In 2025, China’s autonomous driving industry presented two starkly contrasting sides.

The one side was the “silence” resulting from the increasingly fierce knockout competition within the industry. The once highly anticipated “future star,” the multi-billion dollar unicorn, the company led by the one dubbed “the first in autonomous driving,” and publicly listed companies favored by capital, all announced layoffs, bankruptcies, delistings, and restructurings in 2025. Many once-prominent star companies were on the dangerous edge of this elimination race.

The other side was the “noise” of capital investment. According to statistics from Low-Speed Automated Driving Industry Alliance (LSAD), in 2025, there were over 205 significant financing events in the global autonomous driving sector, with a disclosed total financing amount of approximately over 81 billion yuan (including mergers and acquisitions, IPOs, and equity financing). Capital’s attention to autonomous driving continued to rise. (Further reading: Nine Major Events in the Global Autonomous Driving Field by 2025)

Driven by capital, in 2025, the Chinese autonomous driving industry not only saw the emergence of new unicorn companies such as ZELOS and Westwell, but also welcomed several companies, including CiDi, to the HKEX. Unicorns such as Neolix, COOWA, and QCraft also achieved varying degrees of breakthroughs in technological innovation, market expansion, and application implementation, demonstrating the core competitiveness of leading companies in different sub-sectors and laying a more solid foundation for the development of the entire industry.

CiDi: Successfully listed on the HKEX

On December 19, 2025, CiDi officially listed on the main board of the HKEX, becoming the first listed company in Hong Kong focusing on intelligent driving for commercial vehicles, raising a total of HK$1.422 billion.

In terms of technology implementation, CiDi focused on core essential scenarios, achieving breakthroughs in technological depth, and building a product line matrix including unmanned mining trucks, autonomous driving logistics vehicles, V2X intelligent terminals, train autonomous perception systems, and commercial vehicle on-board intelligent perception and safety management solutions. It successfully empowered the intelligent upgrading of parks, mines, rail transit, and smart cities, creating several industry benchmark projects. Meanwhile, the company was selected as one of Fortune China’s Top 50 Tech Companies in 2025 and actively expanded into overseas markets such as the Middle East and South America, demonstrating a leap from “technological benchmark” to “commercial scale.”

Neolix: Over 16,000 L4 autonomous vehicles deployed

In 2025, Neolix achieved significant progress in technological breakthroughs, large-scale commercialization, capital support, and global expansion: in September, the company delivered the world’s first batch of 10,000 L4 autonomous vehicles, marking a new stage of large-scale commercialization in the industry; in October, it completed a Series D financing round of over US$600 million, setting a record for the largest private equity financing in China’s autonomous driving sector.

By the end of 2025, Neolix had operations in over 300 cities across 15 countries, with over 16,000 L4 autonomous vehicles deployed and a cumulative mileage of nearly 80 million kilometers. In 2026, the company planned to accelerate global expansion, establishing offices in key regions such as the Americas, Australia, and Southeast Asia, and expanding its business through partnerships with local partners. The goal is to deliver over 50,000 autonomous vehicles by 2027, promoting the application of Chinese autonomous delivery technology globally.

