根据CMR产业联盟和新战略移动机器人产业研究院的数据,2024年,全球移动机器人产业(工业和仓储物流领域)将共完成44起融资事件,融资总额超过8.4亿美元(折合人民币约61亿元)。

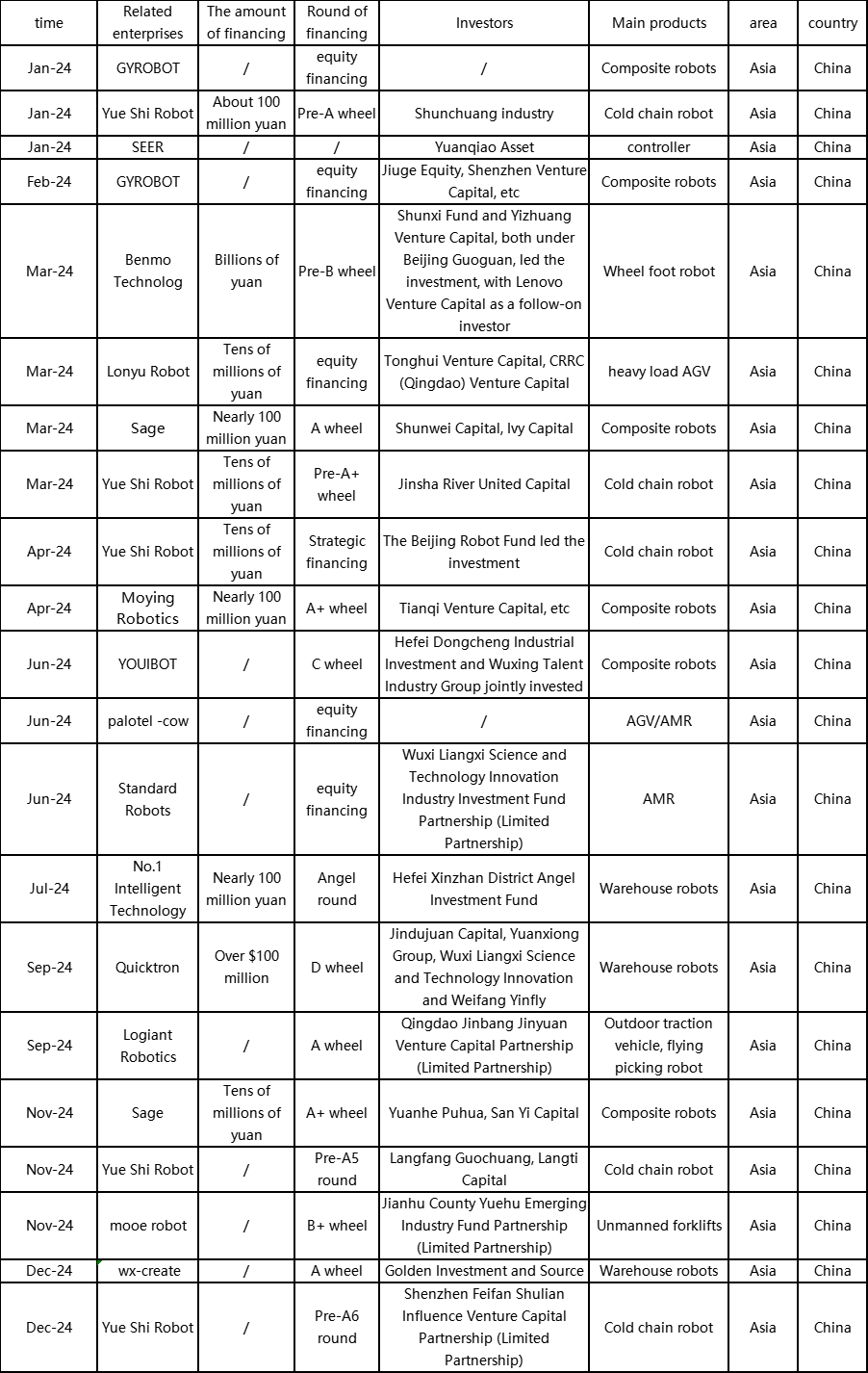

Overview of financing in Chinas mobile robot industry in 2024

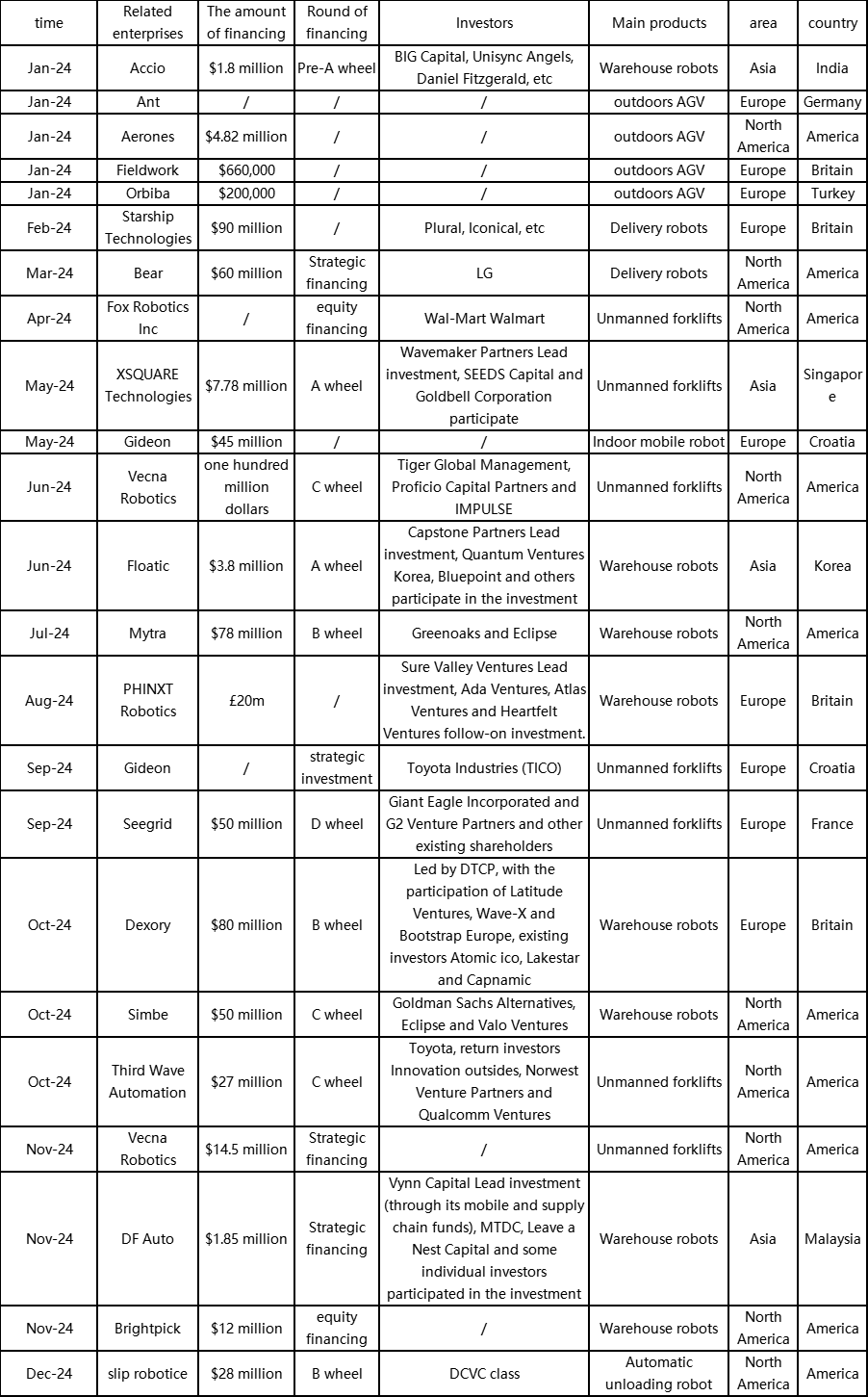

Overview of foreign mobile robot industry financing in 2024

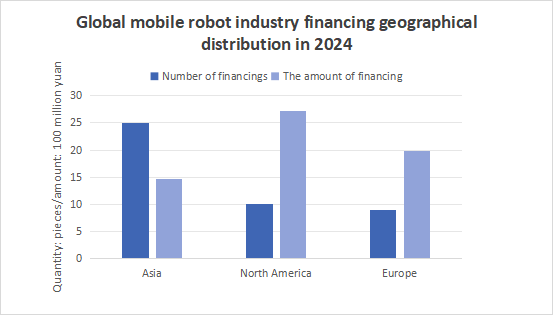

From the perspective of financing both domestically and internationally, foreign mobile robot companies have secured 23 funding rounds, totaling over $660 million (approximately RMB 4.8 billion); domestically, there have been 21 funding rounds, with a cumulative amount exceeding $180 million (approximately RMB 1.3 billion). Foreign capital markets show more active investment in the mobile robot industry, providing greater support. Among these, North American mobile robot companies have the strongest fundraising capabilities, while the Asian region has the most funding events.

