2025 marked a pivotal year for the global mobile robot industry, a year of both rapid growth and consolidation, breakthroughs and deep cultivation.

According to data from China Mobile Robot Industry Alliance (CMRA) and incomplete statistics from New Strategy Mobile Robot Industry Research Institute (NSRI), Chinese and overseas AGV/AMR companies launched a total of 126 new products throughout the year, averaging one new mobile robot product every three days.

Looking at the total number of new products alone, the industry remains in a period of high-intensity innovation and frequent new product launches; however, looking at a longer timeframe, the mobile robot industry in 2025 was undergoing profound changes—product launch rhythms, product category focus, and Chinese and overseas market strategies were all significantly adjusted.

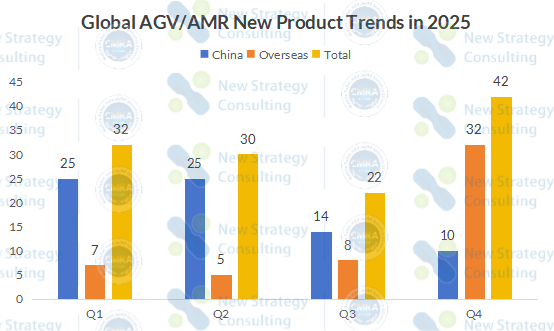

According to statistics from CMRA and NSRI, the number of new AGV/AMR product launches in each quarter of 2025 was 32, 30, 22, and 42 respectively, showing a clear curve of “stable at the beginning, decline in the middle, and surge at the end“. While the overall market did not experience a precipitous decline in the first three quarters, the pace of product launches slowed significantly in the third quarter. Entering the Q4, the market saw a strong rebound, with 42 new products launched-a breakthrough that not only achieved the equivalent of two quarters’ worth of launches in a single quarter, but also maximizing the buzz surrounding new product releases throughout the year.

Specifically, of the 42 new products launched in Q4, 2025, 32 were from Chinese companies and 10 from foreign companies, making this quarter the one with the highest number of new product launches of the year. This figure represents a significant leap compared to the first three quarters, reversing the slowdown in Q3 and confirming a concentrated release of market demand and corporate R&D activity.

From an industry perspective, the concentrated launches in Q4 are not simply a year-end sales push. On one hand, the concentration of large-scale exhibitions prompts most companies to choose this period to launch new products, aiming to capture high traffic and gain greater exposure. On the other hand, products launched at this time also indirectly demonstrate their technological maturity and feasibility for commercialization. It’s worth noting that these new products are not mere trial explorations outside the existing technological framework, but rather a series of iterative upgrades and segmented scenario adaptations based on the company’s core technologies and focused on key application scenarios.

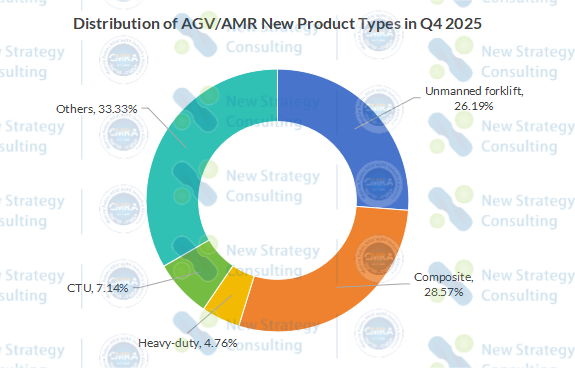

In terms of product form, unmanned forklifts and composite products dominated the new product launches in Q4.

Among them, 11 new unmanned forklifts were launched, accounting for approximately 26.19%. These products are evolving towards greater segmentation, continuously refining their tonnage, aisle adaptability, and environmental adaptability, with increasingly prominent customized attributes for specific scenarios such as narrow aisle operations and small-batch, high-frequency handling.

Composite products also performed impressively, with 12 new products launched this quarter, accounting for approximately 28.57%. A number of mobile robot companies, including EP, Gen-song, RobotPhoenix, and IPLUSMOBOT, have all launched composite robots with wheeled humanoid half-body. In mainstream industrial and commercial scenarios such as warehousing, manufacturing, and logistics, the wheeled chassis of these products offer significant advantages not only can they maintain stable movement in flat environments, but they also boast high speed, long endurance, and strong load-bearing capacity. They can be directly integrated into existing production and operation systems without requiring large-scale modifications to existing sites or processes.

From an application perspective, warehousing and logistics remain the primary focus for new products, but the proportion of products related to manufacturing, cold chain logistics, and special environments has increased. This change foreshadows the transformation of the new product structure throughout the year.