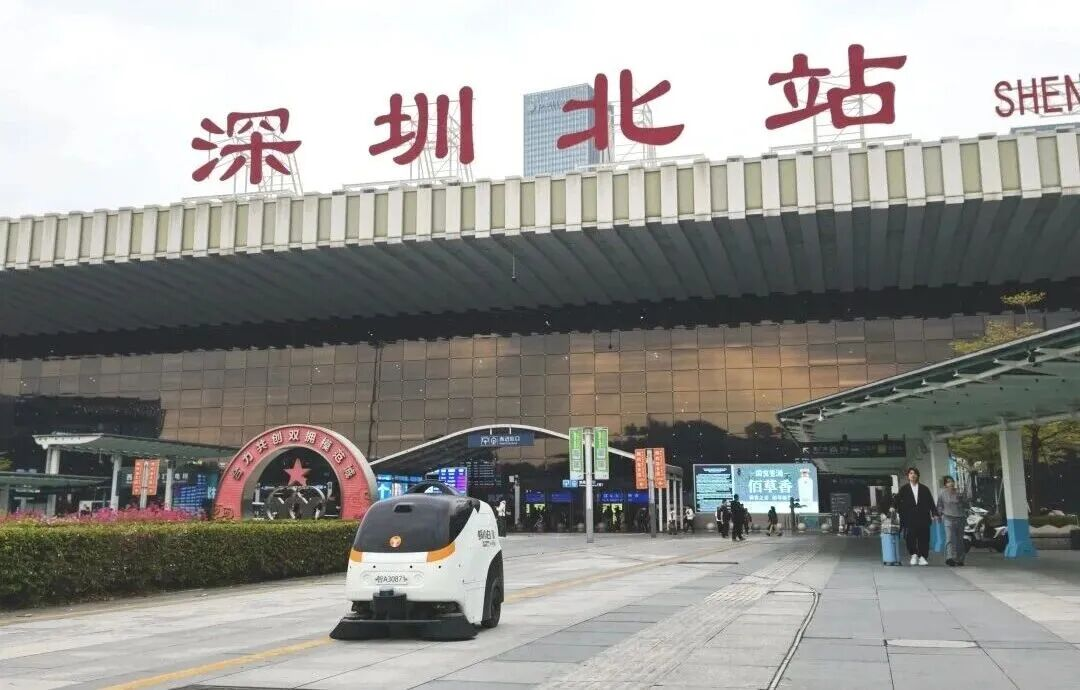

COOWA: Winning multiple large-scale sanitation projects

As one of the first companies to achieve commercialization in the domestic autonomous driving sector, COOWA demonstrated strong growth momentum in 2025. The company focuses on the research and application of L4 autonomous driving technology and intelligent networked city services, covering four major areas: municipal sanitation, urban logistics, autonomous taxis, and buses.

In 2025, COOWA won multiple large-scale projects in the field of autonomous sanitation, such as the smart city management service project in Yongchuan District, Chongqing, and the integrated urban infrastructure maintenance project in Baiyang Street, Qiantang District, Hangzhou. According to data from LSAD, in 2025, COOWA won over 20 autonomous sanitation projects, with a cumulative contract value of nearly 2 billion yuan. Currently, it operates regular autonomous driving services in over 50 cities and regions worldwide.

QCraft: Entering the Trillion-Dollar L4 Autonomous Logistics Market

In 2025, QCraft accelerated its progress in mass production, commercialization, and new business expansion: achieving a milestone breakthrough in commercialization, with regular operations launched in 26 cities including Suzhou, Shenzhen, Wuhan, Beijing, Wuxi, and Jiaxing, mainly applied in scenarios such as subway connections, micro-circulation buses, and park commuting. In terms of new business, QCraft reached a strategic cooperation with Chery Commercial Vehicles, officially entering the L4 autonomous logistics field, launching its first-generation autonomous logistics vehicle solution, and deploying operations in Jinhua, Wuhu, Ningbo, and other places, exploring a new paradigm of “mass production and operation.” In terms of global layout, it expanded its business in Europe and Singapore, established an office in Munich, and plans to move towards large-scale deployment of Robotaxi in 2027.

ZELOS: Two rounds of over $100 million financing in the year, instantly becoming a unicorn ZELOS also achieved rapid development in 2025. This company, specializing in L4 autonomous driving urban delivery vehicles, completed a Series B financing of over $400 million in 2025. Subsequently, industry sources reported that ZELOS’s valuation reached 11.7 billion yuan (approximately $1.6 billion), making the company a unicorn.

In terms of business expansion, in October, ZELOS was shortlisted for all bidding sections of China Post’s 7,000 autonomous vehicle procurement project, becoming a core supplier. As of 2025, ZELOS’s autonomous delivery vehicle deployment scale exceeded 16,000 units, its business covered more than 300 cities, and its cumulative operating mileage exceeded 75 million kilometers. It successfully expanded to markets such as Singapore, Malaysia, Japan, South Korea, the UAE, and Austria, and established cooperative relationships with companies such as SF Express, ZTO Express, and China Post.

Westwell: Over a thousand autonomous vehicles in operation, covering 30+ countries and regions

In October 2025, Westwell completed its F+ round of financing. Investors in this round included well-known institutions such as JIC Group, BOC ASSET INVESTMENT, and Shenwan Hongyuan Securities. After the new round of financing, its valuation further increased, and some sources say its valuation has reached the unicorn threshold.