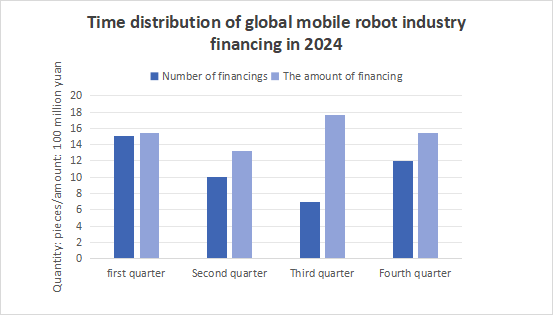

From the perspective of the annual financing time distribution, in 2024, the mobile robot industry concentrated financing events in the first and fourth quarters, with the financing amount of 1.54 billion yuan; while the third quarter received the largest amount of financing, with the number of financing events of 7, and the total amount of financing of 1.76 billion yuan.

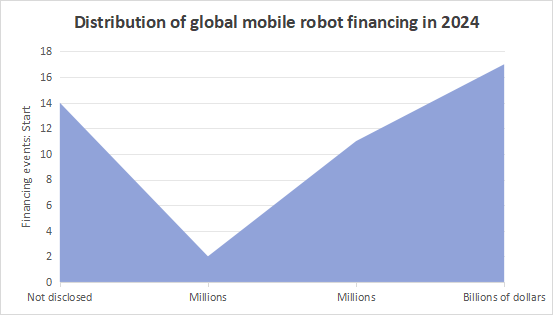

In terms of financing amounts, apart from those not disclosed, the scale of mobile robot financing in 2024 is concentrated at the hundred million yuan level, indicating an enhanced ability to integrate resources among mobile robot companies and demonstrating capitals confidence in the future development potential and profit margins of mobile robots. Large-scale financing can enable companies to rapidly expand their scale and enhance competitiveness, securing a dominant position in market competition. This also signifies increased competition within the industry, necessitating substantial funds for technology research and development, market expansion, and talent reserves to cope with new competitive dynamics. At the same time, the concentration of capital may also spur more mergers and acquisitions within the industry, accelerating integration and optimization.

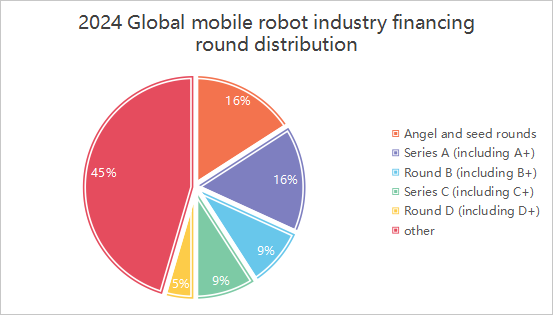

From the perspective of funding rounds, apart from those not disclosed, the mobile robotics industrys funding rounds are mainly concentrated in the angel and Series A stages. This indicates that the industry is still in its early stages and has not been fully explored or unleashed. It also suggests that investors see the long-term potential of the industry and are willing to get involved at an early stage. Additionally, many “new faces” companies have secured funding, which indirectly confirms the acceleration of industry “renewal” and intensifies competition.

From the main products of companies that have secured funding, unmanned forklift and warehouse robot companies lead the financing race in 2024. According to incomplete statistics, global warehouse robot companies received 13 funding rounds in 2024, with a total amount of 2.4 billion RMB; the global unmanned forklift sector saw 13 funding events, with a cumulative amount exceeding 1.5 billion RMB.

Among them, Quicktron, which mainly focuses on warehouse robots, has secured the top spot in annual funding; while Vecna Robotics from the United States completed two rounds of financing in 2024, totaling $114.5 million; YueShi Robotics has raised funds five times consecutively, continuously driving the development of the cold chain unmanned forklift market. This clearly demonstrates that, despite the cooling trend in the financing market, investors remain optimistic about companies in the warehouse robot and unmanned forklift sectors.

From the perspective of the main body participating in the investment, the types of investors are diversified, and the participation of state-owned capital and local government capital in the financing of mobile robot industry is gradually increasing, which will increase the access to enterprise resources, improve their ability to resist risks, promote enterprises to improve corporate governance structure, standardize business behavior, and promote the healthy and orderly development of the industry.

Overall, whether domestically or internationally, the financing scale of the mobile robot industry is showing a downward trend compared to 2023, with the capital winter continuing to intensify. In an environment where financing conditions are becoming increasingly difficult, focusing on the theme of “profitability,” strengthening cash flow management, and exploring new business models should be the core priorities for mobile robot companies.

探索者论坛-scaled.jpg)