For emerging industries, capital activity is often the most direct and authentic indicator of industry trends.

According to statistics from China Humanoid Robot Scene Application Alliance (HRAA), as of now, the humanoid robot sector has seen over 210 financing rounds in 2025, totaling over 54 billion yuan.

If we extend the timeframe to the past three years (2023-2025), the number of financing events has exceeded 300, with a total financing amount approaching 70 billion yuan. Capital is pouring into this emerging sector of humanoid robots at an unprecedented density.

In these over 300 financing events, an average of 4-5 investment institutions participated in each round. Furthermore, most investment institutions are not “making a trial” but rather have repeatedly and continuously increased their investment in the humanoid robot sector over the past three years, forming a stable investment trajectory.

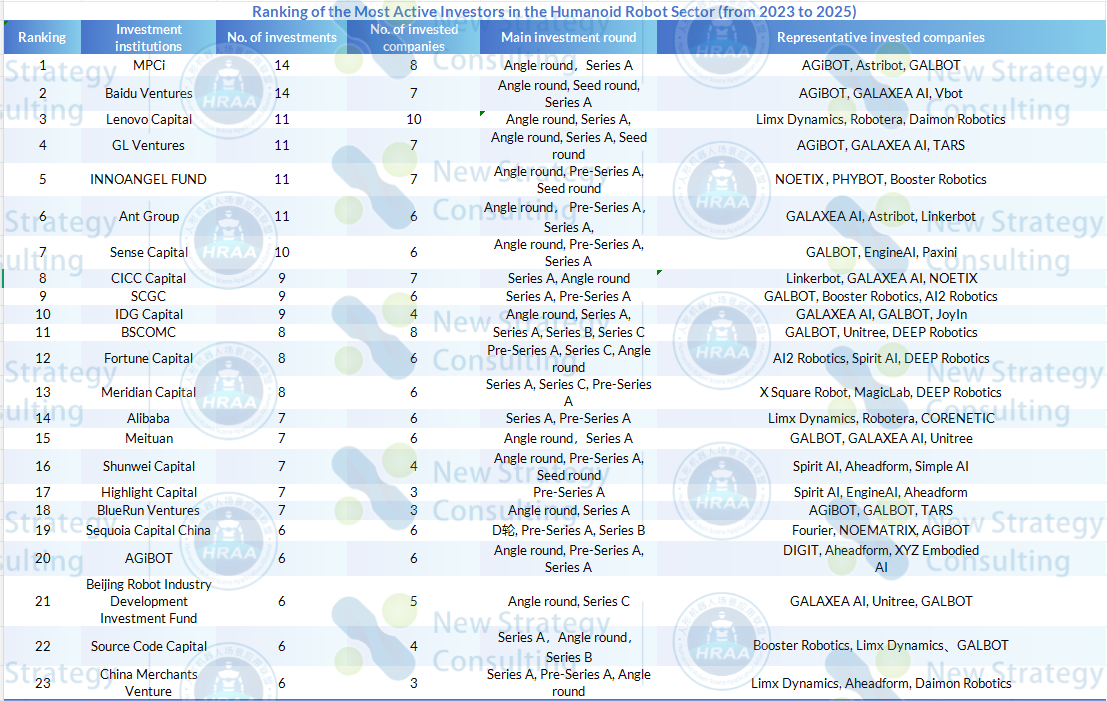

Against this backdrop, we systematically reviewed humanoid robot financing events over the past three years, selecting investment institutions that made six or more investments in the humanoid robot sector between 2023 and 2025, and compiled the Ranking of the Most Active Investors in the Humanoid Robot Sector. The ranking is shown below:

(As of December 22, 2025, compiled based on publicly available online information; please point out any omissions.)

Who is most optimistic about humanoid robots?

A total of 23 investment institutions were included in the ranking. The ranking itself shows that a group of highly stable “long-term investors” has emerged in the humanoid robot sector.

MPCI and Baidu Ventures tied for first place with 14 investments each, making them the two most active institutions in the past three years; Lenovo Capital, GL Ventures, InnoAngel Fund, and Ant Group followed closely behind, each making more than 10 investments.

Meanwhile, “national team” capital such as CICC Capital, BSCOMC, SCGC, and Beijing Robot Industry Development Investment Fund also occupy important positions on the list.

From an investment round perspective, most institutions on the ranking are concentrated in the angel round, Pre-A round, and Series A stages. This indicates that humanoid robots as a whole are still in the process of continuous technology and product form verification; on the other hand, it also reflects that leading investment institutions are more willing to enter the sector at an early stage, capturing potential “long-term winners” through multi-project deployment.

