According to incomplete statistics from the New Strategy Mobile Robot Industry Research Institute, domestic and international AGV/AMR companies launched a total of 60 products in the first half of 2025, covering various categories including unmanned forklifts, AMRs, and hybrid robots. Among these, Chinese enterprises launched 49 new models while foreign companies released 11. Compared with the same period last year, the number of new domestic products showed a slight increase.

| Enterprise | New product |

|

Domestic |

|

| Langyu | 300 tons of unmanned AGV |

| Agile Robots | Mobile automatic receiving robot |

| VMR | Smart charging robot for cars |

| Hangcha | New high performance heavy load counterbalance AGV |

| TZCO | Unmanned forklifts |

| VMR | Cage handling robot FR4800P |

| ZIKOO | Six-direction shuttle |

| JATEN | Single arm forklift |

| EF Robotics | Autonomous forklift POLLUX |

| Linde | Linde MATIC series unmanned forklifts |

| Heli | Cold storage forklift AGV-CQD series |

| Hai Robotics | The new generation of CTU system products–HaiPick Climb |

| SEER | Surface handling intelligent forklift SPT-1000 |

| SEER | Thin body intelligent reach forklift SSR-1400 |

| KH Robotics | KH counterbalance unmanned forklift AGV selection (KH-E30) |

| Beacon Robot | Omnidirectional forklift AMR series |

| CSSC Haishen, Deep Robotics and other companies | Emergency (transport) robot |

| KEENON | Cleaning products and narrow channel delivery robot T11 |

| VMR | Latent forking robot FR31201P |

| Gongboshi | Four series of cobots (A/B/C/D series) |

| Guowei Intelligent | AGV intelligent robot, cooperative palletizing robot |

| YUNLY | Outdoor omnidirectional heavy load mobile robot |

| Noble Lift | Counterbalance logistics robot PS15-CB |

| Robot Phoenix | Camel50 case handling mobile robot |

| S100 magnetic AGV | |

| SANY | A7 AGV |

| Syrius | Smart delivery AMR FlexPilot |

| Standford Robots | DARWIN-01 industrial humanoid robot |

| IPLUS MOBOT | N series single boom intelligent forklift |

| Ankuny | Pallet truck T16EA |

| Beacon Robot | Handling forklift BR-F15P |

| iRAYPLE | Counterbalance fork type AMR FPE150 |

| Linde | Linde K MATIC k VNA turret forklifts |

| Linde R-MATIC K reach forklift | |

| Linde L MATIC AC k counterbalanced pallet stacker with a cantilever fork | |

| YUNLY | Intelligent case handling mobile robot |

| iRAYPLE | “Stacking” series D150 fork type AMR |

| iSOFTSTONE Tianshu | iSOFTSTONE Phyxis inspection cobot |

| Surveying cobot | |

| Surveying and layout cobot | |

| Aubo Robotics | Mobile charging robot |

| King Young | All-in-one standard robot |

| Miniaturized narrow channel robot | |

| Dual-arm collaborative enhanced robot | |

| UQI | Wali heavy-load omnidirectional robot H3000 |

| Elephant Robotics | Mobile cobot myAGV Pro |

| EP | Narrow channel unmanned forklift |

| Side-oriented intelligent loading and unloading forklift | |

| Embodied material handling robot | |

|

Overseas |

|

| Ocado Intelligent Automation | Chuck AMR |

| Isitec international | The fourth generation of latent AMRs C060 and C100 |

| Brightpick | Brightpick Giraffe |

| Kassow Robots | Cobots |

| Ocado | Palletizing Porter AMR |

| Twinny | NarGo order picking robot |

| RoboForce | AI robot Titan |

| Hitachi Elevator | Elevator inspection robot |

| OMRON Corporation | AMR OL-450S |

| ABB | Heavy load AMR |

| Brightpick | Autopicker 2.0 |

Chart: New products of global AGV/AMR enterprises in the first half of 2025 (sorted out according to public information. If there is any omission, please make a correction!)

