Embodied intelligence and robotics have become the main battleground for global technological competition, and CES 2026, held on January 6, is the first stage for vying for dominance in robotics at the beginning of the new year.

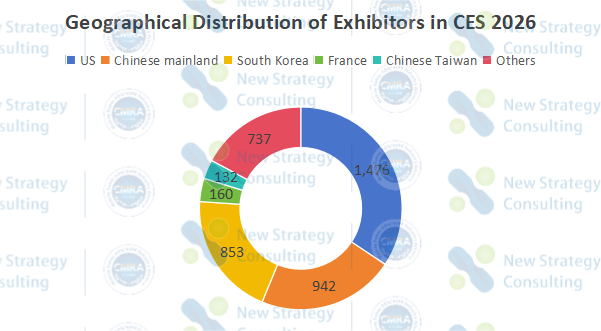

Of the more than 4,300 exhibitors in CES 2026, 942 were from Chinese mainland, second only to the US (1,476). South Korea had 853 exhibitors, ranking third. Of the 598 robot exhibitors, Chinese companies accounted for nearly a quarter, and in the humanoid robot sub-segment, Chinese exhibitors made up more than half. (Further reading: CES 2026: 26 Chinese Humanoid Robot Exhibitors)

While Chinese companies were clearly more active in terms of sheer numbers, another noteworthy change was observed at the exhibition: South Korea did not participate as a single company or product, but rather as the K-Humanoid Alliance. Furthermore, conglomerates like Hyundai, Samsung, and LG all participated, explicitly elevating “humanoid robots” to a strategic level.

CES is not the final answer to the industry landscape, but it often serves as a harbinger of trends. Judging from the collective action displayed on this stage, South Korea is moving humanoid robots from individual exploration to a more systematic industrial layout.

Beyond the US-China competitive landscape, this change deserves serious examination.

South Korea’s Nationwide Efforts to Create Humanoid Robots: An Attempt to Break Through Between the US and China

From an industrial perspective, South Korea has long held the top position globally in terms of industrial robot density. Its highly automated automotive, electronics, and heavy industry systems have allowed it to accumulate extensive experience in motion control, servo systems, sensor integration, and industrial-grade reliability.