In 2025, the company updated its IPO guidance filing, and the capitalization process is expected to be a key focus in its next phase. On the other hand, the company continued to be committed to building a multi-scenario intelligent logistics network covering sea, land, air, and rail, enabling 24/7 operation in scenarios such as seaports, airports, ports, logistics parks, and factories. Currently, its business covers over 30 countries and regions worldwide, serving more than 200 customers, with over a thousand autonomous vehicles operating stably globally.

Didi: Cumulative financing exceeds 13 billion yuan, valuation reaches 36.5 billion yuan

In October 2025, Didi completed its Series D financing of 2 billion yuan, with investors including GAC Group and Zhongguancun Science City Technology Growth Fund. To date, its cumulative financing exceeded 13 billion yuan, ranking it among the global unicorns with a valuation of 36.5 billion yuan.

In terms of commercialization, in 2025, Didi conducted full-scenario, fully autonomous testing in cities such as Beijing and Guangzhou, covering complex scenarios such as rush hour, rainy days, and nighttime. The test vehicles operated safely for over 1,900 consecutive days and gradually opened up fully autonomous Robotaxi service testing to the public, verifying the reliability of the technology. Leveraging its global mobility network, Didi plans to promote global expansion between 2027 and 2032, exploring application scenarios for autonomous driving services based on the policies and technological environment of overseas markets.

Momenta: Planning to launch Robotaxi services in Europe and Southeast Asia

Founded in 2016, Momenta’s core team comprises technical talents from top universities such as Tsinghua and MIT, as well as well-known technology companies, focusing on the research and development and application of autonomous driving technology. Momenta, with its “Flywheel Large Model” technology at its core, adheres to a dual-track product strategy of “Mass Production Autonomous Driving (MPilot)” and “Fully Autonomous Driving (MSD),” building a full-stack self-developed solution system covering L2 to L4 through a data-driven technology closed loop.

In 2025, it ranked 331st on the Hurun Global Unicorn Index 2025 with a valuation of 22 billion yuan. In terms of commercial cooperation, it has deepened cooperation with global mainstream automakers such as BMW, Mercedes-Benz, and Audi, jointly developing intelligent driving assistance solutions for the Chinese market. Meanwhile, the company is actively pursuing a global expansion strategy, collaborating with international companies such as Uber and Grab, and planning to launch Robotaxi services in Europe, Southeast Asia, and other regions. In December 2025, a luxury Robotaxi service, a collaboration with Mercedes-Benz and Lumo, was launched in Abu Dhabi, with official operation planned for 2026.

Mogo.ai: Exclusively awarded the first official autonomous bus projectin Singapore

In 2025, Mogo.ai was selected for lists such as the “Top 100 Sci-Tech Unicorns of 2025” and the “Top 100 New Economy Unicorn Companies of 2025,” demonstrating its technological strength, market growth potential, and commercialization capabilities in the autonomous driving sector.

In terms of commercialization, as of November 2025, Mogo.ai’s autonomous vehicles had been operating regularly in more than 10 provinces in China, accumulating over 2 million kilometers of safe driving and serving over 200,000 passengers. They also completed shuttle tasks at events such as the FISU World University Games Summer and the F1 Chinese Grand Prix. Notably, in October 2025, the company exclusively won Singapore’s first official L4 autonomous driving bus project, becoming the first Chinese company to integrate autonomous buses into an overseas public transportation system.

DeepRoute.ai: Cumulative funding exceeds US$500 million

Currently, DeepRoute.ai has completed six rounds of financing, with cumulative funding exceeding US$500 million. Shareholders include GWM, Fosun RZ Capital, and Dongfeng Asset Management, providing financial support for technology research and development and business expansion.

DeepRoute.ai is accelerating the deployment of its Robotaxi business. Its Robotaxi vehicles are built on consumer-grade mass-produced cars, resulting in lower deployment costs and stronger system stability and platform compatibility. Technically, DeepRoute.ai’s Robotaxi shares the same technical framework as mass-produced vehicles already on the market, enabling technology transfer. At the same time, DeepRoute.ai is also promoting the implementation of general artificial intelligence for roads through its self-developed VLA model. RoadAGI integrates two core models, VLA and VLN, empowering mobile intelligent agents to navigate autonomously in real environments using natural language commands. The application scenarios cover public roads, campus pathways, and indoor shopping malls, creating “any-point-to-any-point” connectivity. The plan is to launch Robotaxi services in Shenzhen, Wuxi, and other locations by the end of 2026 with consumer-grade mass-produced vehicles.

