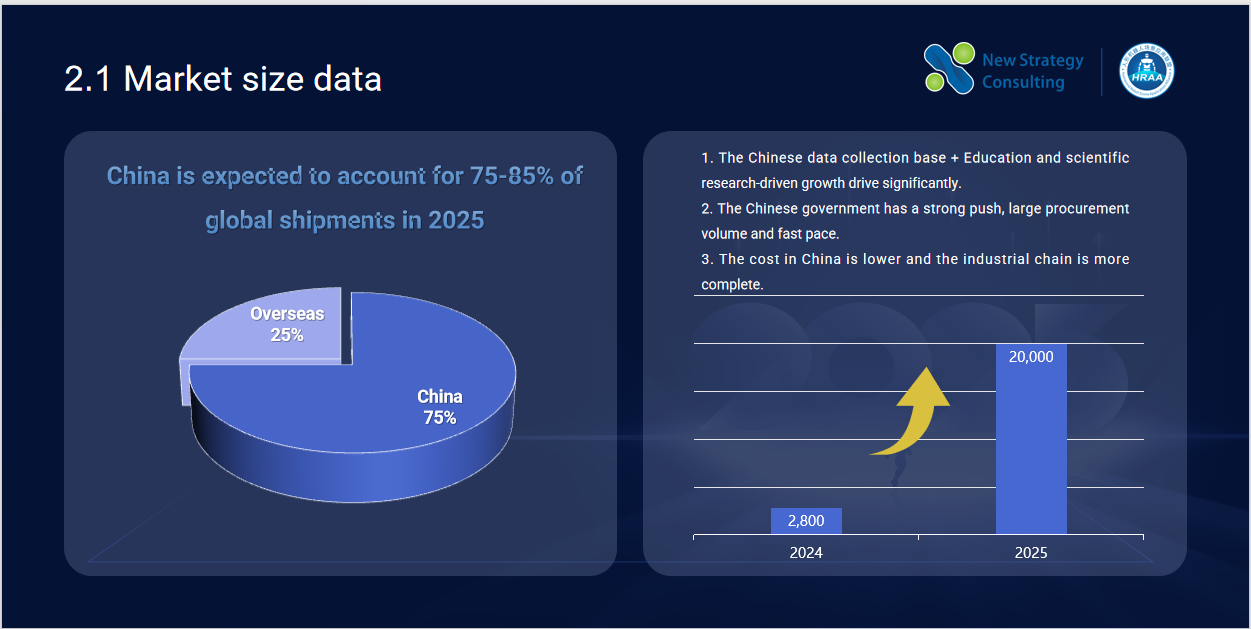

By 2025, China is expected to contribute 75%–85% of global annual shipments, rapidly establishing its leading industry advantage.

China’s ability to achieve such a rapid leap in shipments in a short period is due to the industrial cluster effect formed by the combined effect of multiple structural advantages.

Firstly, in terms of data collection bases and education and research systems, China possesses the world’s most extensive embodied intelligence testing grounds. Colleges and universities, research institutes, and industrial research institutions are actively introducing humanoid robots as experimental platforms. These needs are often characterized by high frequency, standardization, and replicability, providing a foundation for stable growth for enterprises.

Secondly, the government’s driving force is crucial. Policies at all levels, from special funds and pilot demonstrations to scenario opening and government procurement, have formed a systematic synergy, enabling the industry to have extremely high trial-and-error speed and promotion efficiency.

Furthermore, China’s well-developed supply chain system and strong manufacturing capabilities have significantly reduced the production cost of humanoid robots, allowing companies to continuously iterate products and rapidly scale up production at more controllable costs. It is precisely because China has formed a closed-loop system of “R&D-manufacturing-testing-application” that it has been able to be among the first globally to cross the industrial threshold of “mass delivery.”

Who is truly scaling up production?