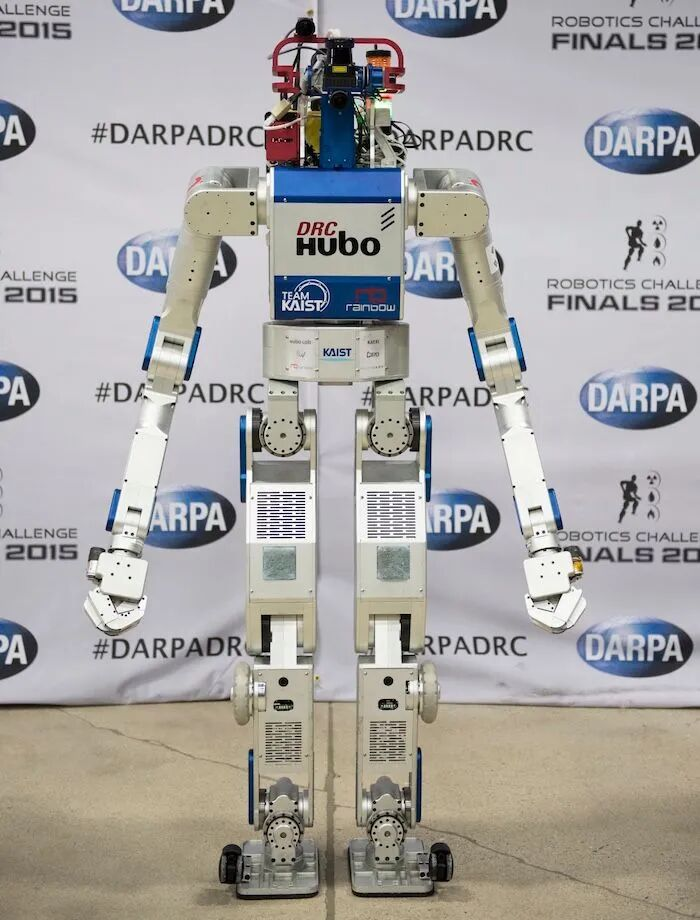

From a technological perspective, South Korea’s exploration of humanoid robots can be traced back more than 20 years. In the early 2000s, Korea Advanced Institute of Science & Technology (KAIST) initiated research on bipedal humanoid robots, releasing the first generation, HUBO, in 2005. After several technological iterations, HUBO won the DARPA Robotics Challenge in 2015, demonstrating its comprehensive capabilities in walking, maneuvering, and task execution in complex environments.

Although these achievements did not immediately translate into commercialization, they laid a long-term technological foundation for South Korea in humanoid robot control, balance, and full-body coordination. Some of the companies active in the forefront of industry today originated from this generation of research.

For example, Rainbow Robotics, founded by core members of the HUBO project, continues to advance the engineering of dual-arm collaboration and mobile control platforms. Meanwhile, many universities and research institutions maintain long-term investments in fundamental areas such as control algorithms, motion planning, and human-robot collaboration.

The real change has occurred in recent years. On the one hand, large-scale models have propelled “embodied intelligence” to become a new technological focus, redefining humanoid robots as crucial carriers connecting algorithms and the physical world. On the other hand, the continued investment by China and the US in artificial intelligence, advanced manufacturing, and computing infrastructure has rapidly scaled up and engineered related industries.

Against this backdrop, Japan and South Korea, long known for their industrial robots and precision manufacturing, are beginning to show a gap in pace and volume in the new round of the “AI + Robotics” race.

However, South Korea clearly does not want to lose its presence in the next generation of general-purpose intelligence. Over the past two years, the South Korean government has repeatedly listed humanoid robots as an important direction for the intelligent robot industry in public documents.

In January 2024, South Korea’s Ministry of Trade, Industry and Resources released the “4th Basic Plan for Intelligent Robots (2024-2028),” proposing to invest over 300 billion won by 2030 to jointly develop a so-called “K-Robot Economy” with the government and businesses. This plan directly positions robotics as a core national industry, emphasizing core technologies and talent cultivation, global market expansion, and the construction of “robot-friendly” infrastructure.

In 2025, the South Korean government further designated general-purpose humanoid robots as one of 15 key projects in its medium- to long-term AI plan: starting with logistics, gradually expanding to manufacturing, construction, and service industries, and establishing a 100 trillion won AI innovation fund.

Under this policy framework, South Korea officially launched the K-Humanoid Alliance in April 2025. Led by the Ministry of Trade, Industry and Resources, the alliance unites robotics companies such as Rainbow Robotics and Doosan Robotics, as well as large conglomerates like LG, Hyundai, and POSCO. It also includes over 20 universities and research institutions such as KAIST and Seoul National University, aiming to integrate scattered resources in a “national team” format and planning to establish a dedicated humanoid robot fund.

The establishment of the K-Humanoid Alliance is South Korea’s institutional response to global competitive pressure: reducing redundant R&D costs through alliances, providing real-world application scenarios through large conglomerates, and extending the timescale for technology and industrial investment through government planning.

The “comprehensive debut” of South Korean humanoid robots at CES 2026 is the first concentrated demonstration of this systematic approach on the international stage. It also signals that, against the backdrop of escalating US-China competition, South Korea is heavily investing in humanoid robots, hoping to secure a key position in a still-developing field.

Samsung, Hyundai, and LG Electronics: The Humanoid Robot Ambitions of the Three Giants

In South Korea’s humanoid robot industry, Samsung Electronics, Hyundai Motor, and LG Electronics are the three most representative companies. As global giants, their strategies in humanoid robots and related technologies cover multiple dimensions, including product development, technology investment, and ecosystem cooperation.