Velobotics: Over 130 million kilometers of commercial operation for autonomous vehicles

Since its establishment in 2015, Velobotics has consistently focused on the research and development and application of specialized autonomous driving technology. The company’s core team originates from the Department of Automotive Engineering, Tsinghua University, possessing deep expertise in key areas such as unmanned system architecture, multi-sensor deep fusion, and vehicle control algorithms. To date, Velobotics has obtained over 1,200 patents, with invention patents accounting for over 60%, and has participated in the formulation of several national and industry-related standards.

In terms of commercialization, Velobotics has successfully applied its autonomous driving technology and related products to multiple fields, including public safety, life services, and intelligent transportation, with over 130 million kilometers of commercial operation for its autonomous vehicles. Its business covers over 100 cities nationwide and over 40 countries and regions overseas, achieving collaborative operations with over 3,000 client sites. In specific scenarios such as emergency rescue, sanitation, and urban transportation, its solutions have achieved large-scale replication and stable 24/7 operation, effectively improving operational efficiency and safety.

UISEE: Over 1100 autonomous vehicles in operation

By 2025, UISEE’s products had achieved large-scale deployment in various scenarios such as airports, factories, and urban services, serving clients including 35 Fortune China and Fortune Global 500 companies.

In airport scenarios, L4 autonomous driving solutions had been deployed at 21 airports domestically and internationally, including Singapore Changi Airport, Hamad International Airport in Qatar, Hong Kong International Airport, and Urumqi International Airport; in port scenarios, it continued to expand its boundaries, deploying safe, efficient, intelligent, and low-carbon AI drivers, continuously injecting strong momentum into the digital transformation of ports; as of December 2025, UISEE’s autonomous vehicles had been operating in nine major categories of scenarios, with over 1,100 vehicles in operation, accumulating over 7.5 million kilometers of fully autonomous operation, and accumulating over 1000 items of independent intellectual property rights.

PlusAI: Over 80% of employees are R&D Personnel

Since its establishment in 2018, PlusAI has consistently focused on autonomous driving for heavy-duty trucks and has built a full-stack technology system covering perception, prediction, decision-making, and control. In terms of core algorithms, PlusAI has independently developed the end-to-end autonomous driving framework SSR and formed the DualBEV technology route in the BEV vision field. Its research achievements have been selected for top international conferences such as ECCV and ICLR, demonstrating the company’s originality and systemic completeness in core technologies.

Currently, over 80% of PlusAI’s employees are R&D personnel, and the company has established a comprehensive R&D and management system covering the entire lifecycle of autonomous driving products. In terms of quality management, functional safety, and cybersecurity, PlusAI has successively obtained international standard certifications such as ISO 9001, ISO 26262, and ISO/SAE 21434, providing institutional guarantees for the safe and compliant operation of mass-produced products.

Conclusion:

In 2025, amidst both excitement and quietude, successes and departures coexist, collectively sketching a new picture of the industry’s maturation, marking the shift from pursuing “technological singularities” to deeply cultivating “commercial fundamentals” in autonomous driving.

Whether it’s the successful IPO of CiDi or the deployment of tens of thousands of units by Neolix and ZELOS in the unmanned logistics field, these leaders have found clear commercialization paths, proving that autonomous driving technology can create measurable economic value in specific scenarios. While the elimination of some companies is regrettable, for the entire industry, this “knockout” is a necessary process of squeezing out bubbles and refining true value. Resources will be more effectively concentrated on companies that can achieve sustainable development.

This field, once full of idealistic aspirations, is undergoing a profound and necessary “return to value.” Capital and companies are no longer blindly pursuing flashy concept demonstrations, but are more pragmatic about the ability and cost-effectiveness of technology in solving real-world problems in real-world scenarios.

Looking ahead, the dimensions of industry competition will become more diverse and profound. It will no longer be a simple competition of algorithmic superiority, but a comprehensive competition of technology, cost, supply chain, operational management, and global capabilities. For both the survivors and the frontrunners, the real race has only just begun: how to transform the sparks of technological innovation into widespread, profitable business solutions will be the core chapter they need to write next.

探索者论坛-scaled.jpg)