The shipment by tier reveals the industry’s competitive landscape

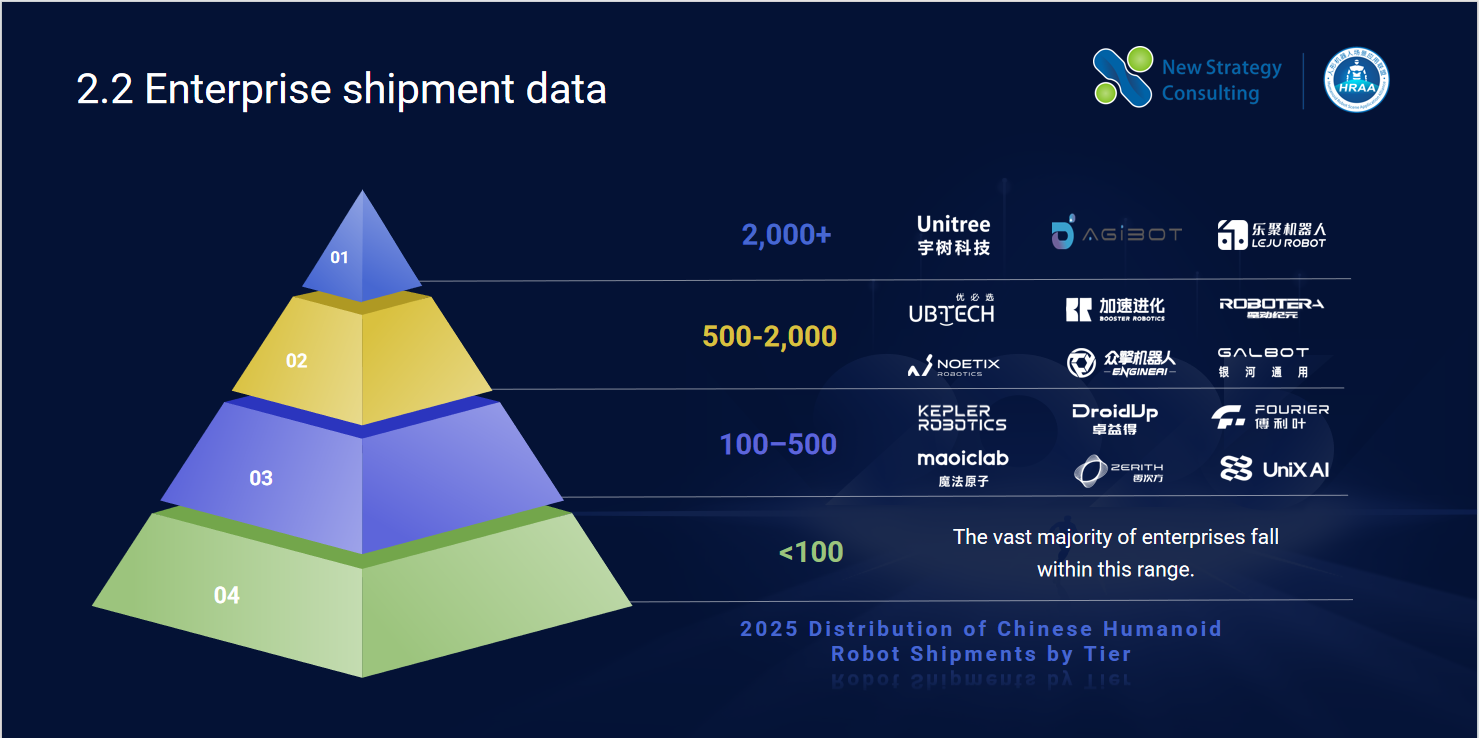

Currently, the shipment of Chinese humanoid robot companies exhibits a clear tiered structure, reflecting that the industry is transitioning from an “early stage of diverse development” to a “stage of large-scale winners.” (The following company shipment information is for reference only and may be updated later.)

In the first tier, companies such as Unitree, AGiBOT, and Leju Robot have already exceeded 2,000 units shipped, possessing stable industrialization capabilities and mature supply chain management systems. It’s worth noting that AGiBOT announced the delivery of its 5,000th general-purpose humanoid robot on December 8.

The second tier includes companies such as UBTECH, Booster Robotics, Robotera, NOETIX , EngineAI, and GALBOT, with shipments between 500 and 2,000 units. They are in a period of rapid expansion, and their products are gradually entering real-world application scenarios and beginning to undergo systematic market validation.

The third tier includes companies such as Kepler, DroidUp, Fourier, MagicLab, Zerith, Limx Dynamics, and UniX AI, with shipments between 100 and 500 units. They have completed small-scale mass production and shipments.

The fourth tier comprises numerous companies, with shipments mostly below 100 units. They are still in the R&D validation, scenario pilot, or small-scale commercialization stage.

Overall, China’s industrial ecosystem exhibits both “leading breakthroughs” and “innovation diffusion.” Future industry competition will revolve around platform capabilities, scenario depth, and supply chain optimization.

Who is buying humanoid robots?

The scenario structure reflects the logic of the “demand curve”