Why are venture capitals, state-owned enterprises, and internet giants entering the market simultaneously?

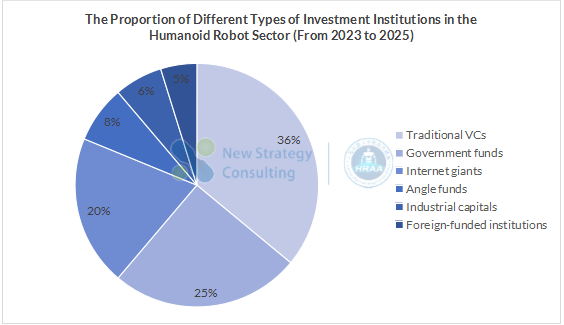

Broadening our perspective to the more than 300 humanoid robot financing events in the past three years, we can see a clearer picture of the capital structure: the humanoid robot sector is forming a pattern of participation from multiple types of capital.

Traditional venture capitals still dominate, accounting for about 36%, and are the core force driving early-stage innovation and technological exploration; government and state-owned enterprise-backed funds account for about 25%, demonstrating the importance of humanoid robots in strategic emerging industries; capital related to internet and technology giants accounts for about 20%, becoming an undeniable force; the remainder consists of angel funds, industrial capitals, and foreign-funded institutions.

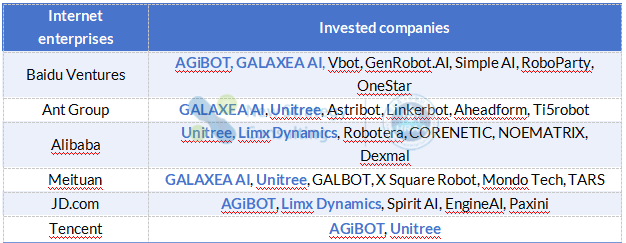

Among them, internet companies are the most noteworthy changing factor in recent years. Among the top 22 investment institutions, internet-related companies explicitly mentioned include: Baidu (14 times), Ant Group (11 times), Alibaba (7 times), and Meituan (7 times).

Besides these companies, major internet giants such as JD.com (more than 5 times), Tencent, and ByteDance have also repeatedly invested in humanoid robots and embodied intelligence industries.

The List of Humanoid Robot Companies Invested by Internet Companies over the Past Three Years

This has transformed the humanoid robot sector from a purely “hard technology investment” field into a competitive arena where platform capitals, industrial capitals, and technological capitals intertwine.

Which humanoid robot companies are most favored by capital?

Judging from the frequency of repeated investment cases, a group of humanoid robot and related startups have become “highly consensus targets” in the eyes of capital.

In the list, AGiBOT, GALBOT, and GALAXEA AI appear in almost every major investment institution; in addition, companies such as Unitree, DEEP Robotics, Limx Dynamics, Astribot, and Linkerbot have also been repeatedly invested in by different types of capitals.

These companies typically share some common characteristics: relatively clear technological roadmaps, engineering and continuous iteration capabilities; they not only receive support from traditional venture capitals but also attract industrial capital or major internet companies; and they possess differentiated advantages in key areas such as robot body, motion control, perception, embodied intelligence, or system integration.

Meanwhile, a noteworthy new phenomenon has emerged on the list: some humanoid robot startups have begun entering the market as “investors.”

For example, AGiBOT made the list with six investments; in addition, companies like GALBOT and GALAXEA AI are also actively investing in early-stage projects. This indicates that some leading startups are no longer simply investees but are attempting to preemptively invest in key upstream and downstream technologies, building an industrial network around their own capabilities.

This, to some extent, suggests that the humanoid robot sector is beginning to show early signs of a model of “leading company—ecosystem company”, with the industry moving from single-point innovation to initial ecosystem competition.

Conclusion:

From the perspective of the financing pace and investment institution structure over the past three years, humanoid robots have gradually moved from the proof-of-concept stage to a development stage characterized by continuous capital investment and increasingly convergent directions. The investment institutions that repeatedly appear on the list include not only traditional venture capitals that frequently invest, but also government funds and major internet companies, indicating that a broader capital consensus is forming in this sector.

At the same time, leading startups that have received repeated investments from multiple institutions are beginning to emerge, with some companies even participating in industry development as investors, reflecting that humanoid robots are moving from “single-point innovation” to ecosystem and systemic competition. Overall, humanoid robots are still in their early stages, but capital has already entered the market, and the long-term competition surrounding this sector has only just begun.

The Explorer Forum on Embodied Intelligent Mobile Robot (EIMR) 2026 will be hold on March 5, 2026 in Beijing. Welcome to join us!

探索者论坛-scaled.jpg)