Samsung’s path is relatively more long-term and platform-based

At the R&D level, as early as the 2000s, Samsung’s involvement in the EveR series of humanoid robots, which appeared in the South Korean research system, was evident in its technical participation at the component and system levels. In the past decade, Samsung has repeatedly showcased robot prototypes with humanoid features or operational capabilities at international conferences and exhibitions such as IROS and CES, such as Roboray and Bot Handy, with related explorations focusing more on perception, operation, and human-computer interaction.

Roboray

At the capital and organizational level, Samsung’s actions in recent years have become more concentrated. From 2023 to 2024, Samsung continued to increase its stake in Rainbow Robotics, a South Korean robotics company, raising its shareholding to 35% by the end of 2024, becoming its largest shareholder. Following the transaction, Samsung announced the incorporation of Rainbow into its consolidated statements and the establishment of a dedicated organization for future robotics, coordinating related R&D and business development, including humanoid robots.

In November 2025, Samsung Electronics announced its official entry into the humanoid robot field. An executive confirmed that the company was actively developing humanoid robots. In December of the same year, Samsung made a strategic investment in Alva Industries, a Norwegian high-performance motor developer, signifying the company’s increased focus on building a competitive hardware supply chain for humanoid robots.

Hyundai Motor Group, on the other hand, is expanding into the robotics industry through acquisitions and application scenarios