126 Models! A Look at the Changes in the Mobile Robot Industry

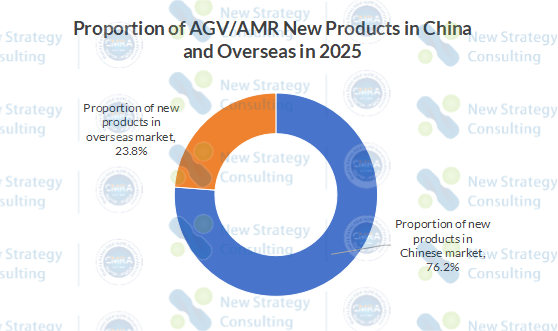

Throughout the Year Looking back at the whole year from the Q4, according to data from CMRA and incomplete statistics from NSRI, Chinese and overseas AGV/AMR companies released a total of 126 new mobile robot products in 2025. Of these, 96 were launched in the Chinese market, accounting for approximately 76.2%, while 30 were launched in the overseas market, accounting for approximately 23.8%. The Chinese market maintains its numerical advantage, driven by broader application demands and more frequent scenario testing. The overseas market, however, continues its trend of relatively restrained new product releases, but with higher maturity levels for individual products.

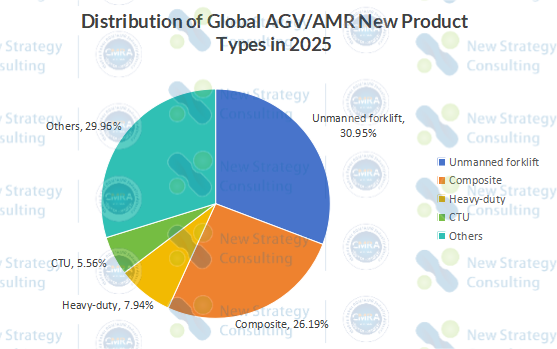

In terms of product type structure, 39 unmanned forklifts were released throughout the year, accounting for approximately 30.95%, firmly holding the core position in new product launches. Composite products saw 33 releases, accounting for 26.19%, becoming one of the most rapidly growing categories. A significant trend is the rapid evolution of their form from a simple combination of “robotic arm + chassis” to wheeled or wheel-arm humanoid robots launched by companies such as SEER, IMPLUSMOBOT, and RobotPhoenix, indicating a shift from “mobile operation” to a higher level of “embodied intelligence” and flexible interaction.

Heavy-duty and CTU new products numbered 10 and 7 respectively, with relatively stable proportions. These target scenarios with high standardization and mature operating logic, with new product innovation focusing more on improving reliability and long-term operational capabilities rather than frequent changes in form. Other new product types, totaling 37, constitute a diversified supplement to the product structure.

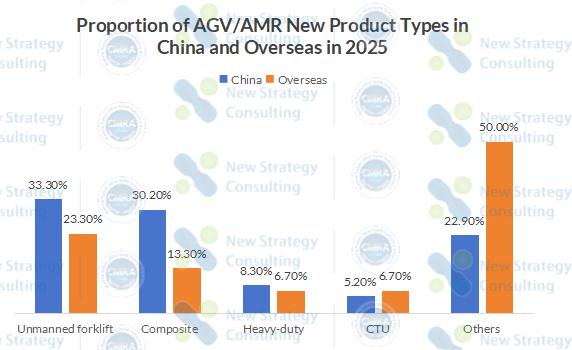

The chart showing the distribution of global AGV/AMR new product types in 2025 reveals a similar trend among Chinese and overseas companies in their product portfolios, both focusing on unmanned forklifts and composite robots. Specifically, the Chinese market is particularly concentrated, with over 60% of new products falling into these two categories, reflecting a strong demand for large-scale deployment and rapid adaptation to various scenarios. Meanwhile, overseas companies also invest a significant proportion of their resources in these two product categories.

However, the development orientations of Chinese and overseas markets differ. The Chinese market emphasizes efficiency, scale, and the breadth of applications, driving companies to continuously iterate products and compete on price in mainstream sectors; the overseas market, on the other hand, focuses more on specialization, reliability, and the depth of solutions, encouraging companies to build technological barriers in niche areas.

In the long run, these two paths may complement each other in the global market, jointly driving the evolution of mobile robots towards a richer and more mature industrial ecosystem.

Conclusion

In 2025, more and more companies began to slow down their “trial releases,” concentrating their resources on refining a small number of highly compatible products. Looking back from the starting point of 2026, the 126 new products outline not a simple expanding market, but an industry that is moving towards differentiation and maturity.

探索者论坛-scaled.jpg)