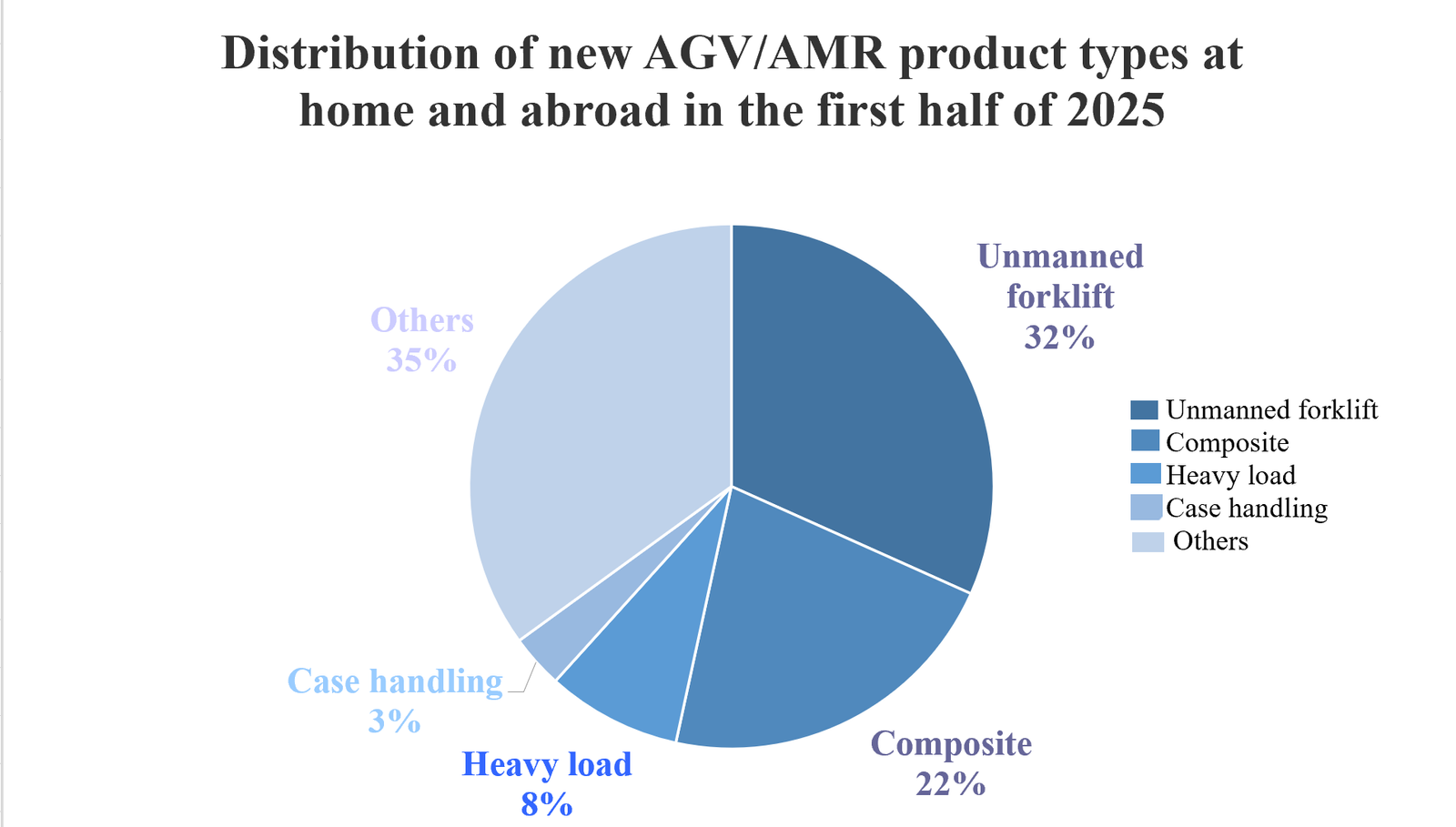

In terms of product categories, there were 19 new unmanned forklifts launched, representing approximately 32% of the total, making them the most densely released category in the first half of the year. Composite mobile robots followed, accounting for about 22%, while heavy-load and case handling robots contributed around 8% and 3% respectively.

In general, the unmanned forklift sector continues to thrive with expanding product diversity. Narrow channel and lightweight variants are emerging to meet evolving warehousing demands. Concurrently, composite mobile robots are driving technological advancements, where robotic arms are transitioning from single-arm configurations to dual-arm designs. This evolution addresses high-performance requirements in precision manufacturing, complex inspection processes, and medical support applications that demand superior robotic capabilities.

For heavy-load products, manufacturers are focusing on core performance enhancements. Companies prioritize boosting load-bearing capacity by launching heavier-duty variants.

With growing market demand for flexibility and customization, case handling robots are experiencing new growth opportunities. Their applications are expanding from single sectors to multiple fields. Some enterprises are accelerating product upgrades and iterations, introducing new models tailored for industries including automotive, footwear and apparel, pharmaceuticals, and 3C manufacturing.

In the first half of 2025, new product applications predominantly focused on traditional industrial sectors like manufacturing, warehousing, and logistics, addressing growing market demands for automation and smart solutions in these fields. However, with technological advancements, some companies are now expanding into emerging application areas such as charging and equipment inspection. This trend demonstrates that as technology evolves and market needs diversify, automated products are increasingly being applied beyond conventional industrial uses to meet evolving demands.

While the number of new products in the first half of 2025 has decreased compared to the same period last year, the variety of innovative products continues to expand. It is foreseeable that future product development will maintain the current trend of diversified innovation. Beyond deepening expertise in traditional industrial sectors like manufacturing and warehousing, technological exploration in emerging fields will become new growth drivers. This shift will propel mobile robots from single-industry applications toward multi-scenario collaborative development.

Note:

Logistics Automation Development Strategy & the 7th International Mobile Robot Integration Application Conference Southeast Asia will be held in Concorde Hotel Kuala Lumpur, Malaysia on 21st August 2025. At the same time, the2025 Global MobileRobot Industry Development Report will be released. Welcome to join us.

For agenda, please click https://cnmra.com/logistics-automation-development-strategy-the-7th-international-mobile-robot-integration-application-conference-southeast-asia-21st-august-2025-concorde-hotel-kuala-lumpur-malaysia/

For registration, please click https://docs.google.com/forms/d/e/1FAIpQLSdGHjpHRU0mR0_2ZlqtJpUV25s3XlIIHtkkUUfxz0W6vpBqiA/viewform?usp=header

探索者论坛-scaled.jpg)