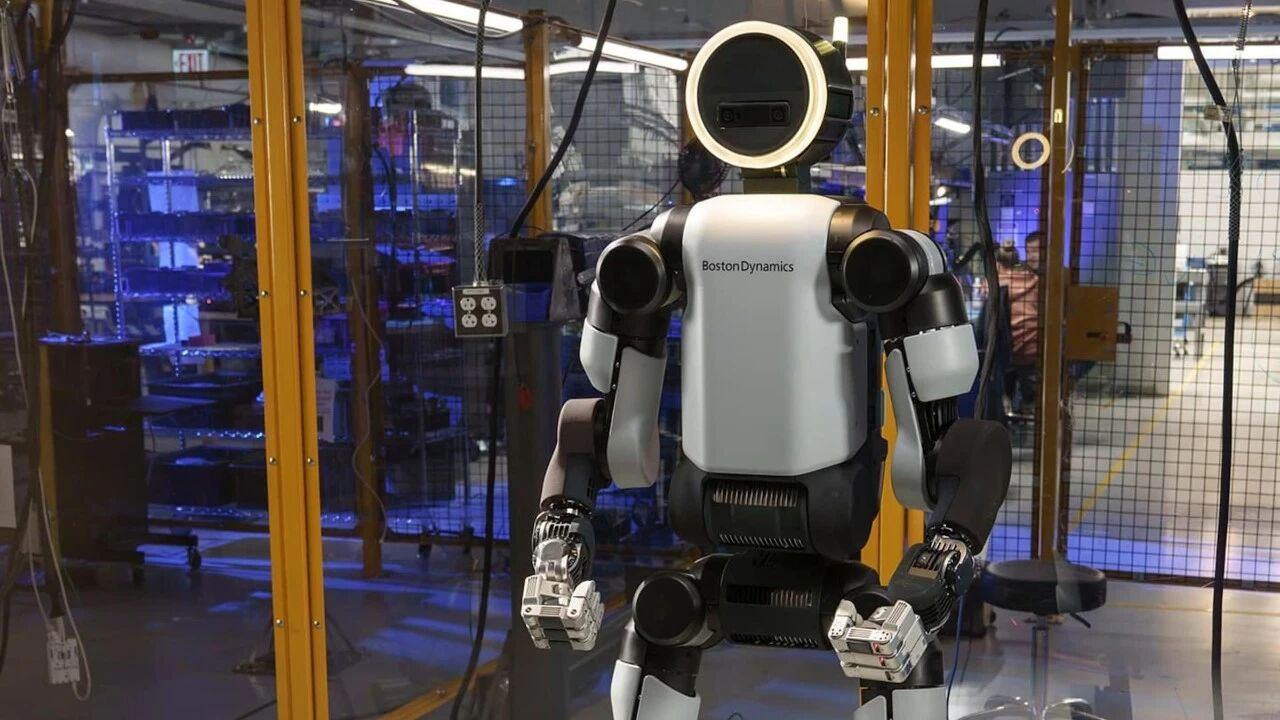

In 2020, Hyundai announced the acquisition of a controlling stake in US robotics company Boston Dynamics, bringing it into the group. This transaction gave Hyundai direct access to globally leading technological assets in bipedal walking, dynamic balance, and full-body control. In the following years, Boston Dynamics gradually shifted from the hydraulically based Atlas system to an electric drive solution, officially releasing the electric version of Atlas in 2024.

During CES 2026, Hyundai further clarified its application schedule and manufacturing plans for humanoid robots: humanoid robots will be prioritized for deployment in Hyundai’s US automotive plants for highly repetitive processes such as parts picking and sorting; simultaneously, the group plans to build a production line with an annual capacity of 30,000 Atlas robots to prepare for future replication in manufacturing scenarios.

Regarding humanoid robots, the Hyundai Group also plans to advance the integration of robot hardware and software and the construction of a data training system with technical support from partners such as NVIDIA and Google DeepMind.

LG Electronics’ humanoid robot strategy focuses more on home and service scenarios

At CES 2026, LG Electronics showcased its LG CLOiD robot product for home use. This product connects to LG’s home appliance ecosystem (ThinQ system) to support collaborative home tasks and intelligent interaction. LG officially describes CLOiD as part of its embodied intelligence platform, supporting task flow scheduling in home scenarios through the collaboration of vision, semantic understanding, and execution capabilities.

LG CLOiD at CES 2026

On the capital front, LG, through its investment institutions, has participated in investments in numerous humanoid robot and embodied intelligence-related companies in recent years, including an investment in AGiBOT, a Chinese humanoid robot startup. This cross-regional deployment demonstrates LG’s intention to track the evolution of humanoid robot technology globally.

Overall, the three giants’ deployments in humanoid robots exhibit different focuses: Hyundai focuses on manufacturing and factory scenarios, LG focuses on home and service environments, and Samsung strengthens its underlying platform capabilities. These paths have not yet converged into a unified form in the short term, but they have already resulted in continuous investment in capital, technology, and applications.

Under the K-Humanoid Alliance framework, these dispersed deployments have also been incorporated into a larger national-level collaborative system, becoming an important part of the South Korean humanoid robot industry landscape.

Wheeled, Dual-Arm, and Dexterous Manipulation: The Consensus of South Korean Humanoid Robot Companies

Compared to China and US, South Korean humanoid robot companies are not as well-positioned in terms of funding and market size. Even so, in the past three years, a number of noteworthy humanoid robot startups have emerged in South Korea, with Holiday Robotics, WIRobotics, and AeiROBOT considered among the most representative companies.

