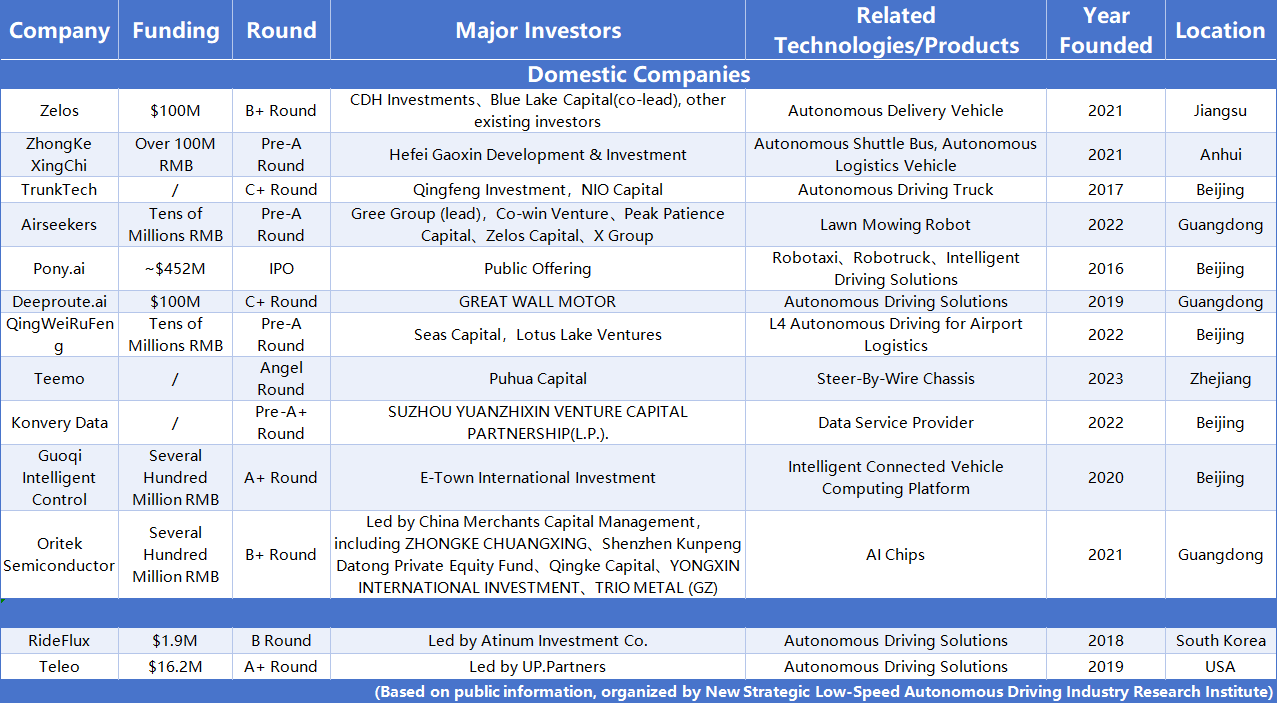

In November 2024, 13 major investment and financing events were reported in the global autonomous driving sector, with disclosed funding totaling over ¥5.2 billion (approximately $520 million, based on an exchange rate of $1 ≈ ¥7.29).

Overview of November Investments in Autonomous Driving

A total of 11 Chinese companies and 2 international companies were involved in the financing activities.

Key Insights

- Industry Focus

Most of the Chinese companies that received funding in November are focused on autonomous driving solutions and vehicle development. These include Zelos, Zhongke Xingchi, TrunkTech, Deeproute.ai, and Qingweirufeng. Their technologies and products primarily serve the smart logistics sector, which has seen increased support from government policies promoting innovations in autonomous delivery and longhaul logistics. This trend has captured significant attention from investors.

- Financing Highlights

Largest Funding: Pony.ai led with an IPO raising $452 million (approximately ¥3.296 billion), exceeding its original target by 33%. Investors included BAIC Group, ComfortDelGro, existing shareholders, and top global investment institutions. Additionally, four investors, including GAC Capital, privately purchased Class A common stock worth $153.4 million.

Significant Investments: Zelos and Deeproute.ai both secured $100 million in funding, with the latter exclusively funded by Great Wall Motor.

International Highlights: Teleo, a U.S.based construction robotics startup, raised $16.2 million in Series A+ funding. Teleo retrofits machinery with autonomous driving software and sensors to enable autonomous operation in controlled environments. The company’s client base spans industries like pulp and paper, logging, port logistics, and agriculture, and has recently expanded to airports, waste management, logistics, and warehousing.

- Accelerated IPO Activity

The autonomous driving sector is witnessing a surge in IPOs:

Companies like RoboSense, Chenqi Technology, Black Sesame, Horizon Robotics, and WeRide have successfully gone public this year.

CiDi filed for an IPO on the Hong Kong Stock Exchange, aiming to become the first autonomous truck company listed on the Hong Kong market. Freetech has also submitted its prospectus to the exchange.

Momenta received approval from China’s securities regulator for an overseas IPO. Meanwhile, ZongMu Technology, after a failed attempt to list on the STAR Market, is now targeting a Hong Kong IPO, and MINIEYE received approval to pursue a Hong Kong listing in late October.

Challenges Ahead

While the industry is buzzing with IPO activity, the competitive landscape remains fierce. For many companies, the challenge lies not only in surviving the intense competition but also in finding scalable and sustainable business models. The race to commercialization is on, and only the most adaptive players are likely to thrive.

探索者论坛-scaled.jpg)