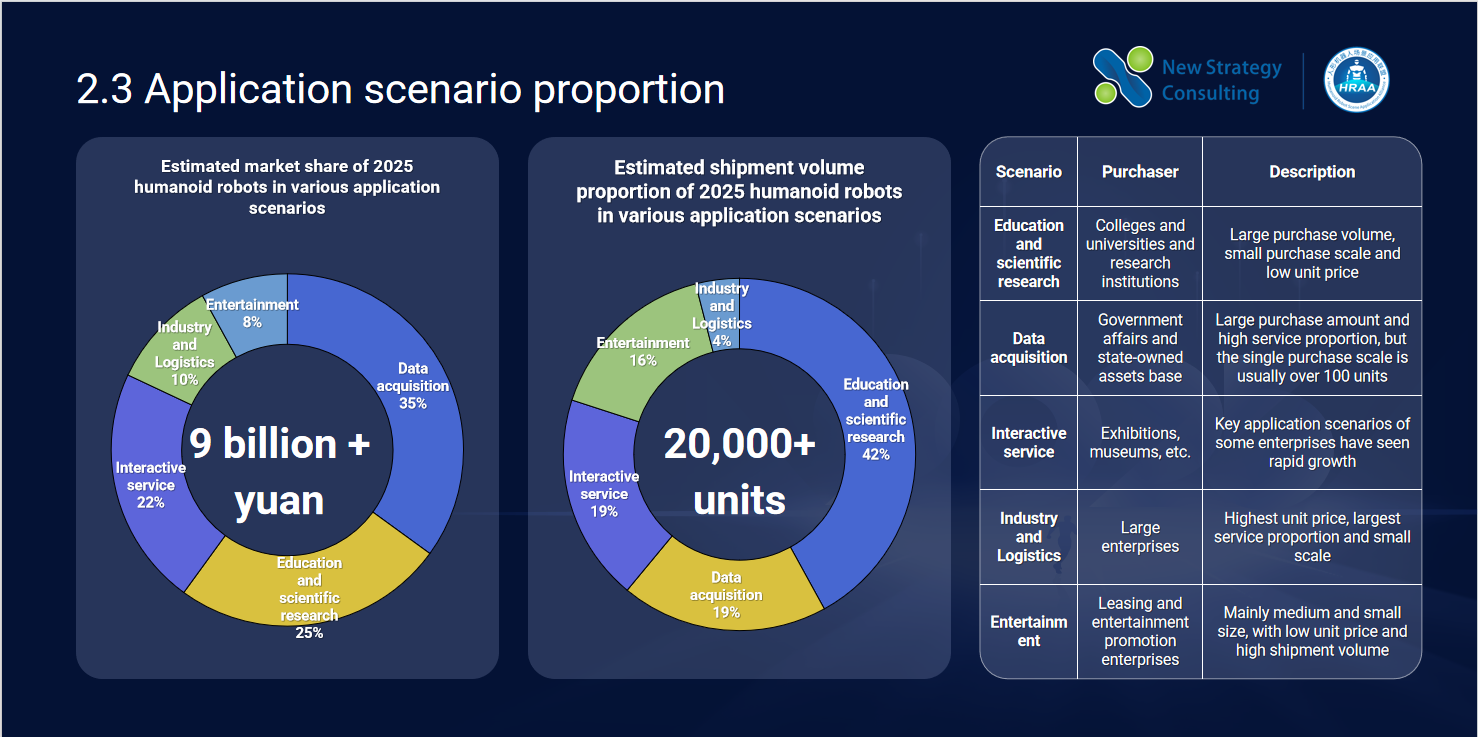

From a market size perspective, data acquisition, education and scientific research, and interactive services constitute the current “three main forces,” collectively supporting over 80% of market demand. These enable companies to rapidly scale up, accumulate data, and validate algorithms.

However, the shipment structure provides a clearer signal. Education and scientific research, accounting for 42%, means the industry is still in its “training phase,” with its core objective being building platform and data capabilities, rather than immediately pursuing commercial profits.

Entertainment and interactive services are growing rapidly, serving the functions of “popularizing awareness” and “brand exposure,” acting as an “accelerator” for the industry.

What truly represents the future value ceiling is industrial logistics, which seemingly accounts for only 4%. It has the highest unit price, the greatest service difficulty, and the highest substitutable value. In other words, today’s scenario proportion represents the industry’s “reality,” but not its “future.” The future global status of Chinese humanoid robots will be determined by a comprehensive breakthrough in industrial and special-purpose scenarios.

What’s next?

From “quantitative growth” to “deepening scenario cultivation”

Since 2025, the humanoid robot industry will no longer focus on “who can build humanoid robots,” but on “whose system is more versatile” and “whose scenario penetration is deeper.”

Embodied intelligence, large-scale model control, and end-to-end policy learning technologies will drive robots from task execution to autonomous decision-making. Only platform companies that truly break through the thousand-unit mark will be able to accumulate sufficient data and user scenarios, enabling algorithms to enter a positive feedback loop.

Simultaneously, high-difficulty scenarios such as industry, security and inspection, and logistics will become the main battleground for the industry. Their technical requirements, stability thresholds, and safety constraints will filter out true global competitors. As costs continue to decline, early trials will also emerge in the consumer market, laying the groundwork for new growth points in the next decade.

Overall, 2025 is not the end, but the beginning of the humanoid robot industry’s shift from “scale growth” to “value growth.” Whoever can seize this turning point will gain an absolute advantage in the next round of global competition.

———————————————————————————————————————————————————————————————————————————

On December 19, 2025, China Low-Speed Automated Driving Industry Alliance (LSAD) and Wuhan Junshan New City Technology Investment Group Co., Ltd. will jointly host the “5th Annual Conference on Low-Speed Automated Driving Industry” in the National Intelligent Connected Vehicle (Wuhan) Test Demonstration Zone. At the conference, the Annual Report and Forecast of Low-Speed Autonomous Driving Development for the Next Five Years will be released offline. Stay tuned!

探索者论坛-scaled.jpg)