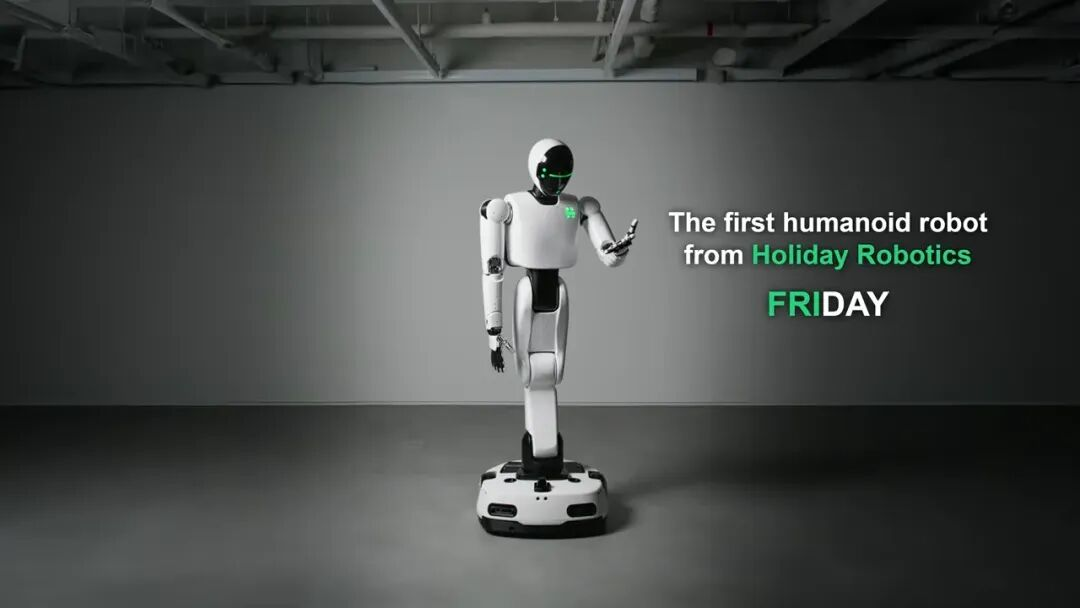

Founded in 2024, Holiday Robotics’ founder, Ki-young Song, previously founded the industrial vision AI company SUALAB, which he sold to the US machine vision company Cognex for approximately $200 million in 2019. In its founding year, the company completed a seed round of approximately 17.5 billion won (approximately $13 million), with investors including several venture capital firms and the Hyundai Motor Group. Holiday Robotics’ FRIDAY robot focuses on high-degree-of-freedom robotic arms, tactile perception, and compliant control, targeting the practical operational needs of complex scenarios such as manufacturing.

Founded in 2021, WIRobotics initially focused on wearable robots, accumulating experience in human motion understanding, force feedback, and safety control. In recent years, it has gradually expanded into humanoid robot control and coordination capabilities, enhancing its international visibility through consecutive CES Innovation Awards. At CES 2026, WIRobotics showcased its technological capabilities through a live demonstration, further reinforcing its technological positioning in control and human-robot interaction.

In contrast, AeiROBOT‘s technology roadmap is more clearly geared towards industrial applications. The company focuses on developing an industrial-grade humanoid robot platform, attempting to combine AI control with humanoid structures for use in real-world workflows such as manufacturing and logistics. At CES 2026, AeiROBOT’s demonstration also emphasized the robot’s ability to execute specific tasks, rather than conceptual demonstrations.

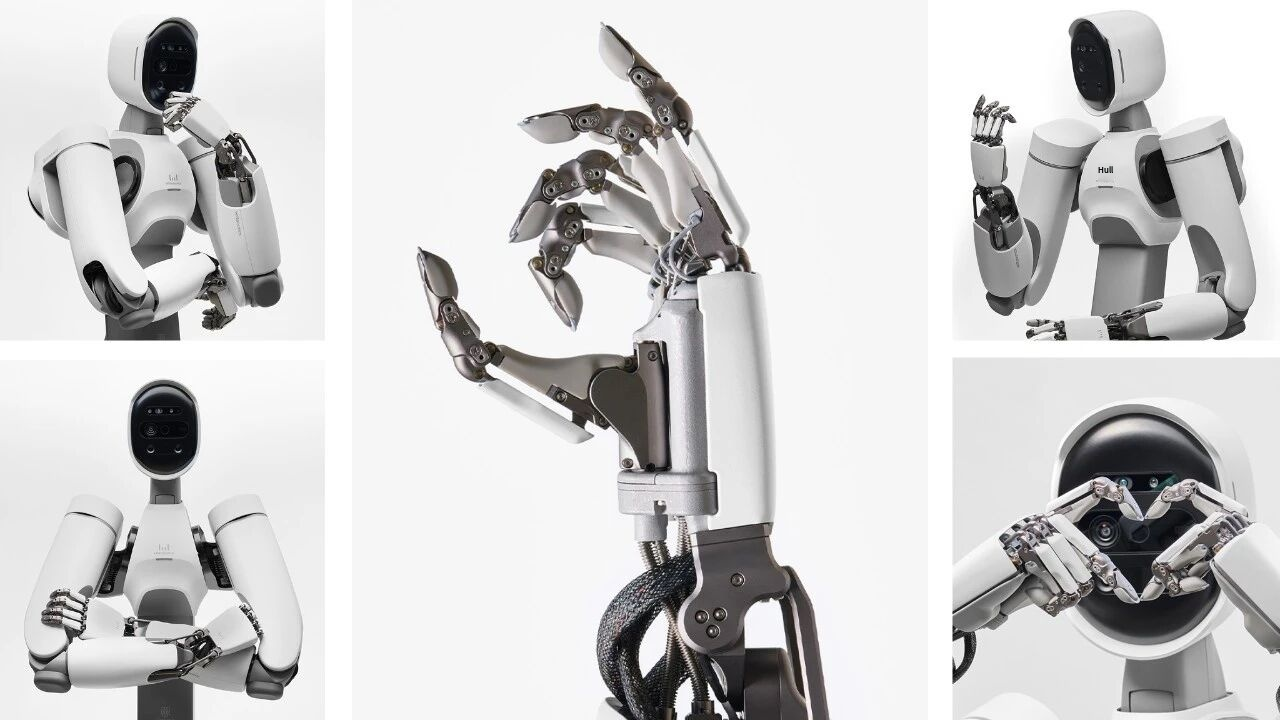

AeiROBOT at CES 2026

Meanwhile, some startups are focusing on more fundamental intelligent issues. RLWRLD is a prime example, focusing its R&D on physical artificial intelligence and basic robot models, aiming to solve the core challenges of robot perception, decision-making, and motion planning in real physical environments. In November 2025, South Korean logistics giant CJ Logistics signed a strategic memorandum of understanding with RLWRLD and made an equity investment, indicating that traditional industries are now addressing the most difficult and critical “brain problem” of humanoid robots from the application end.

From the technology choices of these startups, the product directions of robotics companies like Rainbow Robotics, NAVER Labs, and Doosan, and the strategic layouts of conglomerates like Samsung, LG, and Hyundai, a striking consistency in South Korea’s humanoid robot development strategy emerges: in terms of form, they mostly adopt wheeled chassis with dual-arm structures; and in terms of R&D focus, they are highly concentrated on dexterous manipulation capabilities.

In summary, the high degree of similarity in South Korea’s humanoid robot development strategy is a rational convergence resulting from the combined effects of national-level planning, industrial structure, and application scenarios. Given limited resources and a clear objective, this concentrated approach may be a realistic choice for South Korea to increase its chances of success with humanoid robots.

Conclusion:

From the global perspective, the competition in humanoid robots is showing multiple parallel paths. The US is betting on general artificial intelligence and software-defined capabilities, attempting to reshape the upper limits of robots with models and computing power; China, relying on its manufacturing scale and complete supply chain, is accelerating its progress in overall form and cost curves; while South Korea is choosing to focus on a practical form and dexterous operation capabilities, minimizing the distance between experimentation and application.

At this stage, the outcome is still uncertain. Humanoid robots are still in the early window of opportunity, with ongoing competition between technology, cost, and application. No country can lock in the result with a single path. However, it is certain that future competition will not only depend on who creates the “most human-like” robot first, but also on who can first prove that humanoid robots possess sustainable productivity value in the real world.

As the US and China continuously raise the upper limits of technology and scale, South Korea is trying to find a sufficiently stable position between the two. Ultimately, who will dominate the era of humanoid robots remains to be seen; but at least one thing is certain: this competition is no longer a contest of single technologies, but a long-term game about pathways, patience, and systemic capabilities.

探索者论坛-scaled.jpg)